I see opportunity in business development company MAIN and shorter-term, higher-yielding bonds in ETF ANGL, asserts Mike Larson of Weiss Ratings.

Wild market swings. Large losses. Turmoil in everything from financial stocks to utilities to Real Estate Investment Trusts (REITs).

That’s what you typically see during Federal Reserve rate-hiking cycles. But it’s a total snooze-fest in the interest rate markets right now!

Consider this: You’ve probably heard of the VIX. The Chicago Board Options Exchange Volatility Index (VIX) tracks investor expectations about future stock market volatility using the pricing of various options on the S&P 500. Investors consider it a “fear index” because it typically surges when stocks tank and emotions take over on Wall Street.

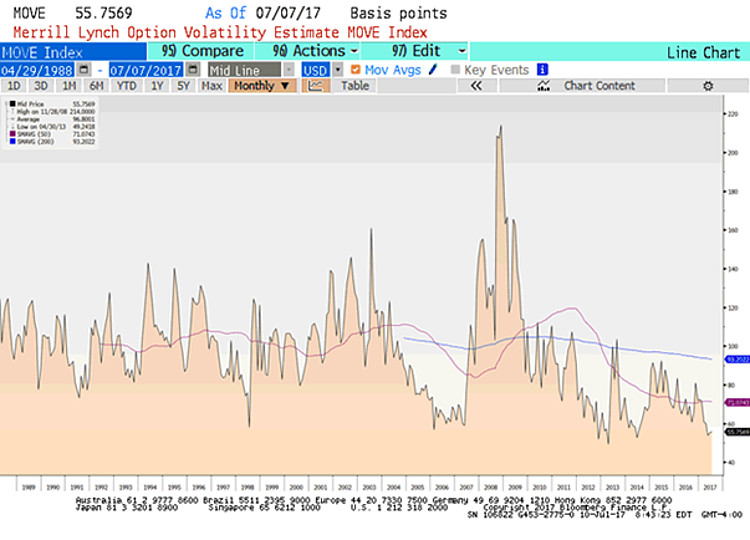

What you may NOT know is that there’s a similar fear index for the interest rate markets. It’s called the Merrill Lynch Option Volatility Estimate Index (MOVE) for short. Just like the VIX, the MOVE index uses options pricing to gauge the level of fear and volatility, only in bonds rather than stocks.

Now, look at this monthly MOVE chart:

It goes all the way back to 1988, and you can see we’ve rarely seen this level of complacency in Treasury bonds. As a matter of fact, the MOVE index is hovering around 55-and-change--close to the all-time record low from 2013.

What’s causing this? For starters, the Fed treats investors like toddlers these days, particularly in the wake of the 2013 “Taper Tantrum.” It foreshadows every move it plans to make to the best of its ability in order to limit volatility. That feeds investor complacency.

At the same time, economic growth and inflation have settled back into the “meh” zone they’ve been inhabiting for the last few years. The surge in optimism about growth that followed Donald Trump’s election has all but faded.

So unless and until we get a Fed policy “surprise”...or a notable increase in growth expectations...volatility will remain subdued. That’s true for both stocks AND bonds.

My advice? Stick with investments that should prosper in this environment, but that should also fare okay if volatility picks up again. Business Development Companies (BDCs) are at the top of my list, with Main Street Capital Corp. (MAIN) one of my favorites. It currently yields around 7%.

I also see opportunity in shorter-term, higher-yielding bonds. You might want to consider an ETF like the VanEck Vectors Fallen Angel High Yield Bond ETF (ANGL). It pays monthly dividends and was recently yielding just over 5%.

I can’t say for sure when the rate markets will awake from the current slumber. But these kinds of investments should help you earn juicy yields and solid returns while you wait.

Follow Mike Larson and subscribe to Weiss Ratings products here...