Since the low on June 21, the pound has risen quite sharply against the U.S. dollar yet the pound could go lower, asserts Mike Golembesky, an Elliott Wave analyst covering U.S. indexes, volatility instruments, and forex in his debut commentary today.

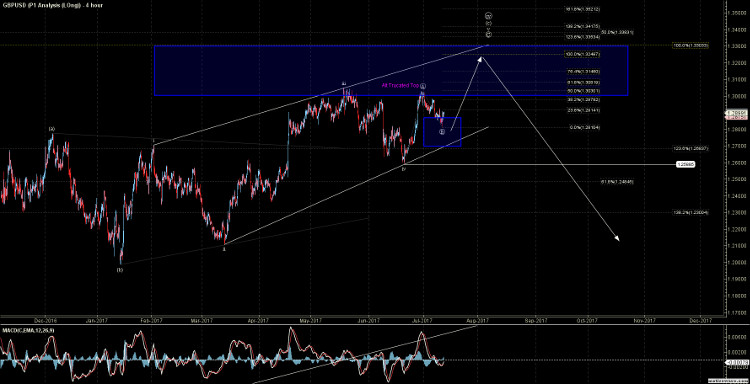

In April I wrote an article discussing the potential inflection point that the GBP/USD was closing in on ahead of the UK elections, which were scheduled to occur on June 8. At the time the GBP/USD was trading at the 1.2860 level, and I was looking for the pound (GPB) to move higher into the longer-term resistance zone that I had been watching on the pair since the 2016 low was struck.

In late May the pound poked its head just into this resistance zone prior to moving lower into the end of May. The pound then retraced back higher as the June 8 election date approached topping in the overnight session on June 7, then proceeded to move sharply lower bottoming on June 12. This was followed by another corrective retrace to the upside followed by one more final low on June 21.

Since this low on June 21, the pound has risen quite sharply against the U.S. dollar and has once again re-tested the May highs and the lower end of the larger degree resistance zone, which currently comes in at 1.3012-1.3303.

I do still view this zone as a significant inflection point, and as long as we do not see a sustained break of that resistance zone, the pound is still poised to see lower levels in the near term.

When there are sharp moves in financial instruments, pundits and the public at large will typically look toward some exogenous event to explain these moves. Most of the time the pundits are able to find some kind of news event to explain a move, but there are times when they simply are not. This was the case with the October drop in the pound as it hit a spike low that saw the pair down over 1400 pips in the overnight session prior to finally settling down just over 500 pips lower from the October 5 closing price.

Now, while at times an exogenous event can act as a timing catalyst for large market moves, this is more of the exception than the rule. Often times when an exogenous event is assigned to a move by a pundit, and later the public, that move was already well underway prior to the event even occurring.

I mention this because GBP/USD now has a pattern that has the potential to see a sharp reversal to the downside. The Brexit negotiations have already begun, and no other major event on the schedule, we simply will have to wait and see if the pundits will be able to find an event to assign to a move should the pound follow-through on the bearish pattern that we are seeing.

Previously I had labeled the consolidation pattern that occurred from October 2016 into the May highs as a rather complex triangle pattern. At the time this pattern best fit with what I was viewing as a thrust up out of the triangle and into the resistance zone as previously noted. While we did see a fairly sharp reversal to the downside after touching the lower end of that resistance zone under this pattern.

That reaction to the downside failed to see continued follow through. This failure to follow-through has since required a revision of how I am counting the sub-divisions within this larger degree fourth wave. As we are still trading well under the larger degree resistance zone, this modification does not change my bigger picture view on GBP/USD. And the 1.3012-1.3303 resistance zone is still acting as a significant inflection zone.

Additionally, the move back up off of the June 20 low is now providing us with not only a much more simple way to count the sub-divisions within this fourth wave but a much better short side setup than we had the last time that the pound had tested the lower end of the long-term resistance zone.

This bearish setup triggers upon any move back over the May 18 high, which comes in at 1.3047 prior to breaking down below the June 20 low at 1.2588 and ideally I would prefer this high to be made while holding over the 1.2692 level. If all of these things can fall into place, then we will have what can be counted as a completed Ending Diagonal pattern.

Follow through on this pattern should then result in a sharp reversal back down towards at least the January lows at 1.1985 and eventually back under the 2016 lows and closer to par against the US dollar on a longer term timeframe.

So while there is no question that the action has been somewhat sloppy on the pound vs. the U.S. dollar as of late, my larger degree perspective on this pound remains unchanged. I will continue to look towards lower levels over the next several years as long as the GBP/USD does not see a sustained break of the longer term resistance zone.

See charts illustrating the wave counts on the GBP/USD.