The economy has more likelihood to have a negative surprise. To be clear, economic growth matters because it will affect future earnings reports even if international sales are strong, asserts Don Kaufman, Co-founder of TheoTrade.

Interestingly, as more attention is being paid to central bank policies, the less effect they are having on markets. I am willing to admit that I wrongly thought increasing rates would cause credit markets to be in flux.

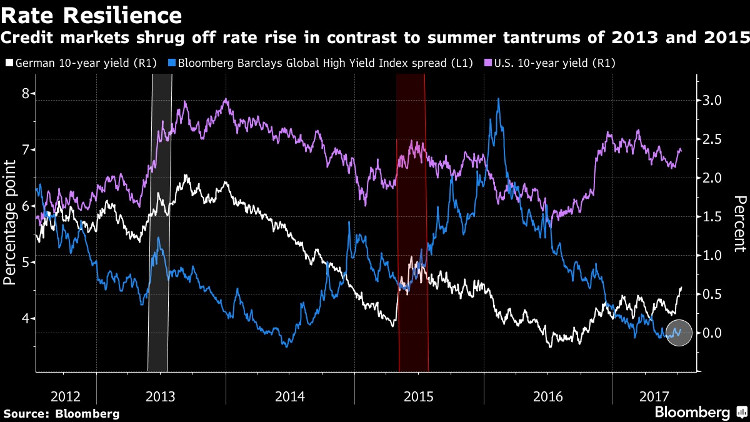

As you can see from the chart below, the last two times rates rose, the high yield spread increased. This time, nothing is bothering spreads as they stay at their 2014 lows. As I have mentioned, a possible reason for this is great corporate earnings. However, earnings were great in 2013, yet during the 2013 taper tantrum, there was a bump up in spreads.

It’s arguable that policy is more uncertain now than ever, yet the market is whistling past the graveyard. This entire cycle the market was afraid of quarter point hikes even as QE was being done. Now QE is being revoked and rates are rising without the bat of an eye.

It will be interesting to analyze this time period 10 years from now to see what is actually driving stocks. Surely the economy of 2017 isn’t any better than other points in this recovery. Why does what mattered in 2013 and 2015 not matter now?

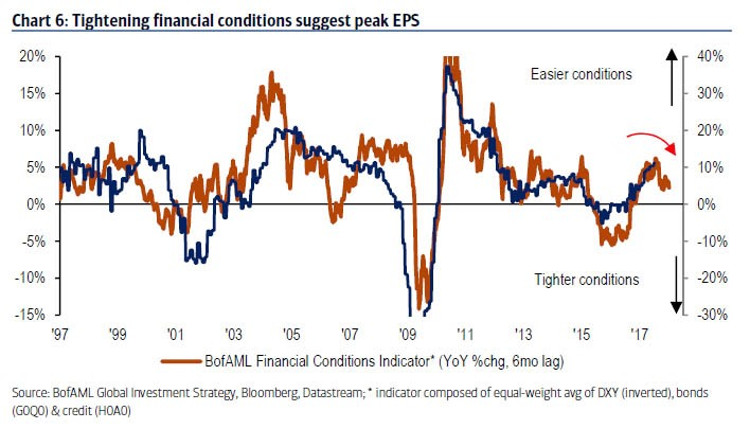

Bringing in corporate earnings to the fold of credit conditions makes the outlook look bleaker than what analysts and management teams are projecting. As you can see, the Bank of America Financial Conditions Index is starting to forecast weaker year over year growth. That’s not a death knell for this bull market because tough comparisons are coming anyway which is why I have been expecting decelerating growth.

I find it interesting to see how the financial conditions were worse in 2016 than in 2001, but the earnings performance was worse in 2001. I think that’s because the energy firms make up a large portion of the junk debt market in 2016, but didn’t make up that much of S&P 500 earnings. As I have said, the swings from negative to positive make energy important, but clearly, the earnings recession didn’t spur a bear market.

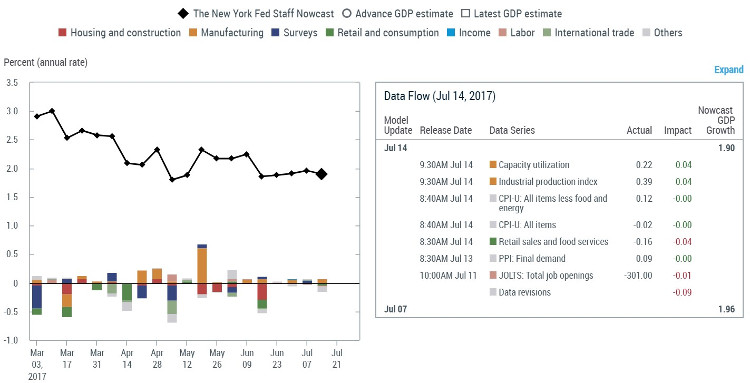

GDP growth looking weaker than initially expected

This current economy isn’t the best of the recovery. The big news on Friday (July 14) which supports this claim was the retail sales report. Retail sales fell in June for the second straight month. Month over month they fell 0.2% in June and were revised higher from a 0.3% decline in May to a 0.1% decline. June retail sales on a year over year basis were up 2.8%, signaling we should be worried about whether Q2 is a great quarter for growth opposed to worrying about an impending recession.

Core retail sales in June were down 0.1% and flat in May. This means consumer spending will likely be a weak point for the Q2 GDP growth which comes out on July 28th.

The latest forecasts were negatively impacted by this weak retail sales information. The Atlanta Fed GDPNow report is now within what I have been expecting GDP to be as it has been lowered to 2.4% from 2.6%.

Specifically, the retail sales and CPI report caused the estimate for real consumption expenditures growth to fall from 3.1% to 2.9%. At this point in the quarter, the estimate is very close to being locked in. Interestingly the New York Fed’s Q2 model has been locked in for about a month as it hasn’t changed much since mid-June. It’s currently at 1.90% as you can see in the chart below. The retail sales and data revisions had the biggest drag on expectations.

I would argue that the lower the expectations for the Q2 GDP, the better. The only way the market will sell off hard because of this report is if it misses expectations by a lot. The blue chip forecasts are expecting 2.7% growth. That’s probably too high. If it stays near there and the report comes out as 2.0% there will be a meaningful sell-off.

I wouldn’t necessarily say that’s a likely scenario yet because we don’t know how the next 2 weeks of data will affect estimates. Because earnings are coming in strong, it will soften the blow from economic reports.

The economy has more likelihood to have a negative surprise. To be clear, economic growth matters because it will affect future earnings reports even if international sales are strong.

Healthcare bill prospects

The healthcare bill will likely have a vote in the Senate next few weeks. It will be much tougher than the House vote because it looks as though the conservative Rand Paul and the moderate Susan Collins will oppose the bill. That means there’s no room for any more dissent.

The latest changes have moved towards the conservative side with the Cruz-Lee amendment being tacked on. This change allows for “skinny” healthcare plans to be given out which don’t meet Obamacare requirements.

The skinny term is often used to describe cable packages which don’t offer a lot of channels. In this case, the cheaper healthcare plans don’t include maternity care, mental healthcare, and pre-existing conditions. This makes it tough on Republicans because they promised to include coverage for pre-existing conditions.

The problem for both Democrats and Republicans is that what the American people want is impossible to give them. They want to have socialism and capitalism. In other words, many voters aren’t experts in the industry so they don’t know what they want. Whenever a plan is released, whether it’s what the GOP produces or Obamacare, the media focuses on the bad parts and the bill becomes unpopular.

The CBO will probably score the plan in the next week. I don’t think that will help it pass because the key unknown holdouts are all moderates. They say they don’t know whether they will vote for it. Their concern is the cuts to Medicaid.

Usually, when bills are voted on it means they have enough support, but just because a vote is coming this time doesn’t mean it will pass.

I can say for certain that it will either barely get enough votes or just miss the mark. If it does miss by 1 or 2 votes, the Senate might be able to save it. You can tell they are pulling out all the stops because there was an adjustment which sets aside 1 percent of the stability funds for states with costs that are 75 percent above the national average.

This appeals to Alaska in the hopes of getting Sen. Lisa Murkowski on board.