Given the weakness in the US dollar, likely because of the collapse of Trump’s agenda and ongoing re-rating of global central bank rate hiking campaigns, why would so many become bearish on the yen? Jack Crooks of Black Swan Capital offers answers.

Quotable

“Uncertainty is an uncomfortable position. But certainty is an absurd one.”

—Voltaire

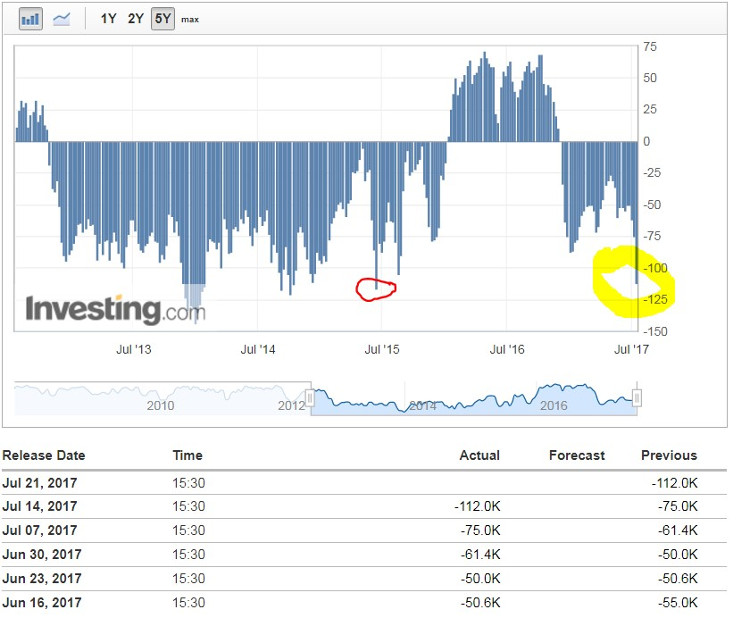

Based on the positioning in Japanese yen–US dollar (USD/JPY) futures, as measured by the weekly Commitment of Traders Report (COT), speculators are increasingly bearish about the prospects for the Japanese yen as you can see from the chart below:

Net short positions for speculators has grown to 112k contracts based on the latest COT report; the biggest short positioning since late June 2015.

Given the considerable weakness in the US dollar lately, likely because of the collapse of President Trump’s agenda and ongoing re-rating of global central bank rate hiking campaigns relative to the US Fed, why would so many become bearish on the yen?

At first blush, it would seem many are positioning short yen in the belief the yen carry trade is back in vogue; i.e. borrow the low yielding currency, then invest those proceeds into higher yielding alternatives; thus, selling the borrowed yen (weakening it in the process).

It’s not just international specs who get in on this game, as domestic Japanese investors effectively make the same trade by moving money offshore to higher yield locals outside Japan.

The carry trade has a self-reinforcing momentum. In this case, the weaker the yen gets, the better the total return on borrowed yen, which in turn stimulates more borrowing and greater leveraging using the yen as the funding currency.

The trade makes sense given the dovish signals we have been getting from the Bank of Japan (BOJ). They do seem quite out of sync with other major global central banks which have either raised rates (US Fed and Bank of Canada) or are threatening to raise rates (Bank of England) or suggesting at the least the punch bowl will start being drained (European Central Bank).

But what is interesting about the Japanese yen is its perversity. What I mean is the yen often doesn’t trade on yield, which makes it difficult to evaluate on a relative yield basis (a good standard for intermediate-term moves in other major currencies). And in an environment when so many other currencies globally are still close to the zero bound, the BOJ doesn’t seem that far out of sync just yet.

One thing we often see with the yen is its ability to rally on risk. It has its own safe-haven quality, as does the US dollar (the primary reserve currency). The yen has deep capital markets and despite the paltry yield on Japanese government bonds (JGBs), it is a hiding place for Japanese institutional money when global risk rises. I believe this helps explains the correlation between the yen and stock prices (given stocks are highly correlated to global risk).

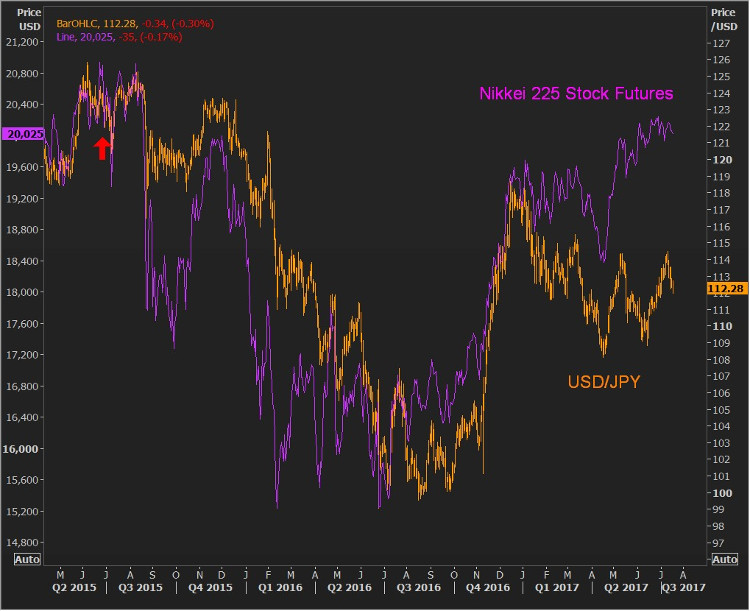

The path of the yen and Japanese stock prices seems tight and negative; i.e. as the Nikkei 225 Index rises, the yen tends to weaken, and vice versa. You can see this in the chart comparing Nikkei Stock Index Futures (NI225) to the USD/JPY exchange rate.

If you take a close look at the chart above you will notice not only a visual correlation, i.e. tendency for the price series to move together, but also a bit of divergence between stock prices in Japan and USD/JPY, with stocks moving higher while USD/JPY ranges a bit and is now moving lower.

So, given that evidence and background, there are two reasons why the speculators who have built up a decent sized short position betting on a weakening yen may be wrong:

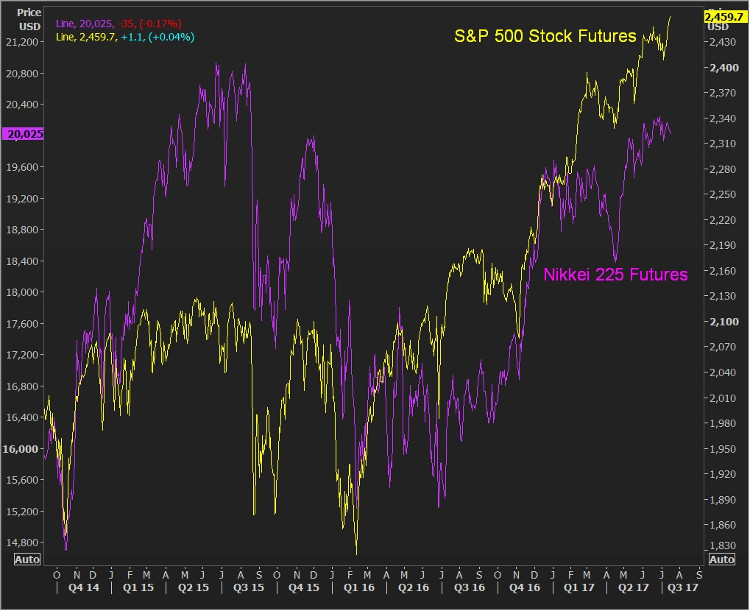

1. Major global stock markets, led by the US, seem due for some type of correction at the least. And given the collapse of President Trump’s much-anticipated reform agenda, would it a surprise to see some of this disappointment feed into equities? We don’t think so. The Nikkei will most likely move closely in line with the S&P 500 Index (SPX) (See the chart below.)

2. One-way position as measured by the Commitment of Traders report is often a good contrary indicator for a change in trend. Note the red arrow in the chart above comparing USD/JPY to Nikkei stock futures: This was the last time (late June 2015) negative positioning was at levels now. And interestingly, this coincided with a strong rally in the Japanese yen, not weakness.

So, when you hear players talking about the yen carry trade is back in play, be careful.

View Currency Currents, commentary, and analysis at Black Swan Capital here…