The precious metals may have a more significant change of direction. Both Silver and Gold responded to important golden spiral cycles. asserts Jeff Greenblatt, director of Lucas Wave International and editor of The Fibonacci Forecaster.

Do you like politics with your markets? Most traders don't but now another condition needs to be managed.

Last week, Donald Jr.'s email scandal broke during market hours and futures took a nose dive. They recovered on word the Senate would forego much of their August recess to debate and vote on health care reform.

This Tuesday (July 18), barely a week later the Emini YM and other futures nosedived again on news the Senate's attempt to reform health care failed.

Each event has two things in common.

First, politics invaded the world of the trader.

Second and most important, each sequence became a failed attempt to go down. In the former, it turned out to be 261 trading days from the Brexit bottom which became an inversion of the cycle. As far as the latter is concerned, we may see deeper implications that have yet to be played out.

In this space, I've discussed how the Washington establishment is making a prophet out of former Reagan OMB Director David Stockman. Nothing we've seen to this point speaks otherwise.

The market is up thousands of points based on certain promises and expectations for economic relief. The public was promised the economy would be better if Obamacare was repealed and taxes would be cut.

Right now, neither are happening.

The great philosopher Yogi Berra famously said, "it gets late early around here." It is late, if the Senate did go on recess, they would be leaving in about nine days. The problem is they've told us no tax reform without healthcare reform.

Today Paul Ryan said the House would have tax legislation ready to go no matter what in the Autumn. Some experts have said tax reform wouldn't be ready until Thanksgiving!

For those of us who must navigate markets every day, we don't have until Thanksgiving. Long term market cycles mature way before then.

This is the 30th anniversary of the 1987 crash and according to Gann, markets tend to react around a 360-degree circle and the Dow hits 360 months from the top of the 87-market starting the last week of August.

That means risk will be extremely high in the time frame from the end of August to the end of October.

Technically speaking, the market continues to shrug off impediments to the Trump growth agenda even as everything is already baked in the cake.

Why is this happening? Nobody knows for sure but one explanation could be if the longer-term cycles are maturing, cycles usually end at an extreme. Markets could surge right through Labor Day.

On another note, the precious metals may have a more significant change of direction.

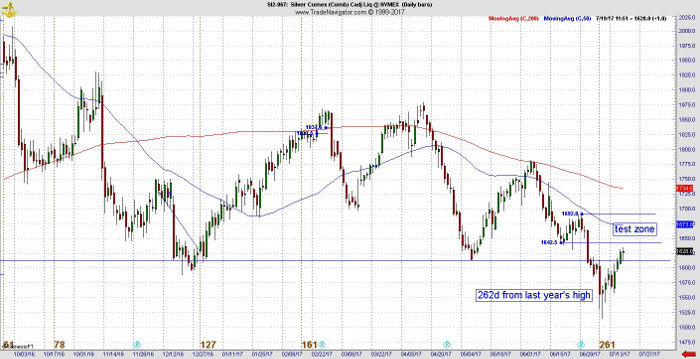

Both Silver and Gold responded to important golden spiral cycles. Gold reversed back up after a 60 day drop while Silver turned back up in the 261-day window from the high on July 4, 2016.

All pivots are not created equal and this one is the most important potential low we've seen in precious metals this year. As you look at the Silver chart, it has already surpassed the prior low on May 9.

It's one important polarity point but now coming against another set of polarity and resistance tests for the current downtrend. So far, the action looks like it can sustain itself. It is early in the game here. Silver would need to hold the 1690 level to confirm the bottom. It doesn't happen overnight. The fact it has survived to here should be encouraging to bulls.