Regardless of whether the dollar is weak or strong or we see more scandal out of Washington, as long as we are over the 21,084 level, the Dow is still likely to see another high prior to topping, writes Mike Golembesky, an Elliott Wave analyst who covers volatility indexes and forex.

Attend The TradersEXPO Las Vegas 2017 - Engage with Top Trading Experts

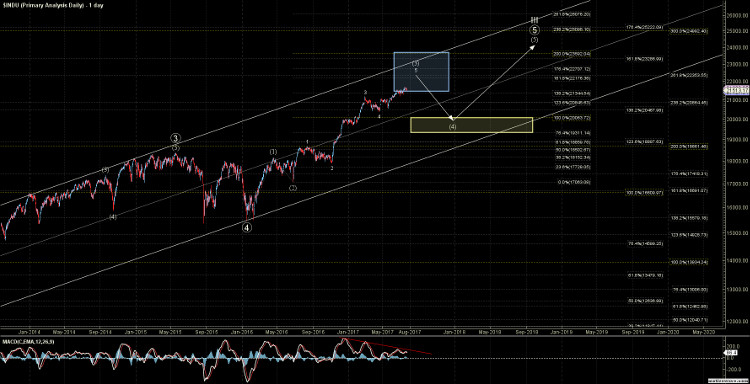

After hitting the 161.8 extension up off of the April 18 lows on July 14, the Dow Jones Industrial Average (DJI) has moved sideways and has traded in a very tight range of less than 1% since that top. Furthermore, the pattern both up and down off of that high has been very sloppy. It hasn’t given us much information to work with on the smaller time frames.

This very tight range in the Dow and the other major stock indices has contributed to the record breaking low Volatility levels that we have seen over the past week, which I wrote about in this article. While these record low levels of volatility are certainly extreme and a “reset” would be welcome by many, for now, the Dow along with the rest of the U.S. equity indexes are still holding over key support levels and have not signaled that a top is in place yet.

Ever since the market bottomed in January 2016, the pundits have been looking for that bombshell news event that was surely right around the corner causing the market to crash. From Brexit to Trump to Russia, there has been no shortage of black swans to go around, yet the market just kept on plugging away higher and higher.

We are approaching the target levels that we had set out back in early 2016 when the Dow was trading almost 40% below current levels. So, we begin to see the pundits start to abandon their black swan theories and to talk about all the exogenous news events that will cause this rally in stocks to continue to move full steam ahead. While not surprising, the fact that we are seeing these articles now, after the Dow has moved up 40% off of the 2016 lows, is quite fascinating.

As I also cover the foreign exchange markets in addition to the equities and volatility markets, I find it quite frustrating when I see articles and analysts discuss how a weakening US dollar should help move stocks higher, such as this headline: U.S. stock market could get powerful tailwind from weaker dollar: Morgan Stanley.

The theory behind this argument is that a weaker dollar will make the goods of U.S. companies less expensive in overseas markets, thus increasing earnings of those companies. That will then, in turn, cause the stock prices of those companies to move higher, spurring the stock market as a whole to rise.

While I certainly understand the argument behind this theory and it certainly sounds like it should make sense, it simply has never proven to actually be the case in reality. There is no long term historical correlation between the value of the dollar and that of the stock market. More frustrating is that all one has to do is simply look at a chart of the dollar overlaid on top of the equity chart to quickly prove this theory invalid.

As is evident by the charts below, it is quite clear that sometimes stocks move up when the dollar moves up, sometimes stocks move up when the dollar moves down, sometimes stocks move down when the dollar moves up and sometimes stocks move down when the dollar moves down. Again, there is simply no long-term correlation that justifies the argument that a weakening dollar is good or bad for stocks.

Yet despite the hard data disproving the theory that a weak dollar is good for the market, this remains to be accepted and the common belief among most market participants and we hear this argument repeated.

What is occurring is two different markets sometimes have similar sentiment patterns that will align with each other. And at other times they will be in complete opposition. These overlapping sentiment patterns will then result in times when there is a positive or negative correlation to each other. Of course, there will also be instances when there is no strong matching sentiment in either direction. Then, these two separate markets will simply show no correlation whatsoever.

So while it may make for a nice headline to state that a weak dollar can help to push the stock market higher, in reality, the only thing capable of pushing stocks higher, or lower for that matter, is the changing sentiment of those who are speculating in the market itself.

As there has been very little change this week in the movement of the Dow, the forward looking analysis from last week has also changed very little.

So regardless of whether the dollar is weak or strong or we see more scandal out of Washington, as long as we are over the 21,084 level, the Dow is still likely to see another high prior to topping.

Once that larger degree top is made we then will focus on the longer term support zone noted above and keep an eye out for a bottoming pattern that would give us the signal that we will still see yet another push higher into 2018.

See charts illustrating the wave counts on the Dow, overlaid by the USD.