The USD is coiled like a cobra against the Australian dollar, Japanese yen and South Korean won. What to do? Wait, suggests Landon Whaley of Focus Market Trader at WhaleyGlobalResearch.com.

Get Trading Insights, MoneyShow’s free trading newsletter »

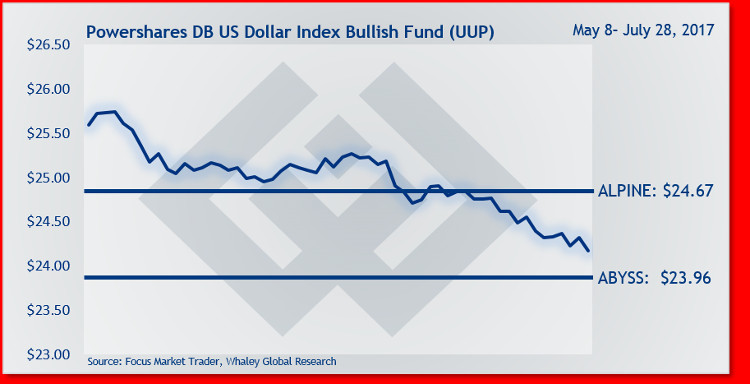

The Powershares DB US Dollar Index Bullish Fund (UUP) declined an additional 62 basis points in the week ending July 28, and is now down 8.7% year-to-date.

I can’t deny that a chart of the USD is as ugly as homemade sin. That said, there are several factors lining up that could cause a violent countertrend rally.

First, the dollar is coiled like a cobra against a host of major currencies, and some of those currencies have already started to pullback like the Aussie dollar (AUD/USD), Japanese yen/U.S. dollar (JPY/USD) and South Korean won/U.S. dollar (KRW/USD).

Second, investors have become all consumed with slowing inflation data and interpreting it as dovish for the Fed and bearish for the USD. The problem with that interpretation is the Fed won’t change its behavior based on slowing inflation because the Fed isn’t normalizing policy based on runaway inflation.

The Fed is normalizing based on an accelerating economy and robust equity markets. As long as the economy remains on its current trajectory and US equities continue to clip all-time highs, then there is nothing to deviate the Fed off its preferred course.

Third, we haven’t seen this level of greenback bearishness in years.

Couple a Fed balance sheet reduction with extreme bearishness and you have a powder keg for a short squeeze. I’m not interested in catching a falling knife but will consider a tactical long trade once the short squeeze begins.

Trade Idea: I would avoid this market entirely for the time being. However, there will be an opportunity for a tactical long trade once the short squeeze begins. Be sure to check back here each week and I’ll make sure to alert you when the opportunity arrives.