The yen plays a safe-haven role when risk rises. So, if risk flows into the market we would expect the yen to act relatively strong compared to the rest of the currency pack, asserts Jack Crooks of Black Swan Capital.

Get Trading Insights, MoneyShow’s free trading newsletter »

Quotable

“Good tests kill flawed theories; we remain alive to guess again.”

--Karl Popper

GBP/JPY the risk trade?

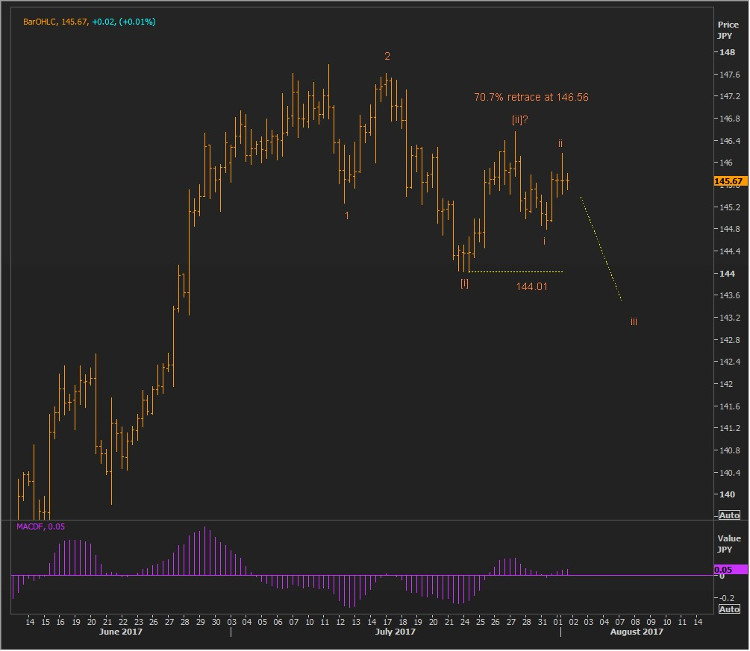

The chart below shows cross-rate for the British pound/Japanese yen (GBP/JPY).

Short this pair is our favorite trade should we finally get some risk (aka risk-off) flowing into this market (global stock sell-off).

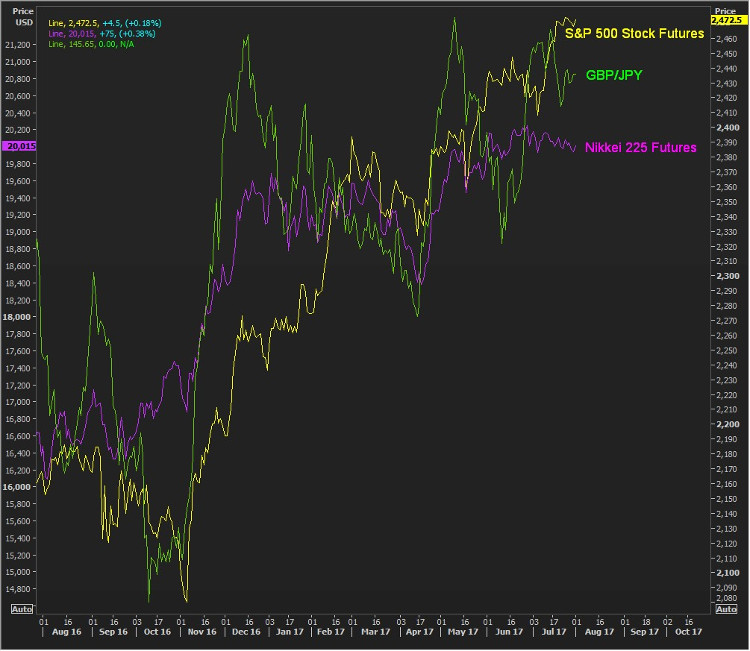

And in the chart below you can see how GBP/JPY has moved relative to S&P 500 stock and Nikkei 225 stock index.

The yen plays a safe-haven role when risk rises.

So, if risk flows into the market we would expect the yen to act relatively strong compared to the rest of the currency pack.

And if risk rises, the UK economy looks vulnerable. And increasing concern about the UK economy, in this still low inflation world would suggest traders might further push out any BOE rate hike expectations; likely weakening the pound.

EUR/USD Again…

We’ve been getting burned in our efforts to short euro/U.S. dollar (EUR/USD) lately. But hope springs eternal and maybe you can see some hope for euro shorts in the two charts below.

- EUR/USD Weekly – Heading into a key resistance level at 1.1875. A good place to correct the powerful move from the 1.0339 low; before going higher.

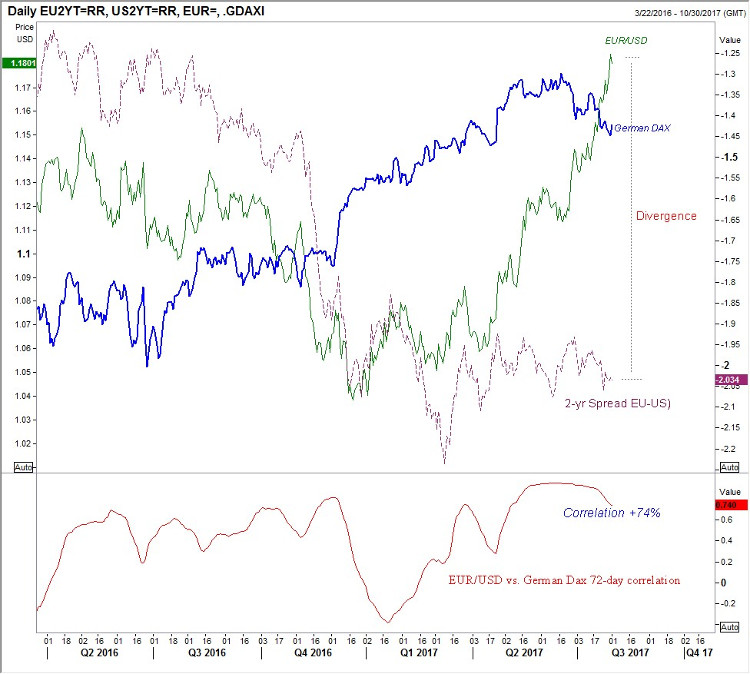

- EUR/USD vs. German Dax (stocks) vs. 2-year spread (Eurozone–United States) Daily…we emphasize two points here:

--Despite the sharp rally in the Euro against the dollar, the yield spread hasn’t followed. It goes to point it isn’t always about yield differentials, but the expected yield differential. With the Eurozone growth improving, the expectation is for a rising spread in favor of the euro.

--and note the tight correlation between the movement in German stocks and EUR/USD. Money flow to European stocks equals buying euro.

Two “buts” here.

--What if the ECB disappoints?

--What if we have a major, or even, minor correction in stocks? And not seen here is the fact the U.S. stock market is outperforming the German stock market.

Maybe time for a bit of rethink among the red-hot euro bulls?

View Currency Currents, commentary, and analysis at Black Swan Capital here…