Trade idea: Wait for an upcoming opportunity to short the U.S. corporate bond market, suggests Landon Whaley of Focus Market Trader.

Get Trading Insights, MoneyShow’s free trading newsletter »

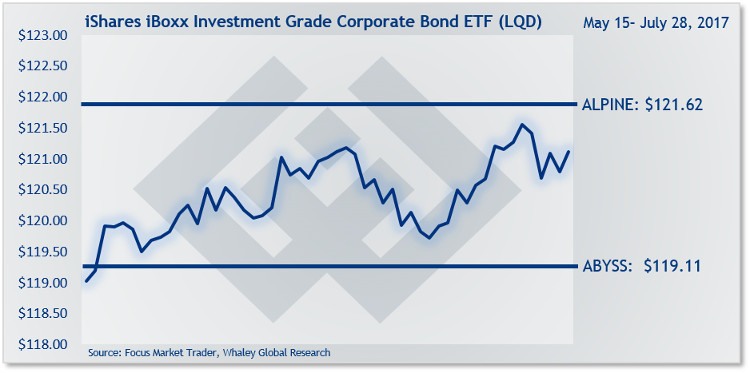

The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) declined 31 basis points in the week ending August 4, and is now up 4.98% year-to-date.

The U.S. corporate bond market has been buoyed for the last two years almost entirely by foreign investors who have been driven by two considerations.

First, investors anticipated, and have experienced, accelerating U.S. economic growth.

Second, international investors have also experienced an increase in U.S. interest rates.

That said, this is no longer 2015 and the Fundamental Gravity for U.S. corporate bonds is shifting to the bearish side of the ledger. Case in point, U.S. corporate interest coverage, which is one indicator of a company’s ability to service its debt, typically improves alongside corporate profits.

However, since 2015, interest coverage has declined even though the corporate profits have improved. This divergence isn’t the only red herring in the corporate sector but it’s one more to add to the list of why I’m firmly entrenched in my neutral bias.

Trade Idea: I would avoid this market entirely for the time being. There will be an opportunity to short this market with a high reward to low risk set-up. However, that time is not now. Be sure to check back here each week and I’ll make sure to alert you when the opportunity arrives.