July could support the narrative of growth slowing. If you focus on the rate of change, then you will be bearish on the economy. In theory, the rate of change predicts slowdowns, but not in practice, asserts Don Kaufman.

Get Trading Insights, MoneyShow’s free trading newsletter »

We’ve gotten most of the economic reports back from July now. Up until the reports I will discuss in this article, I would categorize the reports we’ve gotten as good, but not great.

July could support the narrative of growth slowing. If you are someone who focuses on the rate of change, then you will be bearish on the economy. In theory, the rate of change predicts slowdowns because first growth slows, then it stalls, then declines, and finally there’s a recession when it’s negative.

The problem with this philosophy is it doesn’t work in practice as most indicators don’t act in concert. The economy can be slowing by some measures and accelerating by others. Even if it is slowing, that doesn’t mean a recession is next as there is almost always a mid-cycle soft patch.

The narratives don’t always work because stocks and bonds are affected by a myriad of factors. The one place where I do use the rate of change method is earnings. We’ll see if stocks stabilize in the next 12 months as earnings growth decelerates.

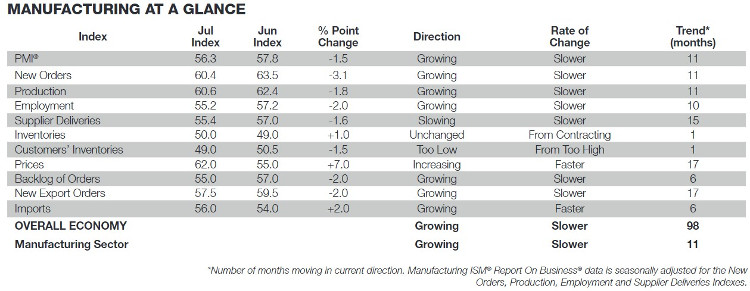

The manufacturing PMI for July certainly adds to the narrative that growth is slowing. The headline was 56.3 which fell 1.5 points from last month. Even worse, the new orders fell 3.1 points to 60.4. A breakdown of the entire report is seen in the chart below. As you can see, most elements are growing and most are slowing.

The manufacturing economy has been growing for 11 months as it has come out of the mini recession it was in. The way the indicator calculates whether the overall economy is growing is by looking at whether the PMI is above 43.3. The manufacturing economy needs the index to get above 50 to grow, which is why the streak is shorter. This shows how the strength of the manufacturing sector isn’t that important to the economy as it fell in 2015, but there was no recession. In theory, the manufacturing sector could be growing quickly while the economy is in a recession. However, recessions are rare and the manufacturing sector would likely follow it lower, so that doesn’t happen in reality.

The one notable figure which is growing faster is the price index which shot up from 55.0 to 62.0. The Fed has been looking for inflation to prove how great the economy and the labor market are doing as well as justify raising rates. This is one example of price increases, but it’s not enough for me to expect a bout of inflation in the second half.

To further hammer home the point that the rate of change isn’t a great way to analyze data, it’s worth mentioning that this data isn’t that bad compared to recent history. It is the 4th best report in the past twelve months. It is one tenth of a point below the 2017 average. This result corresponds to a 4.1% GDP growth rate annually.

Yet, the relationship between the economy and manufacturing is tenuous because of how small it is. I wouldn’t expect Q3 GDP growth to be 4.1%. The Atlanta Fed’s initial forecast is for 4.0% growth in Q3, but as we know, that expectation is virtually meaningless.

Let’s look at a quote from the report to get a more in-depth reading of how well the manufacturing economy is looking. In the food, beverages, and tobacco industry category a respondent said, “In regard to sales, we have had our best year ever. Demand still exceeds supply in our category. Competitors are investing in capital expansion.” This is interesting to keep in mind because, as you can see from the chart below, Q1 was the most difficult quarter in the U.S. food industry history. Either this manager isn’t in the food industry or she isn’t in one of the divisions in which the firms below are seeing weakness.

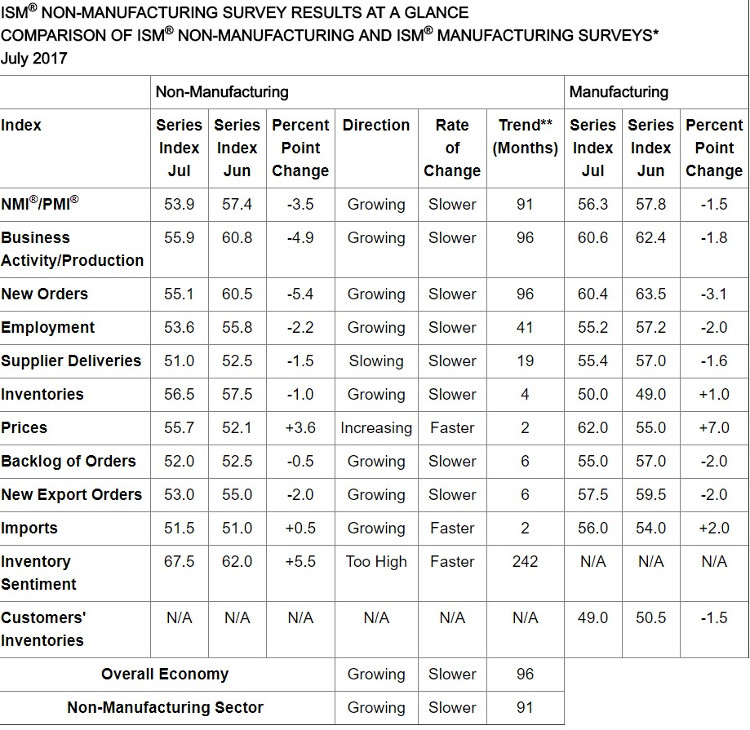

While the manufacturing ISM was slowing, but still strong, the non-manufacturing ISM was slowing and mediocre. As you can see from the chart below, the PMI fell 3.5 points to 53.9. Business activity and production fell 4.9 points to 55.9. The new orders fell 5.4 points to 55.1.

These are all sharp drop-offs which indicate that July wasn’t a great month for the economy outside of manufacturing. Because the non-manufacturing sector is more important than manufacturing, the index can only fall to 48.9 before the economy is considered to be in a recession. The current headline number is consistent with only 1.9% annualized GDP growth. That is almost exactly consistent with the New York Fed’s expectation for Q3 growth which is 1.92%. It’s funny how the manufacturing ISM almost aligns perfectly with the Atlanta Fed and the non-manufacturing ISM aligns with the NY Fed.

I consider the Atlanta Fed’s first forecast to be completely useless. Most indications are that July was a slightly slower month, putting 2.0% GDP growth as the most likely possibility.

This report was bad as it was the second worst report in the past 12 months.The worst report was August 2016 which was 51.7. The number rebounded in September, so it’s possible the same thing happens next month. It’s interesting to see that prices were also up; this index was up by 3.6 points. There still isn’t any inflation to speak of, but these two reports might mean that is about to change.

It’s interesting to see that a healthcare services company said, “Business volume slowed some in June.” As I showed in a previous article, healthcare earnings had the best beat rate in Q2. That’s why some of these quotes need to be taken with a grain of salt. Most of the quotes were cautiously optimistic, but obviously, that didn’t translate into the final headline number.

This might indicate that the headline number is worse than reality. I’d expect a small sequential increase in August. Obviously, we’ll get a better idea if that hunch has any merit when data starts to flow through from August. As of now, we don’t have anything to go by.