If the top has indeed been struck then the pound could very well be on its way down towards par with the U.S. dollar, says Mike Golembesky, an Elliott Wave analyst covering U.S. indexes, volatility instruments, and forex.

Get Trading Insights, MoneyShow’s free trading newsletter »

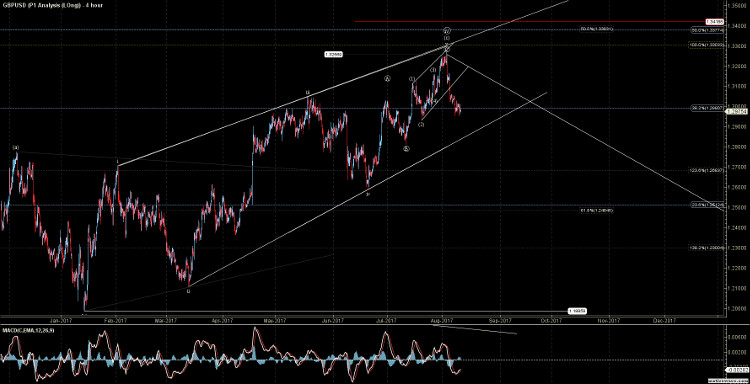

In July I wrote that the pound was still poised to see lower levels. I was tracking a larger ending diagonal or wedge pattern on the pair that once completed should result in a sharp reversal back to the downside.

I was looking for a move a bit higher prior to seeing that top, however. On the chart attached to that article, I was looking for an ideal move into the 1.3249 level on the British pound/U.S. dollar (GBP/USD) currency pair. I had indicated this with the arrows and Fibonacci price levels on that chart.

Two weeks ago just after the BOE announcement, the high on the pair hit that 1.3249 level almost to the penny. It has since then continued to follow through to the downside. The pair is now providing us with a potential 5 wave pattern to the downside, giving us an initial signal that the larger degree top may indeed be in place.

The GBP/USD does still have several price support levels yet to break to give us additional confirmation that we have indeed topped. If those levels are able to break over the course of the next several weeks the setup is certainly in place to still see much lower levels on the pair into next year.

Just prior to the Bank of England’s rate announcement the GBP/USD saw a sharp move lower in value. Just prior to the announcement I alerted our members that the pair was closing in on the ideal resistance/target level at 1.3250.

While the content of what is said during Central Bank announcements is really not terribly relevant, at times these announcements can act as timing catalysts. We saw this recently with the Australian dollar/U.S. dollar (AUD/USD) pair when the pair jumped up after the RBA released some very ambiguous meeting minutes. I wrote about that particular announcement several weeks ago.

Regardless of what is said during these announcements, the market is going in whichever way the sentiment drives it. In the case of the GBP/USD, that reaction was to the downside. We were able to predict this reaction without having any idea as to what the BOE was going to say based on what the chart patterns were telling us well in advance of that announcement.

From here it is simply a matter of if the GBP/USD can continue to follow through to the downside based on the setup that is currently in place. For that, we will continue to keep a close eye on both the structure of the continued moves to the downside as well as the price support levels below.

As noted above I can make the case that the GBP/USD does indeed have a 5 wave move to the downside already in place. This does give us the initial signal that we may indeed have a larger degree top in place. The structure of this potential 5 wave move is less than ideal. So for that reason, I am focused on both the structure of the move as well as key price support levels on the pair.

The next key level is at the 1.2931 level. That is where I would want to see a break to signal that we do have a top in place. A break of this level should then be followed by a break of the 1.2931 and then 1.2810 levels.

Current resistance on the pair comes in at the 1.3184 level and a move over that level would be the initial signal that this may still have more work to do to the upside prior to breaking down lower. Official invalidation of this setup comes with a break back over the 1.3256 high.

So while this is certainly off to a good start, we do still need further confirmation to signal that the larger degree top has indeed been struck. If that top has indeed been struck then the pound could very well be on its way down towards par with the U.S. dollar.

See charts illustrating the wave counts on the GPB/USD.