Surprise is what moves prices the most. One surprise is the Trump agenda. So, stay tuned and don’t bury the buck just yet, asserts Jack Crooks of Black Swan Capital.

Get Trading Insights, MoneyShow’s free trading newsletter »

Quotable

“Never say never.”

―Charles Dickens

We have fortunately have been positioning for a dollar rally, and happy with what we see so far. The key question: Is this move higher in the dollar a simple correction, or is a new bull trend in play? We favor that latter, but without the gift of hindsight we remain open.

We do believe there is a chance the bull can roar again. Why? Yield.

Today’s report of better than expected U.S. retail sales and Empire Manufacturing Index show there may be more giddy-up in the U.S. economy. I think that is what yield spreads are telling U.S.; they continue to favor the U.S. dollar.

Yield spread is usually important as it relates to the intermediate-term trend.

Below is chart showing 2-year and 10-year spreads versus four other competitors: Eurozone, UK, Australia, and Canada. For example, the top chart in the left-hand column reflects the 2-year yield spread (i.e. Eurozone minus the U.S.). The current level, at -2.072 means the yield on 2-year U.S. paper is 2.072% higher than equivalent EU paper (a significant spread indeed favoring dollar deposits). As designated by the down sloping trend line in every chart, the U.S. relative yield is rising…

This alone gives us pause when we suggest the long bull market in the dollar is toast. Obviously, the expected future action by the Fed plays into these relative yields. If expectations change, yield spreads will reflect it quickly. For now, one can say yield is dollar positive.

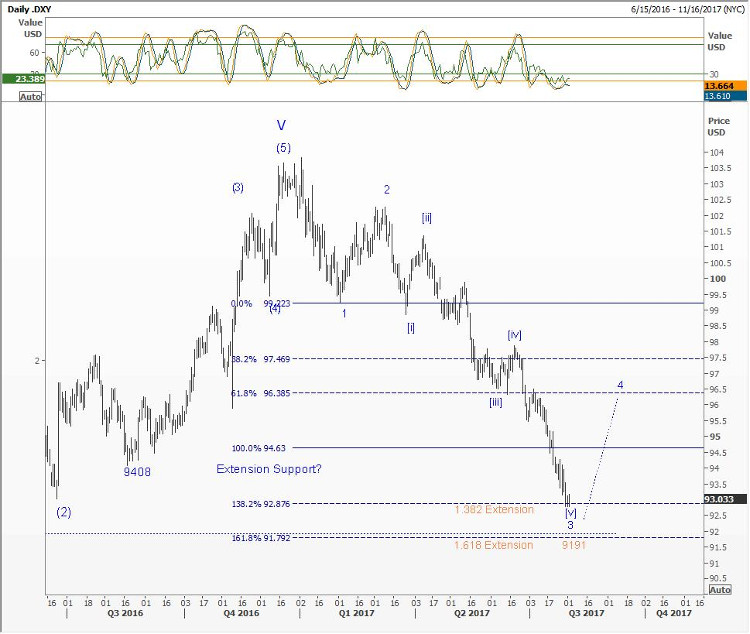

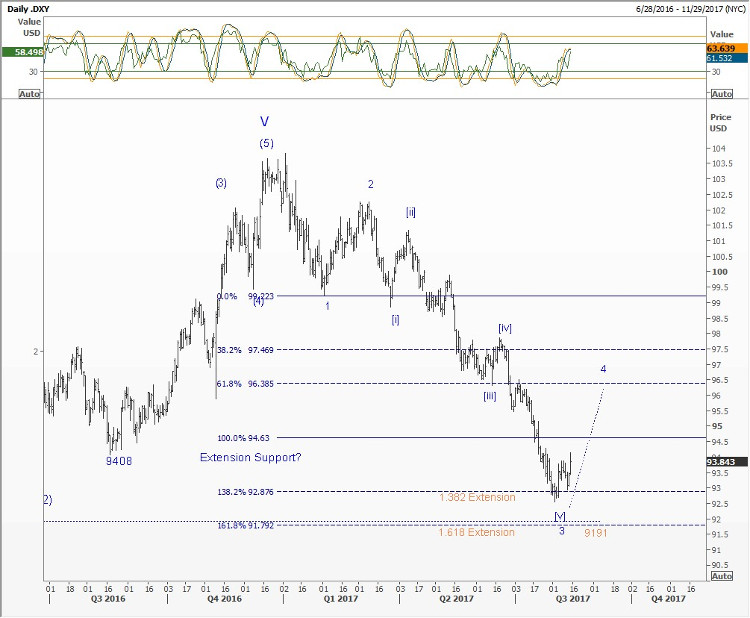

Technically, we thought the buck was due for a bounce, this is the chart and brief comments we shared with our Key Market Strategies subscribers on August 2, 2017:

US Dollar Index: We think we are close to a significant bottom in the US dollar index.

And we seemed to have gotten that bounce right on schedule as you can see here.

U.S. Dollar Index August 15, 2017…

The label 4 in the chart above suggest the rally in the US dollar from the low is a correction—the top is in place. But if we analyze the U.S. dollar from the weekly time frame (next page), and assuming our wave labeling is correctly, the jury is still out as to whether we have seen top….

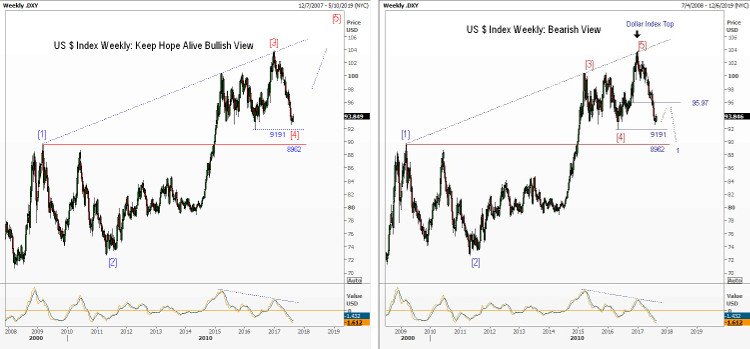

US Dollar Index Weekly: I am showing two views below. On the left is our mostly likely bearish outlook suggesting the top is in place for the buck. On the right is the “Keep Hope Alive” bullish view suggesting a new high is in the cards. According to wave theory, not until Wave 4 crosses below the high at Wave 1 can we say a new bear market has begun. As you can see, that clearly hasn’t happened yet in either chart as labeled.

So, our suggestion is to play this rally in the U.S. dollar as a correction, but don’t be surprised if it turns out to be much more; remain open to a surprise.

One surprise that comes to mind is the Trump agenda. At this stage, most players think D.C. is in total chaos and any significant tax (e.g. rates and/or overseas cash repatriations) or regulatory changes to help the economy is dead in the water. Maybe it’s not. And maybe the falling unemployment rate might start to push up wages pushing inflation into the two percent category as the Fed is hoping.

Who knows? The point is: surprise is what moves prices the most. So, stay tuned and don’t bury the buck just yet.

View Currency Currents, commentary, and analysis at Black Swan Capital here…