Given the undeniable fact that the news is here to stay it behooves us as traders and investors to know when, how, or if to respond to the news, asserts veteran trader Jake Bernstein in his new weekly series.

Welcome to part two of this series. What I had originally intended to cover in this installment has been supplanted by a more meaningful real-time example that has occurred just in the last few days.

I’m referring specifically to the events of the, for lack of better term North Korean missile crisis which as you know has caused considerable geopolitical unrest as well as fear and volatility in financial markets.

In recent days stocks sold off sharply while indicators of volatility rallied sharply. Panic liquidation of stocks which began on August 10 is a classic example of how the news impacts traders emotions which in turn govern trader behavior.

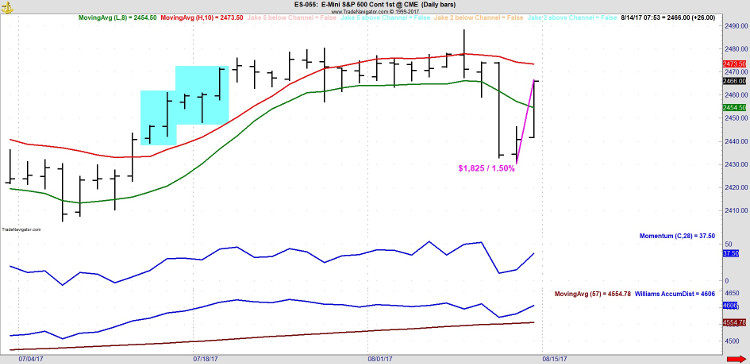

This is also an example of how traders can profit handsomely by taking advantage of extreme declines in pre-existing up trends. The chart below shows the severe reaction and the extreme recovery which is in the process as I write this report.

The chart shows S&P 500 futures currently rallying strongly back pre-panic levels. While this is a great example of how traders can take advantage of bearish news in a bullish trend, the real issue is how do we do this from the standpoint of timing?

Shown below is one of my intraday charts in S&P futures showing how the 30 minutes futures chart can be used to buy after the trend has bottomed in a pre-existing bull market subsequent to “bad” news.

If you have some time, study the events preceding and subsequent to the 1962 Cuban Missile Crisis which has eerie similarities to the North Korean missile crisis. More details next time.

Wishing you the best of trading!

Subscribe to The Jake Bernstein Online Weekly Capital Markets Report and Analysis here…