I think the biggest risk to the market is a quantitative failure and the GOP not passing fiscal reforms. The latter risk is probably mostly priced into the market, but the former risk isn’t, asserts Don Kaufman, Co-Founder of TheoTrade.

Get Trading Insights, MoneyShow’s free trading newsletter »

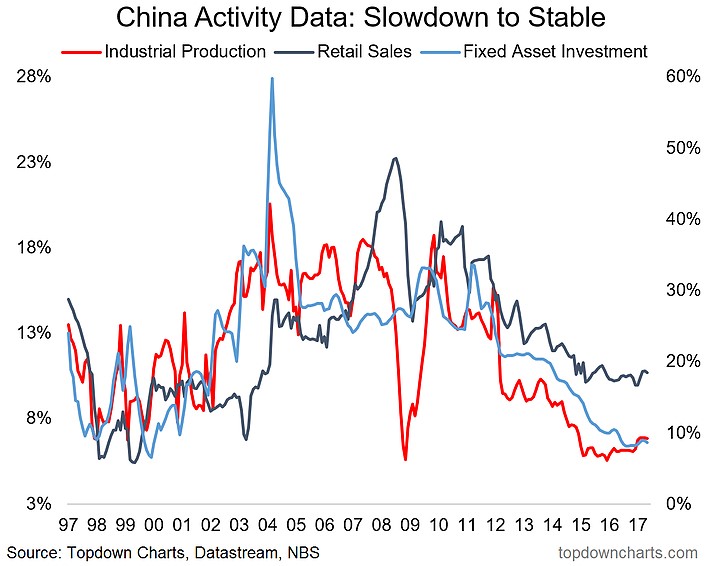

The Chinese economic recovery came at a great time as it has helped the global economy in the wake of the disappointment in the lack of fiscal policy stimulus in America. The improvement in China helps the global economy and acted as a catalyst for American economic growth accelerating this year. As you can see from the chart below, the industrial production, retail sales, and fixed-income investment growth are all stabilizing and beginning to move higher.

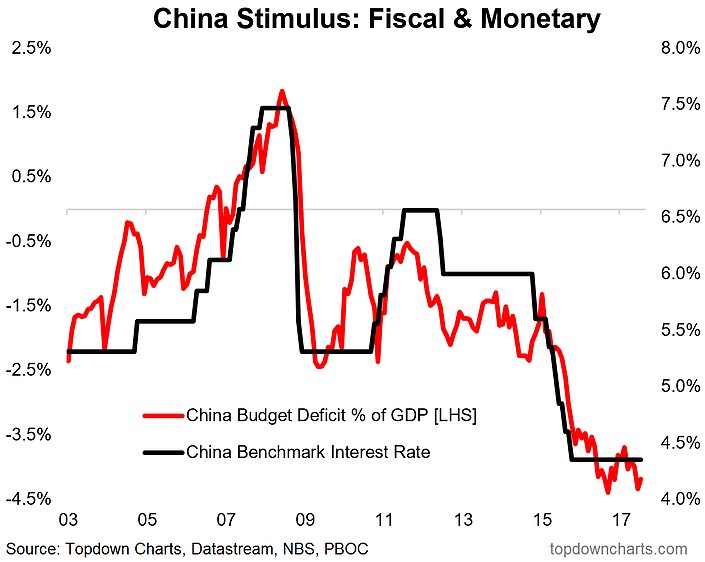

The chart below tells you everything you need to know about the reasons for the Chinese economic improvement. As you can see, the Chinese benchmark interest rate has been cut from about 6% in 2014 to about 4.5% in 2016.

China is combining this monetary stimulus with fiscal stimulus as the budget deficit as a percentage of GDP is at about -4.5%. China is doing what America failed to do as America hasn’t been able to pass a fiscal stimulus. To be fair, America runs huge deficits in its own right, but it hasn’t been able to push some of that spending into short-term economic stimulative measures.

China’s weakening currency is helping exports improving the economy along with the fiscal and monetary stimulus.

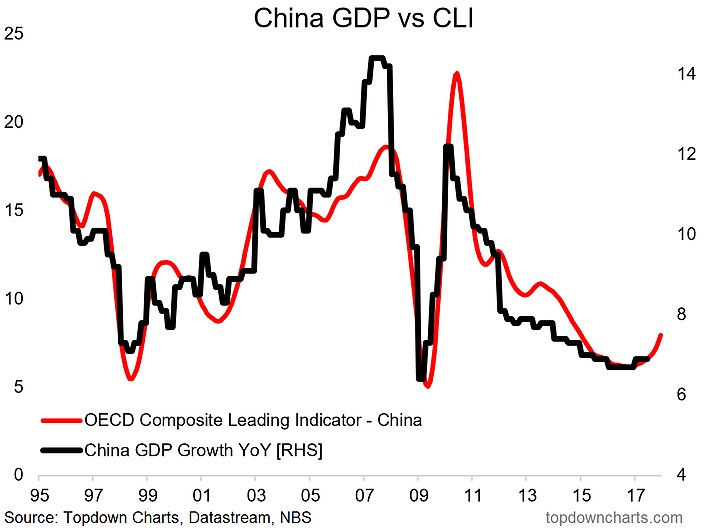

As you can see in the chart below, the OECD composite leading indicators index projects China to see further cyclical improvement. The question is how long this lasts. China might pull back from its stimulation after the change in government to avoid fueling a bubble.

That bubble might burst at some point as the debt to GDP is 327% according to the IIF.

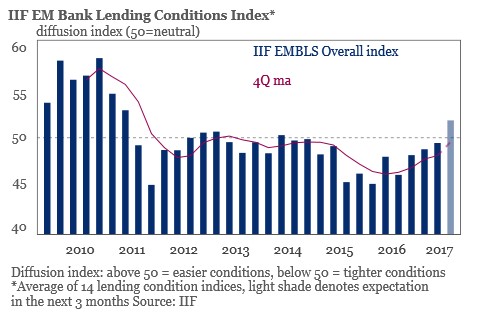

The Chinese improvement has influenced all emerging markets as the credit cycle begins to improve.

As you can see from the chart below, the IIF’s Emerging Market Bank Lending Conditions Index has been improving for three quarters. When the index gets above 50, it means conditions are loosening. Conditions have been tightening for most of the past 6 years which is why emerging market stocks have underperformed. Next quarter is expected to see loosening conditions for the first time since 2014. The index is expected to reach the highest point since 2011.

We will see if the expectations are met but, the other indicators such as global trade and the performance of emerging market stocks seem to indicate this estimate will be met.

Band of America survey changes

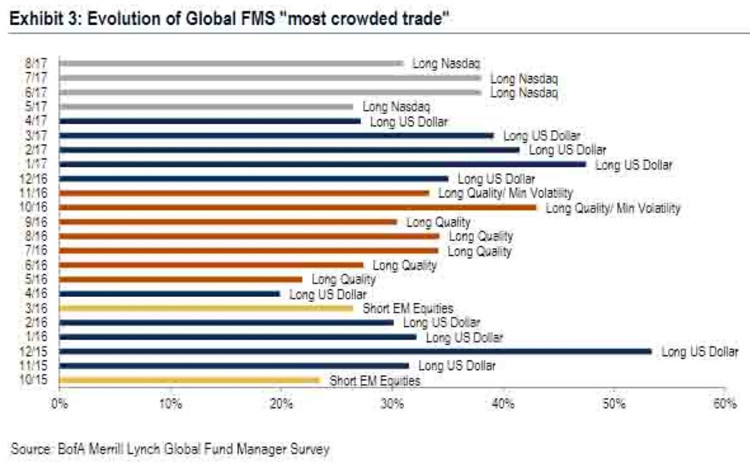

Let’s look at two more Bank of America surveys to get a historical understanding of where fund managers think the most crowded trades and biggest risks are.

As you can see from the chart below, the most crowded trade has been the long Nasdaq trade for the past 4 months. The popularity dipped in the last survey probably because Amazon (AMZN) and Alphabet (GOOGL) have fallen off their perches.

I have said previously this survey has a good track record. You can see that in this chart as the long dollar trade was considered to be the most crowded trade in the beginning of the year and the dollar fell since then. You can also see that the ‘short emerging markets equities’ trade was considered crowded in a month in 2015 and 2016.

We are seeing that trade reverse this year as China rebounds as I mentioned earlier. I guess that it’s easy for these fund managers to see a trade which is long in the tooth, but it’s tough to spot when it will end. The reason I say that is it’s unlikely that all these investors who are spotting these trends are making money off them and timing them correctly is because the aggregate opinion cannot be correct on timing the market because when the opinion changes, the stocks immediately fall.

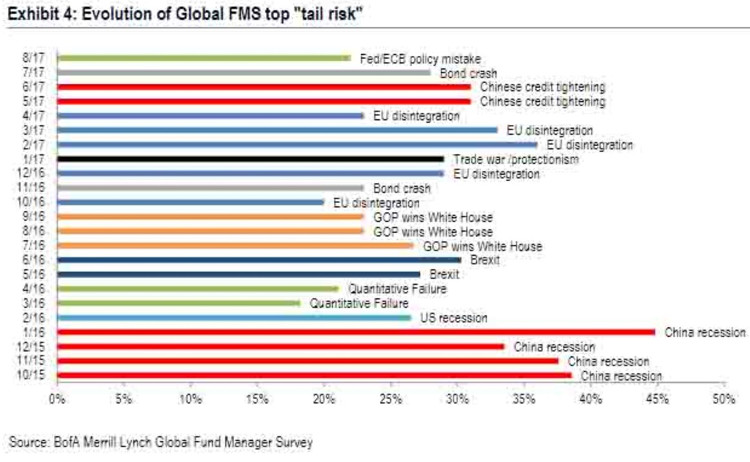

The chart below shows the historical changes in the top tail risk. As you can see, in February 2016 a recession in America was considered the top risk. That ended up being the peak of the recession scare as the stock market bottomed in February and the economy began to rebound because the central bankers added record liquidity into the system through a coordinated QE policy.

These risks are interesting because they mostly haven’t come true and if they have they haven’t been bad. That’s not a problem with the survey; it’s a matter of the economic situation. If you ask someone what the biggest risk is they must respond even if there won’t be anything bad happening.

When I speak of an event that happened but didn’t cause a problem, I’m referring the fear of the GOP winning the election. It’s amazing to see that transform from a risk, to a benefit, back to a risk again as the debt ceiling issue comes front and center.

Clearly, the Chinese recession feared in 2015 never occurred although there was a deceleration of growth. The best reaction to these risks has been to fade them because by the time everyone focuses on them they are priced into the market. However, the crowd isn’t always wrong since sometimes the fear is accurate as was the case in 2008. In that case, the peak fear needed to get more intense because the risk event happened.

Conclusion

The emerging markets are driving the economy higher. They are being driven by Chinese fiscal and monetary stimulus showing the U.S. what it could have been possible if Congress would have got its act together and passed an infrastructure program. In the long run, the jury is still out on Chinese deficit spending, but in the next few months, I see blue skies ahead as growth bottoms.

I think the biggest risk to the market is a quantitative failure and the GOP not passing fiscal reforms. The latter risk is probably mostly priced into the market, but the former risk isn’t. Neither of these risks have specific dates when they will occur, meaning there won’t be a day where we know the shrinking of the balance sheet will cause a crisis and we don’t have a day when it will be clear tax cuts won’t be passed. That’s what increases the uncertainty, the element of surprise.