A longer-term cycle analysis suggests a turn in the relative performance of both the dollar and commodities may be upon us. An accelerated power shift to Asia could be the major global macro driver, asserts Jack Crooks of Black Swan Capital.

Get Trading Insights, MoneyShow’s free trading newsletter »

Quotable

And so, from hour to hour, we ripe and ripe.

And then, from hour to hour, we rot and rot;

And thereby hangs a tale.

—William Shakespeare

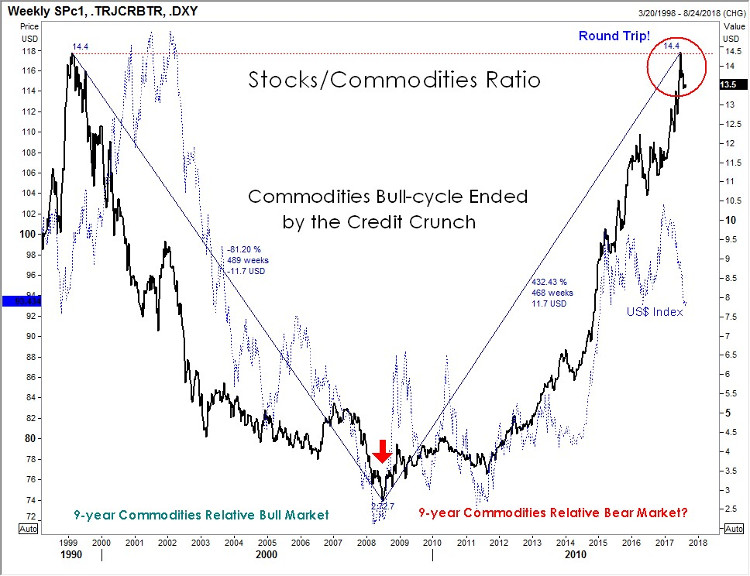

On July 5, 2017 we shared a chart comparing the relative movement of stocks (S&P 500 futures index) to commodities (Reuters CRB index) and said then:

…the peak back on July 5 was a ratio of 14.4—exactly on the prior peak nine years earlier; and if that peak holds shows and eighteen-year cycle—9-years down (commodities market outperformance) and 9-years up (stock market outperformance. In the Stocks/Commodities Ratio as you can see in the same chart below updated through Friday, August 18, 2017:

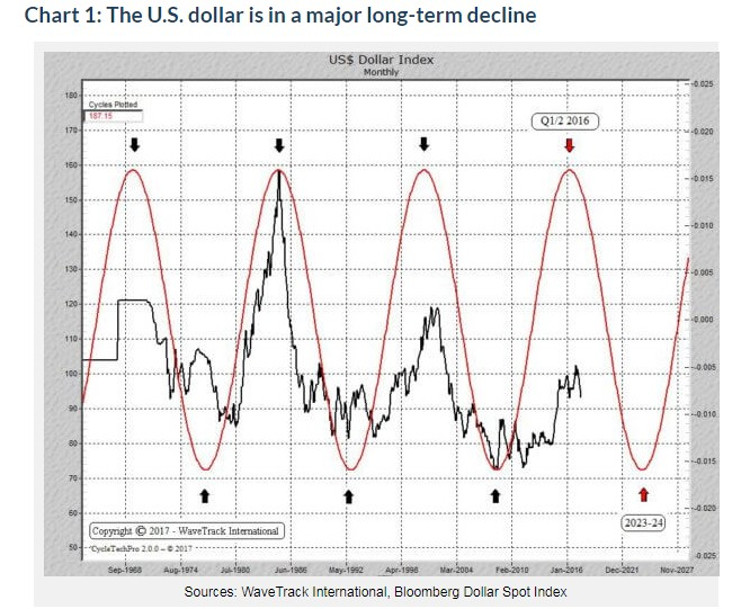

And can you guess what else can be evaluated on a similar cycle view? If you said the U.S. dollar index you are correct.

Below is a chart of the U.S. dollar index showing a 16-year cycle period. It suggests the dollar has topped and is poised for another major long-term bear market.

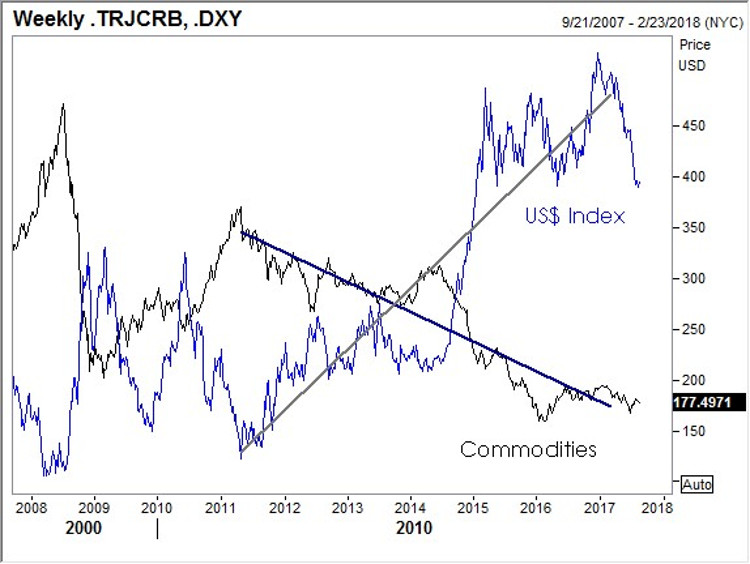

This correlation between the dollar and commodities makes sense, as the major commodities are price in U.S. dollars.

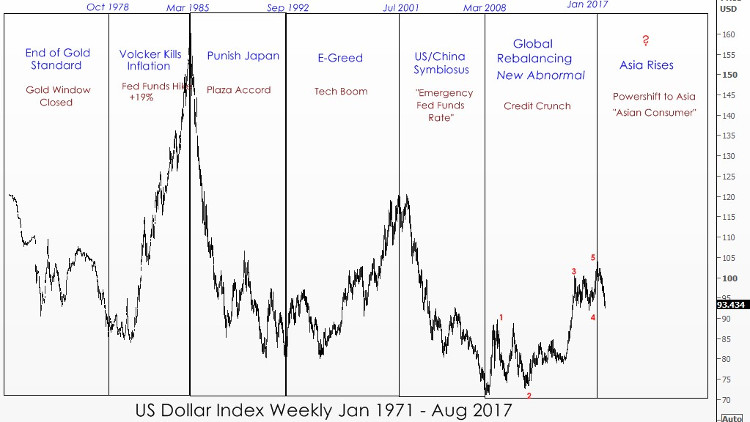

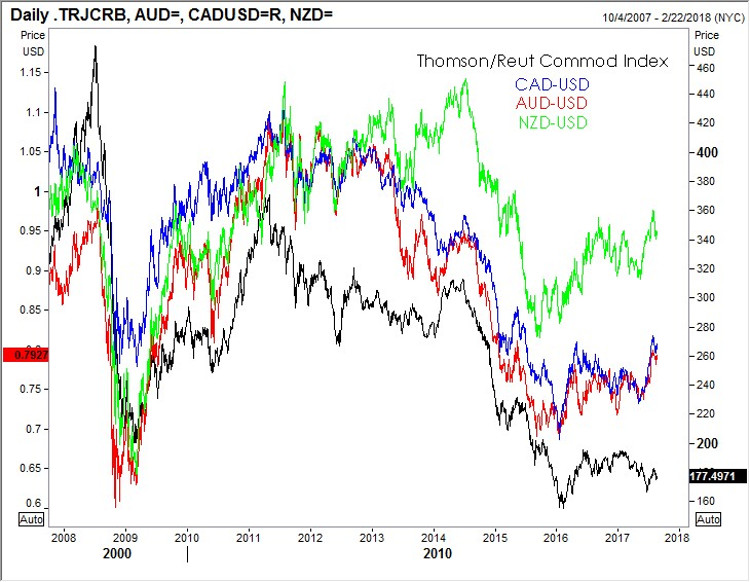

And if commodities as a group do start moving higher (we are expecting higher prices in gold and oil based on our wave analysis; we are long both GLG and USO in our Key Market Strategies service) it probably makes sense to consider the commodity currencies undervalued against the buck. We share a long-term chart of commodity currencies on the next page. But first a look at chart we have shared before defining the global macro era’s as it relates to the U.S. dollar index; our best guess on the new era—the Rise of Asia.

We think with the cultural suicide of the West driven by the new Cultural Marxists across the US and Europe, makes it more probable we will see an accelerated powershift to Asia as China continues to increase its global reach (both economically and militarily) and Japan may be emerging from its long slumber.

Thomson Reuters Commodities index vs. Commodity Dollars (Aussie, CAD, Kiwi)

So, longer term cycle analysis suggests a turn in the relative performance of both the dollar and commodities may be upon us. An accelerated power shift to Asia could be the major global macro driver.

Stay tuned.

View Currency Currents, commentary, and analysis at Black Swan Capital here…