Trade idea: I would avoid this market entirely for the time being. There will be a time to invest in this market, but now is not it. Watch tax reform for a signal, suggests Landon Whaley of Focus Market Trader.

Get Trading Insights, MoneyShow’s free trading newsletter »

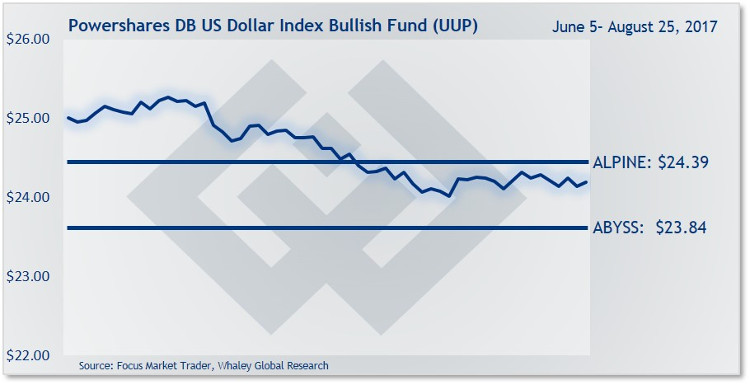

The Powershares DB US Dollar Index Bullish Fund (UUP) declined 91 basis points in the week ending August 25, and is now down 9.3% year-to-date.

The U.S. dollar got kicked around like a political football last week. First, it was Trump revealing he would risk a government shutdown to secure funding for a wall along the U.S.-Mexico border. As a result of Trump’s comments, several rating agencies said failure to raise the debt ceiling soon would lead to a review of the United States' sovereign rating with “potentially negative implications.”

Well, the greenback didn’t like that one bit. It got worse for the USD on Friday when Yellen’s comments weren’t hawkish enough for investors. Investors sold the dollar because Yellen’s comments were about financial markets generally and not one sentence was uttered about the future direction of Fed policy.

The USD just can’t gain any upside momentum and I’m starting to think the only hope it has of picking itself up off the canvas is if the president can make some headway on his economic policies. I’m remaining neutral and on the sidelines.

Trade Idea: I would avoid this market entirely for the time being. There will be a time to invest in this market but now is not it. In terms of anyone out there considering a short trade, I would caution you against chasing this market lower. A 9 percent decline in a currency is a massive move and sooner or later the dollar will get oversold from a quantitative perspective. This decline has led other investors to chase, leading to historically short positioning. This short positioning is setting the stage for substantial behavioral risk of a short squeeze in the greenback. The biggest catalyst for that short squeeze is Trump’s tax reform. If he manages to get any traction on that reform in the remaining four months of the year, the dollar is going straight up and to the right, as investors flee their short positions in droves.