Trading strategy: I’m watching for an opportunity to go short euro/dollar (EUR/USD) with a stop near Tuesday’s high, writes Jack Crooks of Black Swan Capital at the close Tuesday.

Get Trading Insights, MoneyShow’s free trading newsletter »

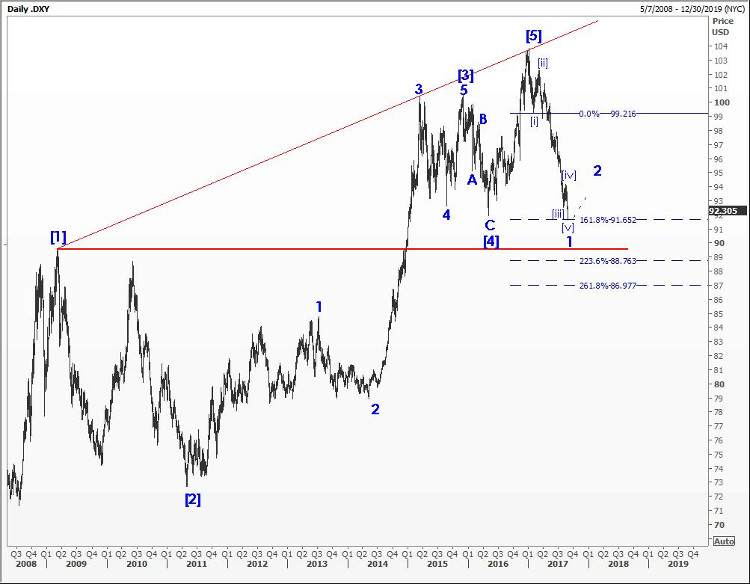

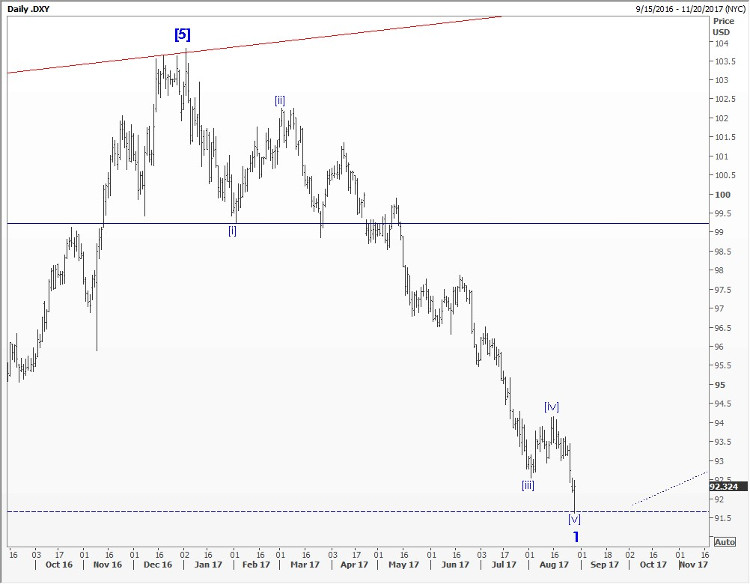

DXY Daily [last 92.34]: Tuesday, August 29, the U.S. dollar index extended to almost exactly a key extension target measured by extending minor Wave [i] by 161.8%, a standard measuring technique we utilize.

The low Tuesday was 91.62—the target was 91.65.

And what is interesting is the fact both the euro and yen put in big reversals Tuesday after reaching their highs against the dollar (the euro and yen make up the bulk of the weight of the US dollar index).

Trading strategy: This could be the level where we finally see a sharp counter trend rally in the U.S. dollar, just as many players have thrown in the towel.

I’m watching for an opportunity to go short euro/dollar (EUR/USD) with a stop near Tuesday’s high.

Wave 1 down View

View Currency Currents, commentary, and analysis at Black Swan Capital here…