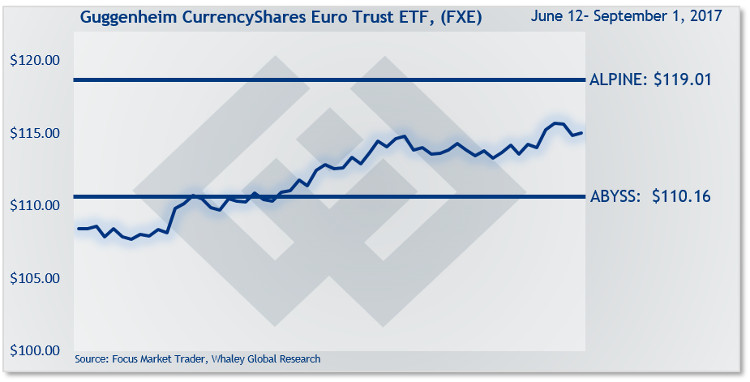

Trade Idea: New short trade ideas on FXE can be initiated between $113.19 and $116.28. Depending on how much room you want this trade idea to move, use a risk price between $114.59 and $119.01, suggests Landon Whaley of Focus Market Trader.

Get Trading Insights, MoneyShow’s free trading newsletter »

The Guggenheim CurrencyShares Euro Trust (FXE) declined 58 basis points in the week ending September 1, but still has a 9.0% gain for the year.

Despite an acceleration in the latest inflation readings, the ECB’s policy trajectory is anything but a foregone conclusion. In addition to inflation remaining well below the ECB threshold, Reuters reported that sources familiar with ECB discussions revealed the euro’s strength is “worrying a growing number of ECB policy makers.” This concern “increases the change of a delay in their QE decision, or a more gradual exit from asset purchases.”

The sources went on to say the ECB “could further relax a requirement to buy bonds in proportion to each country's ECB shareholding, or include new asset classes such as stocks, as raised in July by one policymaker but not given consideration, or non-performing bank loans.” Whammo!

The Euro bulls are being told unequivocally that there hopes of a 2017 taper won’t come to fruition.

You can use the euro’s strength to initiate a short trade idea ahead of the ECB meeting but I would keep the position size smaller than your usual size.

Trade Idea: New short trade ideas can be initiated between $113.19 and $116.28. Depending on how much room you want this trade idea to move, use a risk price between $114.59 and $119.01. Once initiated, close all open trade ideas if FXE opens, or closes, above your risk price. If the trade moves in your favor, then you could consider using $110.16 as your initial profit target price.