Similar to Nvidia, options on Corning are attractively priced, from a volatility perspective. The equity's 30-day at-the-money implied volatility checks in at 18.2%, says Elizabeth Harrow, at Schaeffer’s Investment Research.

Get Trading Insights, MoneyShow’s free trading newsletter »

Given the risks hanging over the stock market right now -- from Hurricane Irma to North Korea -- we can't blame traders for shying away from initiating new long positions.

But despite macro-level uncertainties, there are definitely some compelling trade opportunities out there for stock pickers, on both the long and short sides of the coin. And by playing options instead of trading the shares directly, cautious investors can limit the amount of capital at risk on each trade. Below, we'll highlight a couple of tech stocks at compelling junctures on the charts, based on data compiled by Schaeffer’s Senior Quantitative Analyst Rocky White.

First, a word about the methodology. We look back over three years' worth of data, and consider a "signal" to have occurred when the stock:

(a) closes above the moving average in question;

(b) has traded above the moving average 60% of the time over the last two months;

(c) is less than one standard deviation from the moving average.

This approach allows us to hone in on up trending stocks that are currently testing (or are on the verge of testing) historically significant moving averages that have played a role in previous rallies.

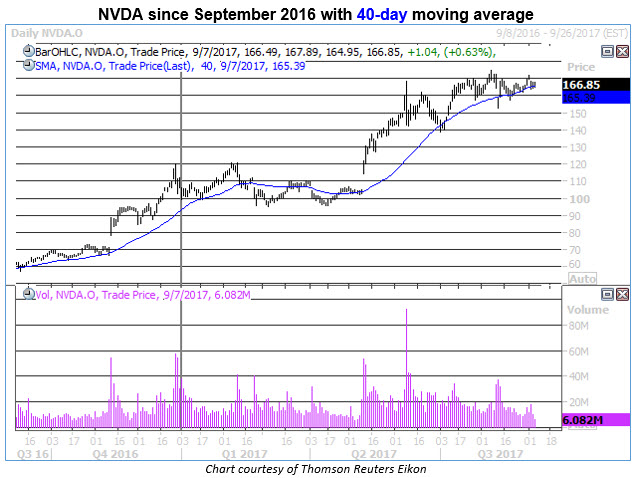

PC graphics giant Nvidia (NVDA) is trading around $166.85, and just triggered a signal at its 40-day moving average (currently docked at $165.39). Following the last 10 such signals, the stock has been higher 60% of the time five days later, with a slim average return of 0.13%. It's when we look out at the 21-day stats that the stock's performance becomes notably bullish -- 70% positive, with an average return of 10.14%.

And NVDA looks particularly appealing from a premium buyer's perspective. Trade-Alert pegs the stock's 30-day at-the-money implied volatility at 31.1%, in the low 10th percentile of its annual range -- meaning that short-term options are priced to move.

Additionally, NVDA sports a Schaeffer's Volatility Scorecard of 97 (out of 100), which indicates the shares have consistently outperformed the options market's volatility expectations over the past year.

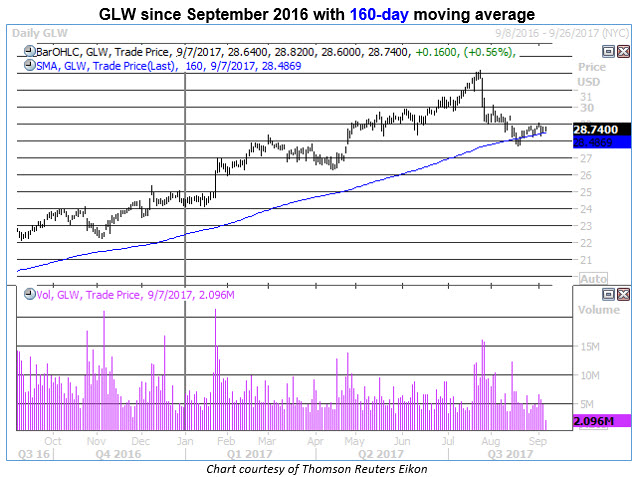

As for Gorilla Glass parent Corning (GLW), it's the 160-day moving average we're watching. With GLW shares at $28.73, this longer-term daily trendline stands at $28.49. On its last four meet-ups with this moving average, GLW was higher 75% of the time five days later, with an average return of 1.03%. Over the next 21 days, the percentage of positive returns falls to 67% -- but the average return jumps to a healthy 7.54%.

Similar to NVDA, options on Corning are attractively priced, from a volatility perspective. The equity's 30-day at-the-money implied volatility checks in at 18.2%, says Trade-Alert, in the 25th annual percentile -- and almost two full percentage points below the stock's 30-day historical volatility of 20.1%.