If inflation was caused by Hurricane Harvey, that implies more inflation will be caused by Irma which will likely affect September results. The Fed wants an excuse to raise rates and these hurricanes are bringing it to them, asserts Don Kaufman, Co-Founder of TheoTrade.

The reason why the stock market is doing so well is because we are in a Goldilocks scenario.

Get Trading Insights, MoneyShow’s free trading newsletter »

Inflation is low, central banks are very dovish, growth is moderate, the dollar is weak, and corporate earnings are at a record high. Valuations are high because of these reasons plus many baby boomers are investing in the stock market at their peak wealth.

This means stocks will go up until something changes. There’s a lot that can go wrong because right now almost everything is going right.

The latest possible aspect which can go wrong is rising inflation. I have been predicting a modest increase in inflation. We saw that play out in the latest report. Don’t be fooled by the headlines that say inflation was sluggish this year and is now picking up. The reality is high inflation is bad. You can see it yourself. This so-called sluggish inflation led to a great year in the stock market. The Fed wants inflation to pick up so it can raise rates, but investors shouldn’t want that.

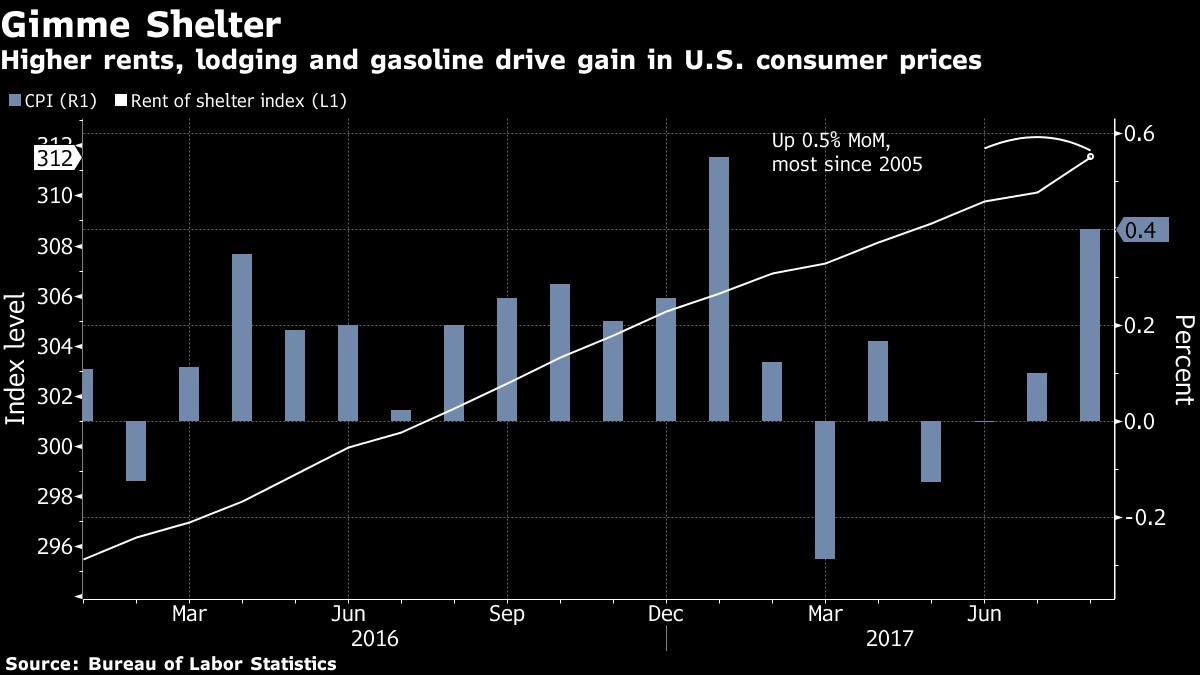

The consumer price index increased 0.4% month over month. That’s up from the 0.3% estimate and the 0.1% increase in July. Year over year CPI growth was 1.9% which was above the 1.8% estimate. It’s very close to the 2% target the Fed has. Core CPI was up 0.2% month over month which met estimates and was one-tenth faster than last month. It was up 1.7% year over year which was better than the 1.6% estimate. This ends the 5-month streak of weaker than expected reports. Some expected the headline inflation reading to increase because of Hurricane Harvey. Hurricanes make raw materials scarce which causes inflation. We saw that effect play out with energy prices up the most since January. However, the surprising aspect was that core inflation did well. That makes some economists think this trend has more staying power.

Advertisement

One of the biggest changes which is problematic for the consumer and pushed inflation higher is the increase in shelter inflation. Lodging away from home was up 4.4% and hotel costs were up 5.1% which is the fastest growth since 1991. This increase may have been impacted by the surge in demand from evacuees fleeing the areas impacted by hurricane Harvey. As you can see from the chart below, broader shelter was up 0.5%. Owners-equivalent rent was up 0.3%. This puts a damper on the recent wage growth transferring into disposable income.

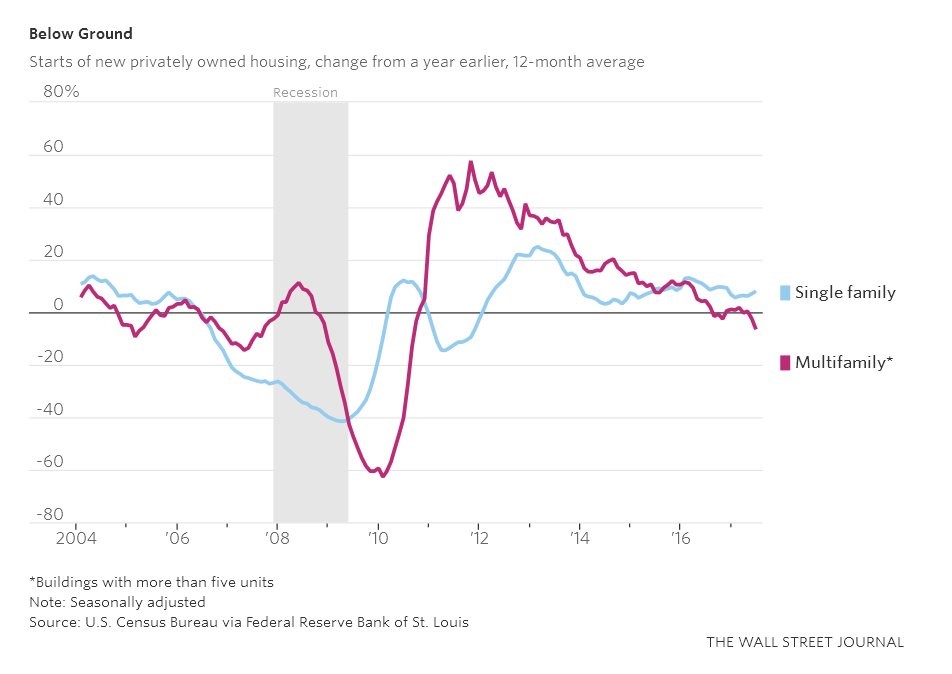

One of the issues with housing is that construction growth is stagnant. It’s a good problem for real estate investors because the supply is limited and demand is strong. However, for the economy, it’s not great because, as I mentioned earlier, shelter inflation hurts consumer spending. As you can see from the chart below, single-family housing starts growth is low and multifamily starts growth is negative. For the first time since the recession, apartment construction is falling even though rents are rising.

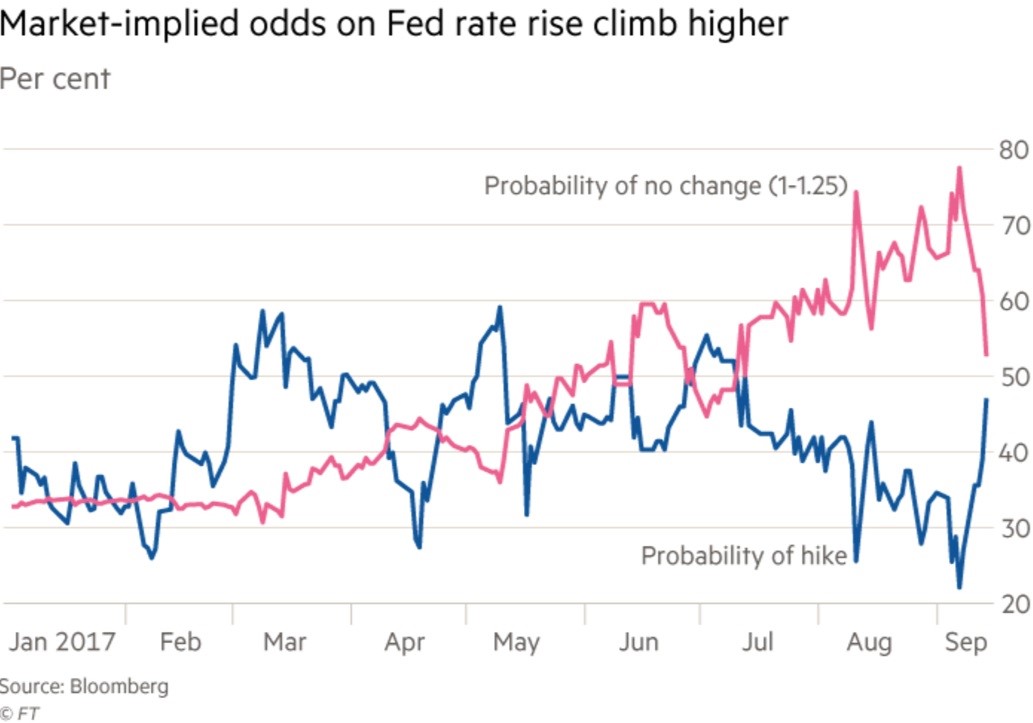

The point of this discussion is to review future Fed policy. Rising inflation leads to rate hikes and possibly a quicker unwind of the balance sheet. Higher inflation means higher bond yields potentially which provides competition for stocks. All these factors are bad news which is why stocks were mixed on Thursday. Fed rhetoric isn’t the only thing that effects the chances of a rate hike.

Sometimes inflation data matters more than rhetoric and forces the Fed’s hand. We’re in that situation now because the Fed’s guidance has been for one more rate hike, but the past 5 months of missed inflation expectations ruined that. Now inflation beating expectations might mean a rate hike in December is back on the table. As you can see from the chart below, the odds of a rate hike have gotten closer to 50%. This data is important because it’s the last release before the FOMC meeting next week, so that means the Fed will lean hawkish.

As I said before, this is great news for the Fed. It gives them support to start the balance sheet unwind in October. The other good news is that the debt ceiling issue is over with as well. There is an all-clear sign to get on with the much-discussed program.

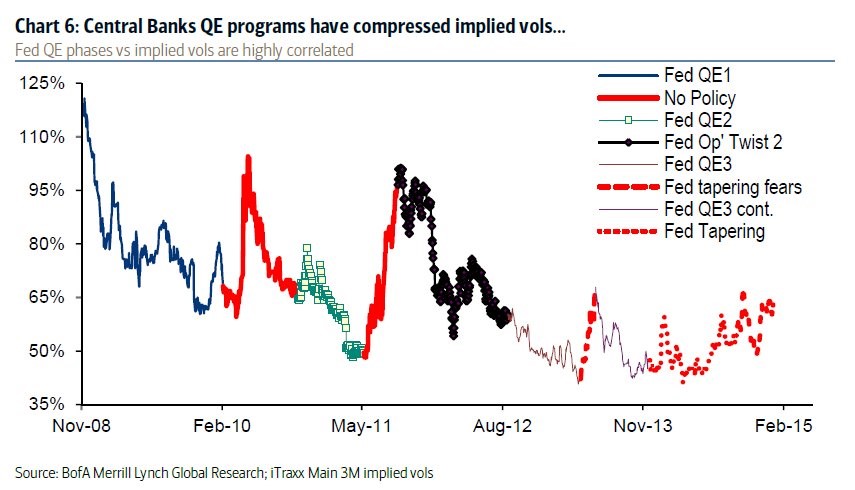

The chart below is a great historical analysis of why the Fed’s balance sheet will be unwound slowly. I’ve seen some people arguing that the unwind will have no effect on financial markets. This chart blows that concept away. I’m not anticipating a crash right away, but I do see volatility coming in the middle of 2018. As you can see from the chart, the QE programs have compressed volatility.

When no policy has been in place or the Fed has been tapering, volatility increased. This year has been different than the market from 2008 to 2016. This year there has been no Fed QE policy and there has been guidance for an unwind, yet volatility has been very low. The question is if this recent scenario will continue in October when the ECB tapers and the Fed unwinds the balance sheet.

The only information we have is from 2008 until now, so it’s an uncertain situation. To be clear, QE is only one factor which affects volatility. That means great earnings and economic news in 2018 would increase the likelihood of a calm market.

Some of the leading indicators I look at such as new credit imply the beginning of 2018 will be weak, so that’s something to watch carefully.

Conclusion

The inflation data doesn’t mean anything on its own, but if it is the start of an improvement in inflation, that could mean a rate hike in December, weakening the stock market.

If inflation was caused by Hurricane Harvey, that implies more inflation will be caused by Hurricane Irma which will likely affect the results from September. That means there’s a possibility two, one-time events will affect monetary policy. The Fed wants an excuse to raise rates and these hurricanes are bringing it to them.