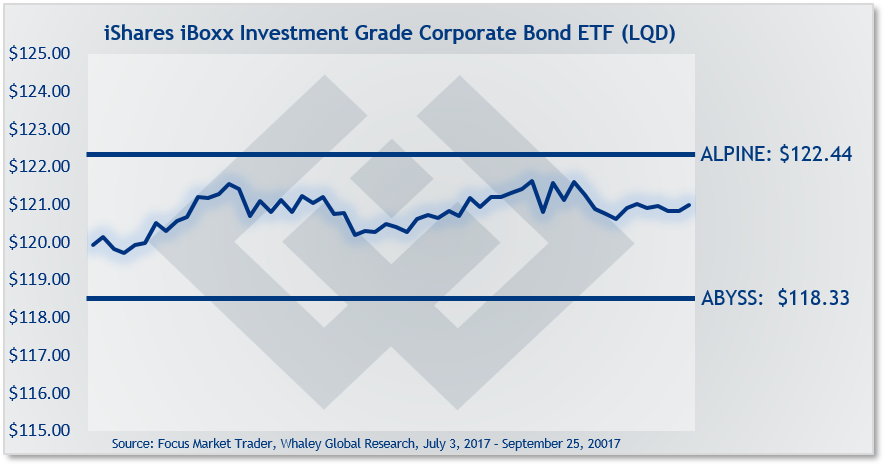

Trade idea: LQD been trading sideways since late June and remains below its glass ceiling at $122.44. As long as LQD trades below $122.44, then you can initiate new short positions, suggests Landon Whaley of Focus Market Trader at WhaleyGlobalResearch.com.

Get Trading Insights, MoneyShow’s free trading newsletter »

The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) declined 3 basis points in the week ending September 22, and has gained 5.5% for the year.

The question on my mind for the better of this year has been: what event(s) could wreak havoc on the U.S. corporate bond market? Since February 2016, U.S. corporate bonds have experienced an historic period of low volatility. In fact, the last time bond markets experienced tightening yield spreads for this long was 1992!

Advertisement

UBS, the Swiss bank, did an interesting study looking at previous low volatility periods and what catalysts cause a disruption to those tranquil time periods. They found that the key catalysts for a widespread bond sell off were: U.S. monetary policy tightening, slowing U.S. growth, slowing U.S. corporate profits, oil price declines, and credit-specific, idiosyncratic events.

Bottom line: All of these catalysts are in play right now, it’s just a matter of which one will cause a crack in LQD’s price action.

Trade idea: LQD been trading sideways since late June and remains below its glass ceiling at $122.44.

As long as LQD trades below $122.44, then you can initiate new short positions.

Depending on your entry price and how much room you want this trade idea to move, use a risk price between $121.80 and $122.44

Once initiated, close all open trade ideas if LQD opens, or closes, above your risk price. That said, your risk price “line in the sand” is that $122.44 level. If LQD trades above that price, even for a second, then promptly close all open trades.

If the trade moves in your favor, then you could consider using the area between $119.11 and $118.33 as your spot to take profits on some or all your position.