Long trade idea: wait for the US Dollar Index (DXY) to close above $93.64 for three consecutive days. Once that occurs, you can invest in the US dollar via the Powershares DB US Dollar Index Bullish Fund (UUP), suggests Landon Whaley of Focus Market Trader.

Get Trading Insights, MoneyShow’s free trading newsletter »

Investors can trade tens of thousands of financial instruments to gain access to hundreds of markets across all four major asset classes. Of the plethora of instruments and markets to be traded, there is one that causes more ripples across the globe than all the others: the U.S. dollar.

Despite being pronounced dead on many occasions in the past, and despite the cryptocurrency fanatics’ best efforts to convince you otherwise, it’s still all about the Benjamins. The dollar remains king, and is currently at a critical inflection point, which will have widespread market ramifications.

The path taken

Advertisement

The U.S. dollar started the year on a line that headed pretty much straight down to a 8.7% loss. You’ll find any number of reasons given as to why the USD has been looking as ugly as homemade sin, but there has been only one primary downside catalyst for the world’s reserve currency, and that is policy convergence.

I wrote many times throughout 2014 and 2015 about the “U.S. Policy Divergence” theme. This divergence developed when the Fed began its normalization path while other major central banks, namely the ECB and the BOJ, were keeping their “monetary easing” pedal to the metal.

The primary beneficiary of this policy divergence was the USD. It saw massive inflows, and moved from a June 2014 low of $78.80 to breaking the century mark at $100.33 by mid-March 2015.

However, since mid-2015, this policy divergence has been shifting, primarily due to a modified ECB policy. When the ECB began buying assets, it was buying $80B a month. Last year the ECB adjusted course, reducing the monthly purchases to $60B, which at the margin is tighter monetary policy.

The USD responded to this policy convergence by trading sideways for well over a year. Since peaking in late December at $103.00, a 15-year high, the greenback has declined 10%, and is now sitting below $92.45.

Part of the decline of the USD Index (DXY) can be attributed to the overwhelming strength of the euro (up 12% this year) because DXY is a basket of currencies, of which the euro represents 60%.

Investors have been piling into the euro at a record pace, believing the ECB has all the economic evidence it needs to make its very own taper announcement. These investors are about to be caught wrong-footed, in a big way.

The catalysts for inflection

The Eurozone’s core CPI readings for August came in at 1.2%, which is both well below its 2% mandate and at the top end of its 5-year trading range between +0.6% and 1.2%. Not only that, but inflation has slowed in four of the last six months. Trend, anyone?

But it’s not just about weak inflation. Reuters reported that sources familiar with ECB discussions revealed that the euro’s strength is “worrying a growing number of policymakers at the ECB,” which increases the chance of a delay in their QE decision, or of a more gradual exit from asset purchases. The sources went on to say the ECB “could further relax a requirement to buy bonds in proportion to each country's ECB shareholding, or include new asset classes such as stocks, as raised in July by one policymaker but not given consideration, or non-performing bank loans.”

As my boy Emeril Lagasse says, “Bam!”

The bottom line is that eurozone inflation isn’t breaking out to the upside anytime soon. And if the ECB is now setting its sights on weakening a euro that is stronger than they like, watch out. This is not good news for the uber-crowded trades in the euro or being short the greenback.

Benjamin’s wearing shorts

To say positioning in the USD has gotten a bit “tilty” this year is an understatement.

The weak USD has been a catalyst for several trades that investors have plowed money into this year, particularly the rallies in emerging market equities and fixed income (in conjunction with weaker inflation expectations). It’s also been a critical component in the U.S. equity rally. The S&P 500 (SPX) is currently rocking a -0.88 correlation to the USD; that’s one hell of a strong relationship, and it means that when the USD rallies, the S&P 500 heads south of the border.

Investors have more short exposure in U.S. dollar futures than at any time in the last three years. On the flipside, bulls have retreated to the very far side of the arena; compared to the 3-year average number of long contracts, they now hold the lowest number of long positions in 20 years! This extreme positioning, on both sides of the trade, has led to the shortest net positioning in greenback futures in quite some time.

These folks are providing the very kerosene that will ignite the dollar’s move higher once the short squeeze begins.

The long trade idea

Before committing any capital to a long U.S. dollar trade, wait for the US Dollar Index (DXY) to close above $93.64 for three consecutive days.

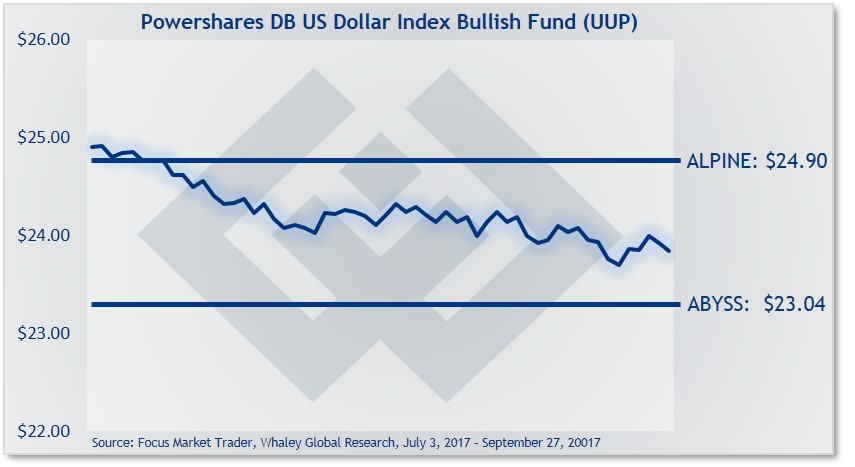

Once that occurs, you can invest in the US dollar via the Powershares DB US Dollar Index Bullish Fund (UUP).

As long as UUP trades above $24.02, then you can use any weakness to initiate new long trades.

Depending on where you enter the trade and how much room to move you want to give this trade, you can use a risk price between $24.02 and $23.40.

That said, your risk price line in the sand is $23.40, if UUP closes below that price, then you should exit any open trades.

If the trade moves in your favor, I would book profits on any rally to the $24.39 to $24.71 range.