Even though the tax cuts get all the attention, the next Fed chair will be one of Trump’s most important economic decisions. It’s not a controversial, considering Congress decides the details of the tax plan, asserts Don Kaufman, co-founder of TheoTrade.

Get Trading Insights, MoneyShow’s free trading newsletter »

As September ends we inch closer to the day President Trump picks the next Fed chair.

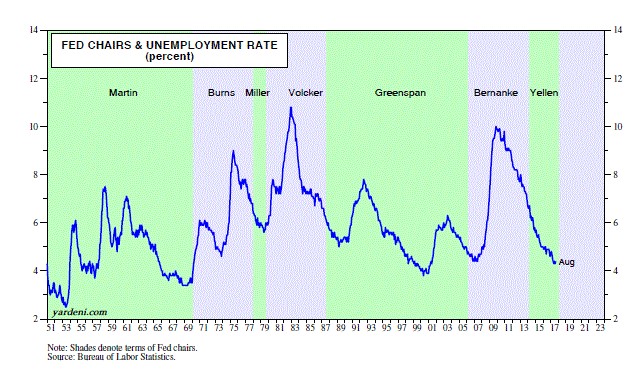

The chart below reviews the previous Fed chairs and the unemployment rate during their tenure.

Miller is viewed as a failure because of his inexperience.

Volcker is viewed as a success for his taming the inflation bogeyman along with helping unemployment fall.

Advertisement

Greenspan was viewed as a success during his tenure, but soon after he left the financial crisis occurred which many blamed him for since he kept interest rates too low for too long.

Bernanke and Yellen are heroes to the bulls. Bernanke will be known for his QE program and his handling of the financial crisis. Assuming the unwind of the balance sheet goes off without a hitch, both he and Yellen will be viewed as a success. While this has been a weak recovery, inflation has been low, unemployment has been low, and a recession has been dodged for a while.

I’m showing this chart to contextualize the scenario the new Fed chair will face. The current odds have Yellen at 32% which means there’s a 68% chance she’s replaced. Her tenure has been relatively short, but she played a key role in normalizing monetary policy. There was talk of Bernanke possibly starting to clean up the policies, which were put in to help ease the financial conditions during the crisis, before he left. However, he didn’t do much, leaving it to Yellen to do the first hikes off the zero bound and finally start letting the balance sheet shrink.

If Yellen leaves early next year, her biggest qualm will be wondering about the lack of inflation despite a tight labor market.

The next Fed chair will be taking charge during the unwind; he/she will make sure the markets are aware of the intricacies of the policy which should last for the next 2-3 years. The Fed has relatively dovish policy stance, but will probably have done 5 quarter point hikes when the next person takes charge.

It would be interesting to see if the candidate is named before the December meeting, if they opine on policy. Giving an opinion will probably only be done to quell the markets. If the market doesn’t react to the announcement, the chair will wait until they are confirmed. If not, then they will make a statement. The wildcard would be if during questioning by the Senate, the candidate is asked to give forward-looking guidance.

Even though the tax cuts get all the attention, the next Fed chair will be one of President Trump’s most important economic decisions. It’s not a controversial thing to say considering Congress is the body which decides the details of the tax plan.

The president hasn’t had many bills to sign into law so if anything gets passed, it would be tough for him to say no. Trump vetoing a bill would be like the parent of a failing student getting mad when their child gets a C on a test. It’s not a great grade, but it’s better than past results. The tax plan passed probably won’t be what President Trump called for, but he’ll sign it because that’s the best they can do.

The net for potential Fed chair is probably the widest ever. There weren’t online liquid betting markets which predicted most previous Fed chairs, but I’d be willing to assume the candidates listed would be unlike the group we have now.

There’s a 4% chance John Allison is picked; he has said he wants to end the Fed. President Trump has picked previous cabinet members who have criticized the department they now head, but the Allison pick would roil the market because of the uncertainty it would bring.

On the other hand, Yellen is being considered and she is the most institutional establishment candidate you can find.

Warsh is one of the biggest critics of QE you can find. I think it’s weird to see the market ignoring the fact that there is such a wind range of potential choices. To me, it looks like the market thinks either Yellen will be picked or another candidate will be picked that won’t change the course.

I find that to be an unlikely assertion because many of the people on this list vary so far from the current establishment mindset.

Jobs reports coming

The jobs report is coming up next Friday. I have stated I think it’s going to show between 50,000 and 100,000 jobs created because of the impact from the hurricanes.

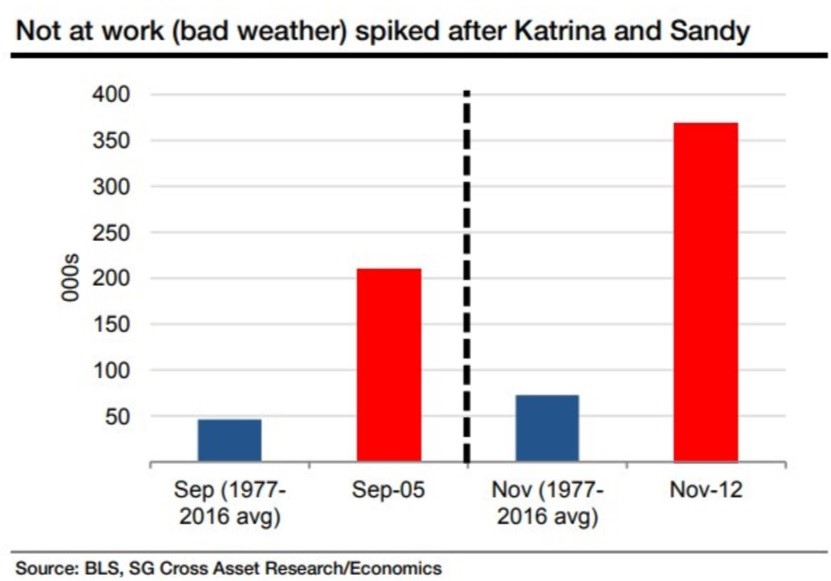

The chart below shows the effects from hurricanes Katrina and Sandy on the number of people not at work because of bad weather. As you can see, the metric quadrupled from Hurricane Katrina and had a similar increase because of Hurricane Sandy.

Sandy wasn’t as strong of a storm, but it affected more people since New York is much larger than New Orleans. There will probably be a similar spike from both Harvey and Irma in September. The number of people not at work because of bad weather is typically about 50,000 in September.

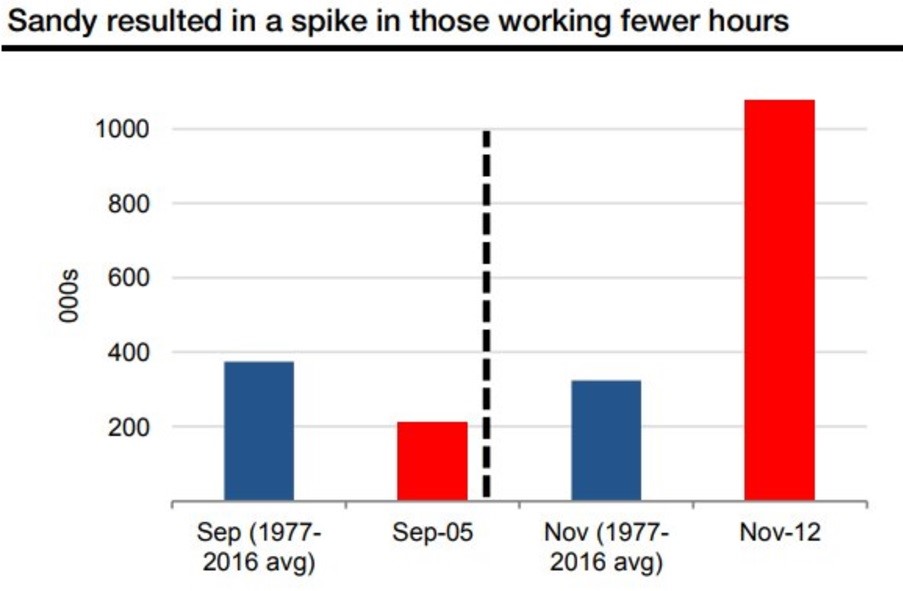

The chart below shows the change in the amount of people working fewer hours. The reason why it fell after Katrina is because those who were affected were devastated, while few people were moderately impacted.

Sandy had a huge burst in those working fewer hours because millions of people were moderately inconvenienced by the storm.

I think Harvey was more like Sandy and Irma was more like Katrina.

Tampa and New Orleans are similar sized cities; Houston and New York are similar sized cities. Irma devastated the Florida Keys and Naples, while the rest of Florida and the southeast weren’t as badly affected. Houston was more affected by Harvey than New York was affected by Sandy, but Houston has fewer people which cancels that out.

Hopefully, the BLS can figure out what the results would have been without the hurricanes so we can figure out the health of the job market. I would have been expecting a healthy report if these storms didn’t occur.