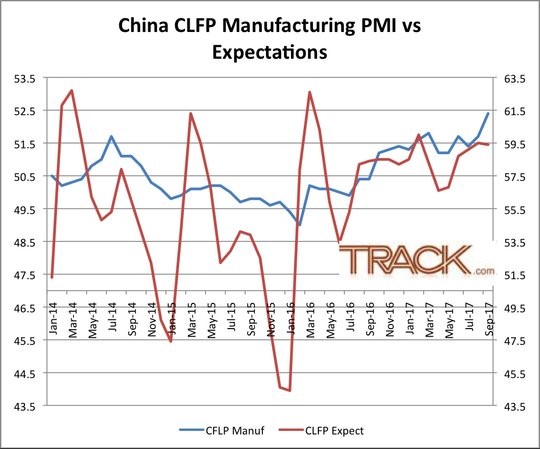

China September CFLP Manufacturing PMI Index rose 52.4 from 51.7 – better than 51.6 expected – best in 5-years. The Caixin Manufacturing new business index in China slowed, as inflationary pressures ticked up, writes Bob Savage, CEO of Track Research in his Sunday commentary.

Get Trading Insights, MoneyShow’s free trading newsletter »

• China September CFLP Manufacturing PMI 52.4 from 51.7 – better than 51.6 expected – best in 5-years. The Manufacturing new orders rose to 54.8 from 53.1 while new export orders rose to 51.3 from 50.4, production rose to 54.7 from 54.1, input prices rose to 68.4 from 65.3, the highest of the year, while Output price rose to 59.4 from 57.4, also the highest reading this year. On the negative side, inventories of raw materials rose to 48.9 from 48.3 and employment fell to 49 from 49.1.

Advertisement

• "Over 40 percent of manufacturers complained about the higher cost due to the rising prices of raw materials, particularly middle- and downstream-companies," Zhao Qinghe, economist with the NBS said in a separate statement. Manufacturers' confidence about the future eased in September but remained at a high level. The business expectations sub-index fell to 59.4 from 59.5 but was still the second highest this year. In addition, the volatility of the exchange rate has increased trading risks, Chen said. "13.4 percent of companies have mentioned the problem during our survey, 2.6 percentage points higher than in August." The Service PMI also rises to 55.4 from 53.4 – linked to new orders and higher input prices with demand rising into the long National Week Holidays.

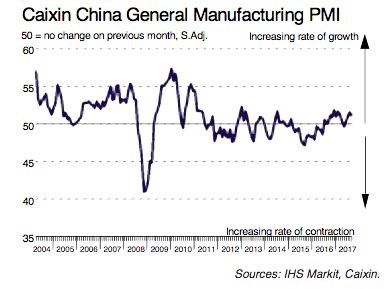

• China September Caixin Manufacturing PMI 51 from 51.6 – weaker than 51.5 expected. The Caixin index showed that new business expanded at a slower pace due to the weak demand. "Notably, new export work increased only marginally during the latest survey period," Caixin said. As a result, survey participants said they reduced their buying activity during September. Although input demand moderated slightly, the average time taken for input delivery lengthened in September to the largest since January, with input providers delaying delivery times due in part to stricter environmental policies and stock shortages of vendors, Caixin noted.

• Inflationary pressures ticked up, with both input prices and output prices rising at faster rates, Caixin warned, adding input costs increased at the fastest pace in nine months. "The manufacturing sector continued to expand in September, although at a slightly weaker rate. The Chinese economy was stable in the third quarter," said Zhong Zhengsheng, director of Macroeconomic Analysis at CEBM Group, a research subsidiary of Caixin, "But the outstanding price pressure from upstream industries will be a drag on the continued improvement of companies' profitability." Zhong warned.

View Track.com, the global marketplace for stock, commodity and macro ideas here