Economic growth is picking up here at home, and it’s also accelerating overseas. Re-orient your investment strategy toward “growthier” stocks and sectors. Think industrials and cyclical resources, writes Mike Larson, senior analyst at Weiss Ratings.

Advertisement

Lower for longer. Slower for longer. A “New Normal” of sluggishness. That’s what investors have come to expect when it comes to growth and interest rates. It’s all the mainstream economists and pundits talk about.

And I think it’s a bunch of baloney!

Get Trading Insights, MoneyShow’s free trading newsletter »

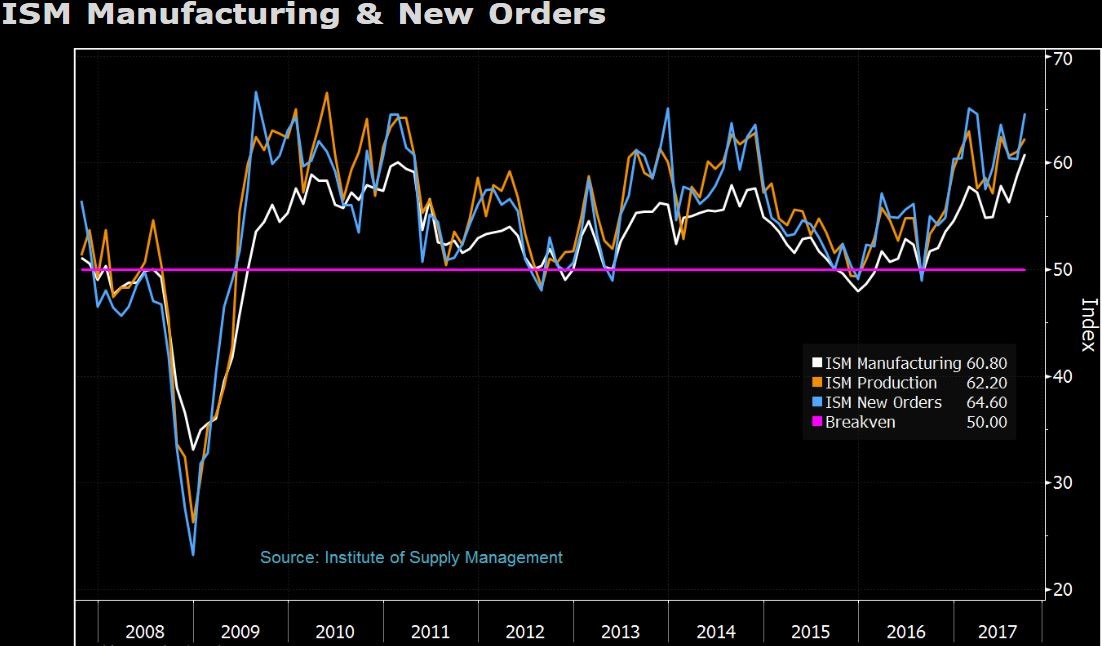

Check out the latest manufacturing figures from the Institute for Supply Management. The group’s monthly ISM index is considered the “gold standard” when it comes to measuring growth in the smokestack sector.

That index jumped to 60.8 in September. Not only was that up from 58.8 in August ... and well above expectations ... but it was also the strongest since May 2004. That’s more than 13 years ago! Separate readings on new orders and production rose to 64 and 62, respectively – very strong considering the dividing line between growth and contraction is all the way down at 50.

The ISM report isn’t the only one giving investors a warmer and fuzzier feeling about growth. Take a look at this chart below of the Citi Surprise Index. It tracks a basket of market-moving economic reports and compares them against expectations. The higher the index, the more “beats” we’re seeing on the growth front -- just like when a company tops analyst earnings forecasts.

You can see this index has been improving steadily since late summer. Plus, that improvement has coincided with a renewed march higher in interest rates and a renewed rise in the prices of key industrial commodities like oil and copper.

My take: The whole “slower for longer, lower for longer” theme is played out! Economic growth is picking up here at home, and it’s also accelerating overseas. That means now is the time to re-orient your investment strategy toward “growthier” stocks and sectors. Think industrials, cyclical resources, and so on.

To help get you pointed in the right direction, I created the following Weiss Ratings “Screener” for you. It shows every Buy rated (“B-” or higher on our grading scale) ETF that invests in industrial metals or industrial sector equities.

I further narrowed down the list to show only those ETFs with positive 1-year and year-to-date total returns, and eliminated any funds with less than $50 million in assets because they tend to be illiquid. The list is sorted in descending order by YTD gains.

Source: Weiss Ratings, Data Date 10/3/2017

Source: Weiss Ratings, Data Date 10/3/2017

You can see that the aerospace and defense subsector of the industrial group is on fire. The top three ETFs were all invested in that space, with the iShares U.S. Aerospace & Defense ETF (ITA, Rated “B”) at the head of the pack with a 29.3% YTD gain.

The iShares U.S. Industrials ETF (IYJ, Rated “B-”) and two similar funds came next on my list, followed by the First Trust Industrials/Producer Durables AlphaDEX Fund (FXR, Rated “B-”). Their gains ranged from 14.5% to 17.2%.

I’d say it’s high time to add exposure to these ETFs and/or some of the highly rated stocks in the sector. If growth ratchets up as I expect, they should lead the market in the remainder of 2017 and beyond.

Follow Mike Larson and subscribe to Weiss Ratings products here