This week starts U.S. 3Q S&P500 earnings reporting. Global companies may outperform domestic ones in the U.S. due to forex – with companies’ earnings 50% or more outside the U.S. expected earnings at 7.9%, writes Bob Savage, CEO of Track Research in his Sunday commentary.

Get Trading Insights, MoneyShow’s free trading newsletter »

Is this the best of times? Markets remain nervous into this week with many still worried about valuations and policy whether from central bankers or from governments.

The U.S. economy is growing well over its 2.0% potential and that alone puts many Fed watchers into panic mode as they listen to the open debate about raising rates to normal – with some thinking 2% is the target.

The risk of being too slow to an inflation party isn’t yet in the U.S. bond market but the vigilantes of old appear to be being resurrected thanks to talk of a bigger tax reform – read as a tax cut funded by more deficits.

The risks and rewards for fading U.S. growth have been pushed aside as the jobs report has shown Friday.

Market Recap: Friday data – U.S. unemployment rate drops from 4.4% to 4.2% with average hourly earnings up 0.5% to 2.9% y/y – big enough to offset the 33,000 drop in NFP linked to hurricanes- all in food services – and with a net July/August -38,000 more weakness.

This was the first negative jobs outcome since September 2010. Canada jobs were up 10,000 – weaker than 15K rise expected but all weakness was part-time. The Canada Ivey PMI rose 59.6 from 56.3 – better than expected. U.S. consumer credit up $13.1bn – less than $16bn expected – after revised $17.7bn. The non-revolving credit up $7.3bn after $15.7bn and revolving $5.8bn after $2.1bn.

Equities: The MSCI all-country World Index rose 0.88% on the week while the MSCI EM index rose 2.1%. The big 8 Bourses were all higher (with China on holiday), led by Hong Kong in a short week and lagged by France. This week starts U.S. 3Q S&P500 earnings reporting with Alcoa and banks the focus.

Advertisement

FactSet sees earnings expectations at 2.8% with energy leading and insurance dragging due to the storms. Sales growth is expected at 4.9% for 3Q. Global companies are again to outperform domestic ones in the U.S. due to forex – with companies’ earnings 50% or more outside the U.S. expected earnings at 7.9% in 3Q.

The S&P500 rose 1.19% to 2,549.33 on the week, with new record highs Thursday at 2,552.51. The DJIA rose 1.65% to 22,773.67 on the week with Thursday record highs at 22,777.04. The NASDAQ rose 1.45% to 6,590.18 on the week with Friday record highs at the close. The CBOE VIX remained below 10% closings all week ending at 9.65% up 0.14pp on the week – the range for the week was all on Friday 9.11%-10.27%.

The Stoxx Europe 600 rose 0.44% to 388.00 on the week with focus on Spain after the Catalan vote and rates – Spanish IBEX fell 1.89% to 10,185.50 on the week while the Italy MIB lost 1.34% to 22,392.31 on the week. The German DAX rose 0.99% to 12,955.94 on the week. The French CAC40 rose 0.56% to 5,359.90 on the week and the UK FTSE rose 2.04% to 7,522.87 on the week.

The MSCI Asia Pacific Index rose 1.33% to 163.31 on the week, with holidays in China, Korea most of the week leaving volumes light. The Japan Nikkei rose 1.64% to 20,690.71 on the week. The Hong Kong Hang Seng jumped 3.28% to 28,458.04 on the shortened week with Monday and Thursday holidays. The India Nifty50 rose 2.01% to 9,979.70 on the week with Monday holiday. The Australian ASX rose 0.51% to 5,710.70 on the week.

Fixed Income: The stronger U.S. and world data mixed with a slightly hawkish tilt to central bank speakers to leave rates higher on the week. There were exceptions with Ireland selling bonds at negative yields, but Europe was a key focus with Spain and periphery fears rising over Catalan independence fears. Some of this may ease with DBRS after the close Friday confirming Spain’s A rating with a stable trend, but Moody’s also said the impact of the vote on Catalunya Ba3 rating was uncertain.”

The Moody’s affirmation of Italy Baa2 with negative outlook is another factor after the close Friday.

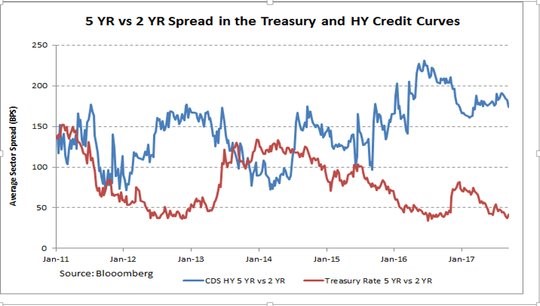

The U.S. ISM reports and jobs reports left the expectations for U.S. rate hikes in December rising (83.5% up from 70%) and March 2018 now 38% – so the curve bear flattening on Friday but steeper on the week again – with the drop in unemployment and the rise in wages offsetting hurricane noise on the NFP.

The next big level in U.S. rates 10Y will be 2.65% while for Europe focus is still on Bunds at 50bps and in Japan 0.10% for JGBs – which held bid into supply next week closing at 0.045% on the week. With China shut – the reopening of that market with bank RRR focus is key.

U.S. supply will be another key focus as well – Tuesday $24 billion 3-year note auction and the $20 billion 10-year note reopening also that day, which follows a Monday Columbus Day holiday and a bill-dominated auction schedule Tuesday.

Thursday then brings a $12 billion 30-year bond reopening auction at the usual 1 pm time.

U.S. Bonds see curve bear flattening post U.S. jobs, but steeper on the week - 2Y up 2bps to 1.505%, 3Y up 1.5bps to 1.638%, 5Y up 2bps to 1.955%, 10Y up 2.5bps to 2.36%, 30Y up 3.5bps to 2.895%.

Canadian 10Y bond yields rose 3bps to 2.123% on the week – despite a mixed week of data with trade notable miss, the lift in US rates hit C$ bonds. BOC speeches mixed on next rate hike.

UK Gilt yields up 0.5bps to 1.362% on the week – focus was on UK May weak speech and her leadership into Brexit talks with BOE facing mixed economic data.

German Bund yields off 0.5bps to 0.456% on the week – safe-haven buying on periphery fears returned. ECB speeches mostly hawkish.

French OAT yields 0.off 1bps to 731% on the week – Macron politics focus along with better data.

Italian BTP yields up 4bps to 2.138% on the week – focus was on Spain more than Italy but politics and growth data hurt as well.

Spanish Bono yields up 10.5bps to 1.695% on the week – Civil war fear drives doubts about debt with 1.75% next pivotal resistance.

Portugal 10Y bond yields up 5.5bps to 2.396% on the week – Municipal elections destroy oppositions party but no one cares with focus on Spain and growth.

Greek 10Y bond yields off 3.5bps to 5.5% on the week – with banks and growth balancing each other out.

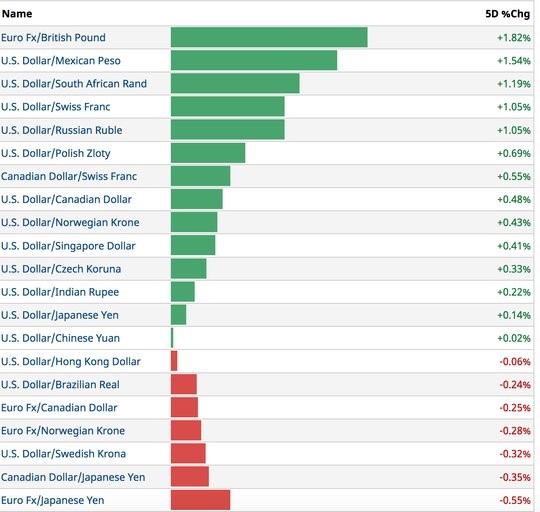

Foreign Exchange: The U.S. dollar rose 0.78% to 93.80 on the week – testing 94.10-40 resistance and failing with North Korea fears Friday eroding rate support. In EM forex USD mostly stronger on the week, RUB fell 1.05% to 58.155 – oil weakness a driver, ZAR fell 1.53% to 13.767– politics and metals a drag, TRY off 1.43% to 3.614 on the week – Kurds, rates key. INR fell 0.2% to 65.375 on the week – focus was on RBI on hold and bonds, KRW off 025% to 1143.80 – holiday market, CNH flat on the week at 6.6460 – holiday market tracking EUR, MXN off 1.5% to 18.545 on the week – U.S. rates, oil drags, BRL up 0.25% to 3.155 on the week – politics vs. rates.

View Track.com, the global marketplace for stock, commodity and macro ideas here