What is the major difference between now and 2007? Then, markets were euphoric, likely because of the housing bubble. Today we have a central bank-driven credit bubble. You can’t say we are euphoric, writes Jeff Greenblatt, director of Lucas Wave International Wednesday.

Get Trading Insights, MoneyShow’s free trading newsletter »

At the start of the week, we reached 233 trading days to the Trump rally. It is a time window I’ve been looking at for several weeks. Upon initial observation it appeared the market would ignore it. After all, we have historic complacency and how could a little cycle point get in the way of a runaway freight train.

It felt that way back in 2007 when markets turned at the latest possible time window. Since the last pullback failed, we’ve been in a position where it feels like the market can go only one way and that is up. Once we get there, it’s the equivalent of the other shoe dropping in a correction. That last shoe which feels like it’s going down and never coming back is usually the end. The only difference between tops and bottoms is fear drops like a rock and hope dies hard. This is the reason tops drag on and become so complex.

Last week was the horrendous attack in Las Vegas and the market reacted by pushing higher. That was strange but not unexpected given the historic complacency.

Part of the complacency problem for mass crowd psychology is the danger is not readily recognized. We saw that with the poor jobs number last Friday. When the hurricanes hit, markets were resilient as well. Only when it gets personal do the markets start to wake up. They retreated a bit Friday as they meditated on the fact disasters do have consequences and the production lost during the Harvey flood and Florida evacuation was realized in black and white.

Advertisement

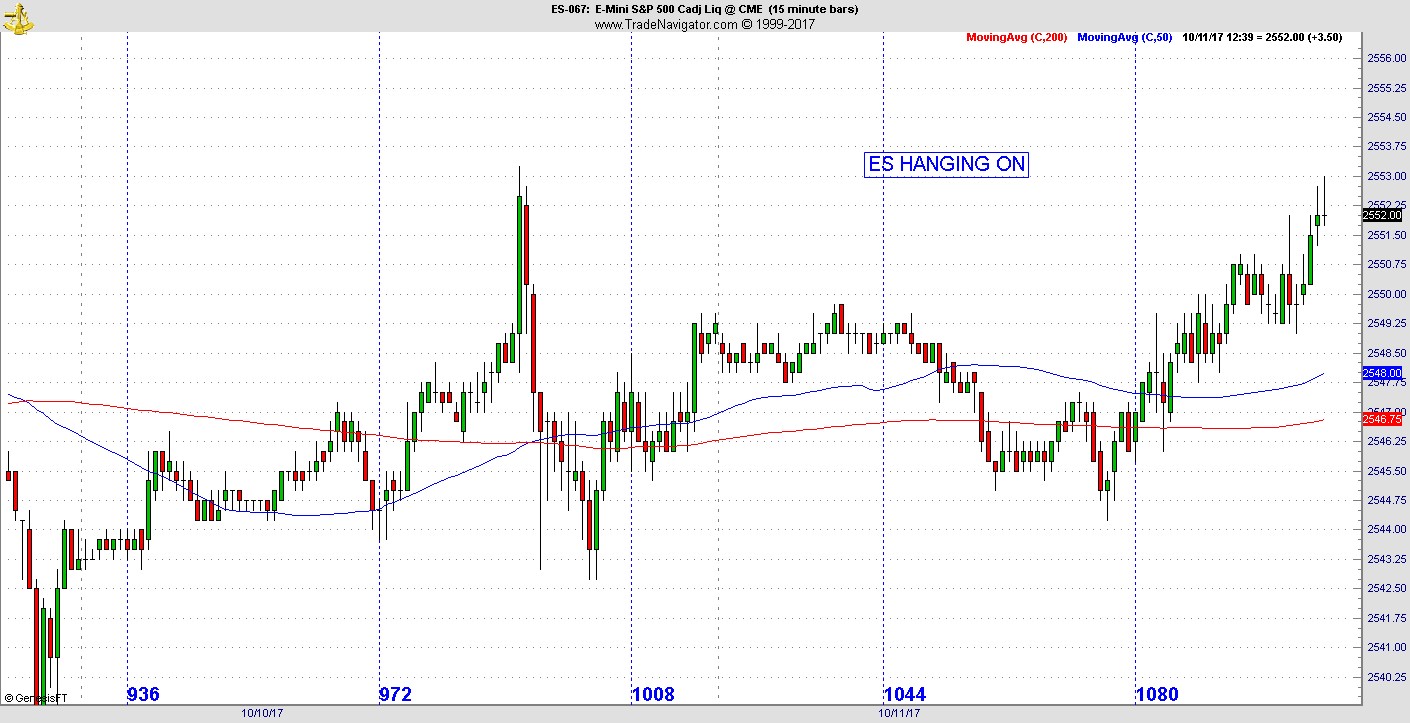

Tuesday started with business as usual but then they took the hit in the first hour. The Dow Jones Industrials (DJI) has recovered but the S&P 500 (SPX) and NASDAQ 100 (NDX) are wrestling with whether they’ll go to a new high.

So, here’s where we stand with the cycle work right now. We are in the 233-day window of the Trump rally, but do you also realize it’s now 609 calendar days (Fibonacci 610) to the February 11, 2016 bottom?

It’s roughly 314 weeks (Pi) to the 2011 bottom October 4, 2011.

It’s roughly 449 (450) weeks to the March 6, 2009 bottom.

It’s 180 months to the October 2002 bottom right on the button. We are also a few days shy of the 30th anniversary to the actual 1987 crash leg which is 360 months. Markets have sold off on a lot less than this.

I have more readings but they could change given the SPX is challenging the high but let’s just say for right now the SPX high from Tuesday has a perfect square of 9 reading going back to the February 2016 bottom.

What people fail to understand is following cycle work is not the business of making predictions. I’ve never made a prediction. Markets change direction when cycles mature or line up. Most of the year they remain in a direction.

Lots of so-called experts claim the market can crash on this or that time. No, it can’t. For a real crash to materialize the conditions must line up. Most of the year they don’t. There are only a handful of times when conditions do line up. That still doesn’t mean it will happen, it means it can happen. We are in one of those periods right now.

I’m not looking for a crash, just a reaction.

It just means that risk is very high and if something is going to happen, this is the time for it. Time is starting to run out for the bears. Thursday is 610 calendar days to this rally and the end of next week is 618. Next Friday will be very close to the 87 crash date. If we get beyond there with no reaction, then it’s time to start drawing conclusions.

What is the major difference between now and 2007? In 2007 markets were euphoric, probably because of the housing bubble.

Right now, we have a central bank-driven credit bubble. You can’t say we are euphoric and that is due to factors such as Las Vegas, hurricanes, North Korea, civil unrest and now the California fires.

It’s like the 1937-39 top. With Hitler threatening Europe, I doubt there was much euphoria in those days.

The implications of no reaction this month? The bubble will get much larger.