Blue chip indexes continue to make new highs, confirmed by market breadth. Day-to-day volatility remains low. Our intermediate-term U.S. equity models remain on hold, so you should maintain equity exposure, asserts Marvin Appel, MD, PhD, of Signalert Asset Management.

Get Trading Insights, MoneyShow’s free trading newsletter »

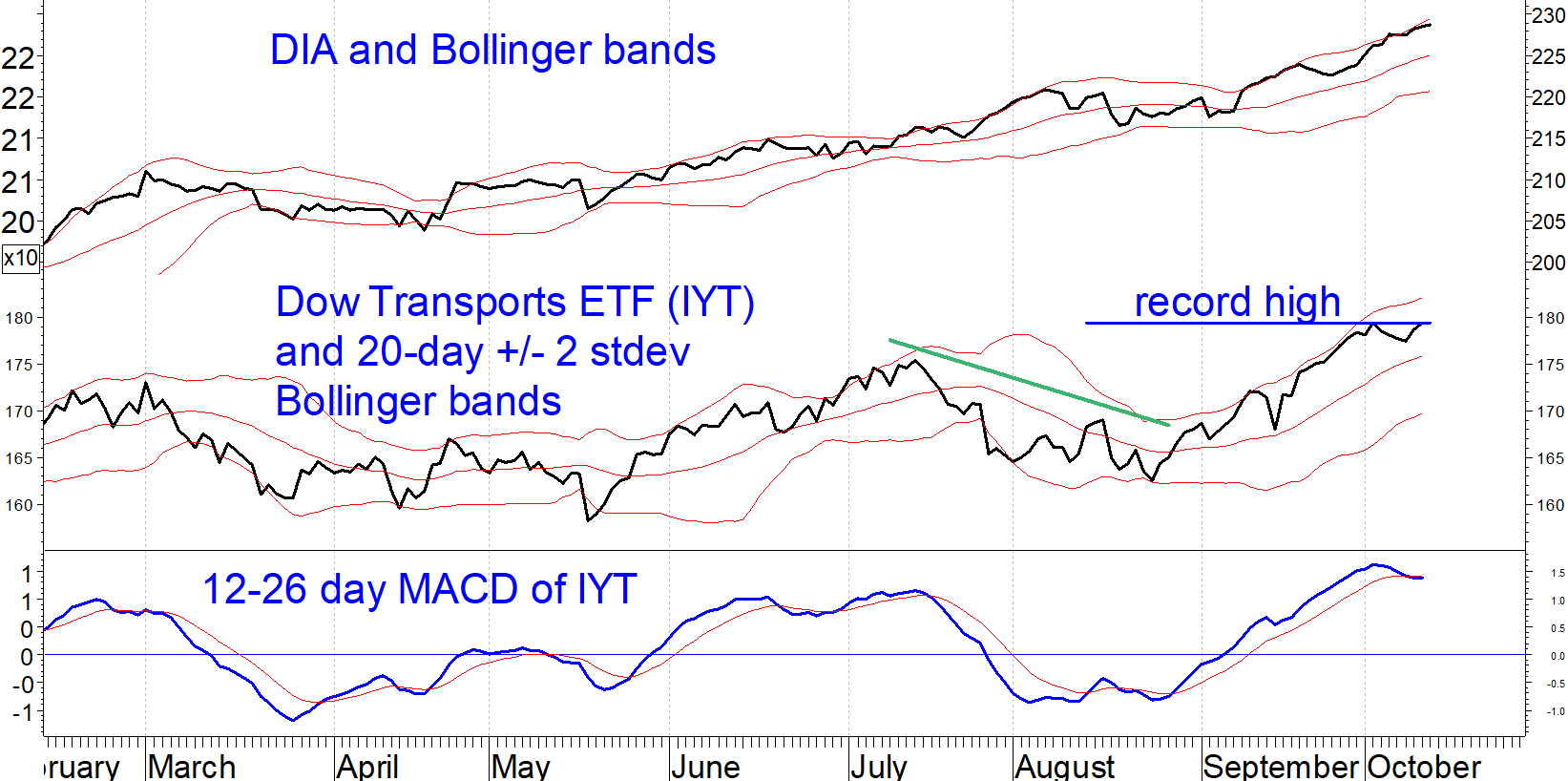

State of the market: For those of you who follow the Dow Theory, we just received a bullish confirmation this week: The Dow Jones Transportation Index (DJT) and the Dow Jones Industrial Index (DJI) both made new all-time highs. (See chart below.)

The theory operates on the notion that if the economy is going well, both industrial and transportation companies should be thriving at the same time, as evidenced by coincident bullish behavior in both indexes.

Back in July-August, the transportation index declined 7% (green line in chart below), which I view as a threshold for a significant pullback.

Advertisement

This week’s new high erases the potential bearish significance of that decline and instead confirms the prevailing uptrend in transportation stocks. (In order for a new downtrend to come into effect, we would have to see two legs down, each of at least 7%, producing a falling double top and two successive lower lows.)

Industrial stocks are near-term overbought with the Dow Industrials, tracked by SPDR Dow Jones Industrial Average ETF (DIA) at its upper Bollinger band.

That suggests the near-term potential for the market to slow down, but is not a reason to raise cash.

I recommend staying the course, and adding to positions on market pullbacks. 250-251 is a support area for the S&P 500 SPDR (SPY) that would be attractive for bottom fishing.

Subscribe to investment newsletter Systems and Forecasts here…