We will find out in about two weeks if this tax plan will pass. Because earnings growth has been so solid, I don’t think stocks will sell off much if it doesn’t pass. I expect a 2%-3% selloff if that occurs, writes Don Kaufman, co-founder of TheoTrade.

Whenever you think you’ve seen everything with the high amount of optimism and low amount of volatility in this market, it surprises you even further.

Usually when stocks are on a streak, you’d expect some people to get worried about stocks falling, but we’ve rallying for so long the naysayers and skeptics have gone home. Some bears have been claiming the bulls are picking up pennies in front of a bulldozer, but it’s been the bears who have been flattened this year.

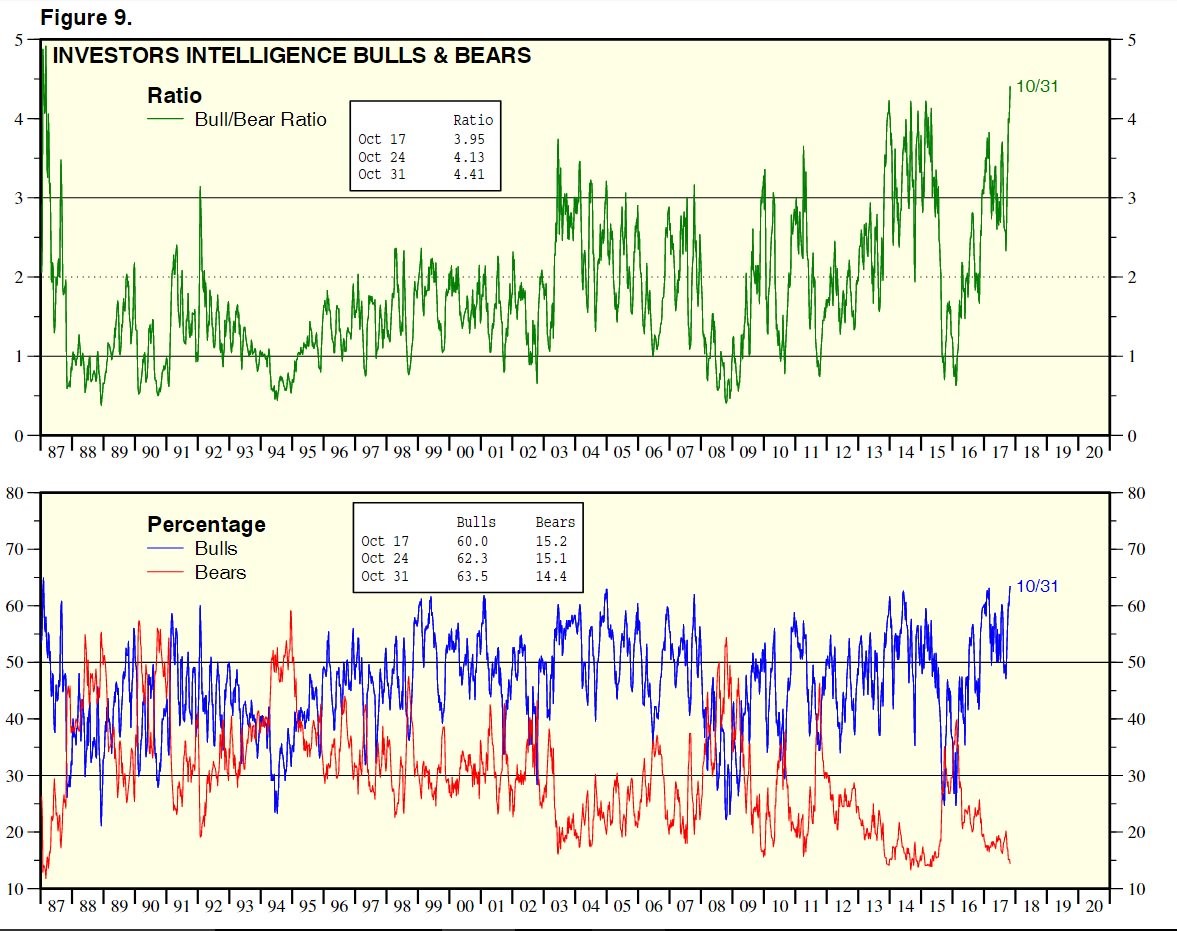

The charts below show depict the current optimism. As you can see, bullishness is about at a record high and bearishness is near a record low. This means the bull to bear ratio is at the highest point since 1987. It’s up from last week, which was also an extremely high reading. Being compared to 1987 isn’t great as the October crash was painful. Instead of having a crash this October, we saw the lowest volatility in a month ever.

Taxes go up for some

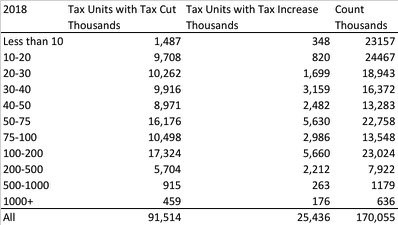

In a previous article, I mentioned that everyone is getting a tax cut. I meant that just by looking at the marginal rate. However, I still shouldn’t have said that.

The marginal rate goes down for everyone except those making over $500,000, but many write offs are going away, so more people besides the rich will have to pay more taxes.

The chart below breaks down who’s getting a tax cut and who’s getting a tax increase from the new plan. As you can see, 91.5 million households get a tax cut and 25.4 million families get their taxes raised. It’s still a tax cut overall, but not for everyone.

Those in high income tax states like New York and New Jersey get hit by the inability to write off state and local income taxes. This tax plan could cause people to move to low-income tax states. However, the benefit might be that these high-income tax states will be forced to lower income taxes to stay competitive.

Keep in mind, that everything is up in the air. This explanation shows why the PredictIt betting market has lower odds for an income tax cut than for a corporate tax cut.

Recession indicators

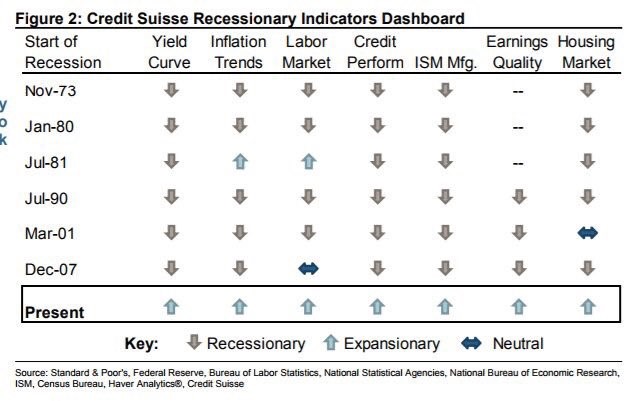

We’ve discussed the business cycle in many articles. The table below shows all the indicators for a recession to compare the current period to previous periods before recessions, so we can see if one is near.

First, we have the yield curve. It isn’t inverted, meaning a recession isn’t coming.

Next, we have inflation. Inflation is increasing. It usually is decreasing before a recession. We need to see accelerated inflation that causes the Fed to hike rates. Then, these hikes will cause inflation to go down, but in the process, create a recession.

The labor market, credit performance, ISM manufacturing, earnings quality, and housing market are usually weakening before a recession.

Now they are all strengthening which means a recession isn’t near. This isn’t shocking news, but the way it’s shown is great to quickly summarize the current environment.

Non-Manufacturing ISM

On the heels of the deceleration in the manufacturing report, the Institute for Supply Management non-manufacturing report showed a boost upwards as the PMI increased from 59.8 to 60.1. Even though that’s only a 0.3 point increase, the nosebleed level we’re at makes it impressive.

That report is consistent with a 4.4% growth rate in GDP. As I have said with most ISM reports this year, the GDP growth won’t reach that level. The higher productivity growth rate means potential GDP growth is up, but we’re still not at a 4 handle.

It’s debatable if the economy’s potential growth rate even reaches 3% even though it has done so for 2 straight quarters. This report is the highest in the past 12 months as it beat the 12-month average by 3.2 points.

Unlike the manufacturing report, there were a few indicators which increased at a faster rate in this one. The business activity index went from 61.3 to 62.2. It has been growing for 99 months. That means this expansion has been 8 years and 3 months.

It’s amazing to say this, but I can see that streak getting to 10 years given the slow GDP per capita growth rate in most of this expansion. You wouldn’t know it from the ISM reports, but there hasn’t been a 2.6% growth year this recovery, let alone 4.4% growth.

So far, this year we’ve had 1.4% growth, 3.1% growth, and 3.0% growth. That averages out to 2.5% growth, meaning we could break this expansion’s record if Q4 GDP is great and Q3 GDP isn’t revised lower.

This report was also impacted by the hurricanes like the manufacturing one. Let’s look at some of the notable quotes from the report. A retail trade firm said, “Uptick based on replacement vehicle activity in hurricane-impacted areas of Texas and Florida.” As you can tell, the economy hasn’t fully recovered from the hurricanes. This could be good news for the Q4 GDP report.

Get Trading Insights, MoneyShow’s free trading newsletter »

A healthcare and social assistance firm said, “We continue to struggle with the ‘unknowns’ around Obamacare, and its impacts on our healthcare and insurance businesses.”

The recent tax legislation tried to cut the Obamacare mandate tax, but it didn’t get in the bill. As for now, all we have is President Trump’s executive action. There are many states where healthcare insurers are leaving which is problematic for pricing.

Nothing says a disaster like one competitor jacking up prices with no one else offering more reasonable rates.

Conclusion

It would be easy if taxes were cut for everyone equally, but nothing in government is that clear cut, so that’s not what we will likely get. There will be many impacts to all industries.

I’ll share any new analysis which comes out on who will be hurt and who will be helped. We will find out in about two weeks if this legislation will become law. Because earnings growth has been so solid, I don’t think stocks will sell off much if it doesn’t pass. I expect a 2%-3% selloff if that occurs. In this market that’s a major selloff, but that might be good news as the worries about this rally being parabolic will be quelled.