Investors would be wise to prepare for bond prices falling as interest rates rise from historic lows. Bond funds are typically hurt the worst in a rising interest rate environment because they are marked to market, asserts Jackie Ann Patterson of Truth About ETF Rotation.

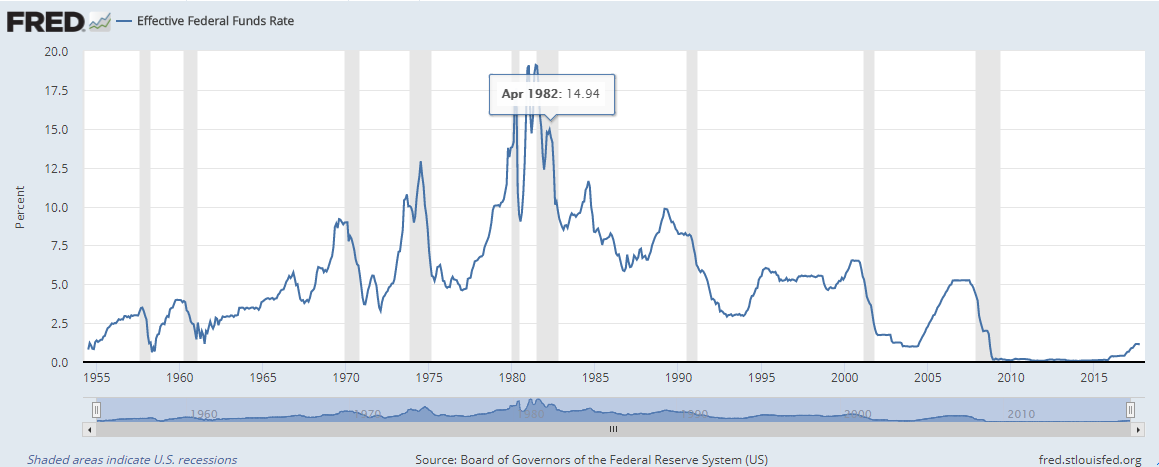

Falling interest rates drove up bond prices for 33 years. According to FRED, the Federal Reserve (of St. Louis) Economic Data, the effective federal funds rate went from a peak of 19.05% in July 1981 to a low of 0.07% in January 2014.

Interest rates didn’t move in a straight line however.

Around recessions, shown in grey bars in the graph above, interest rates behaved in a similar fashion, regardless of whether it was in the rising rate environment of 1955 – 1980 or the falling rate environment of 1981 – 2014.

It appears that rates rose in the year preceding a recession, while during the recession interest rates fell.

We can easily translate interest rates into bond prices as a rising interest rate always pushes down bond prices because buyers demand a discount for an existing bond that pays lower rates.

A falling rate always drives up bond prices because the existing higher-paying bonds are more valuable than their lower-paying counterparts.

In the exciting, frothy stock market times preceding crashes in the business cycle, we’ve seen lower bond prices. After the economy takes its plunge into recession, the interest rates have come down as bond prices rise.

Going forward, investors would be wise to prepare for bond prices falling as interest rates rise from historic lows. Bond funds are typically hurt the worst in a rising interest rate environment because they are marked to market. Holders of the actual bond would see a paper loss, but be able to hold the bond to maturity for redemption at face value – assuming the issuing entity survives the economic upheaval.

Shorter maturity bonds are also less sensitive to interest rates, although they generally pay less interest than longer maturity bonds. The exception is when the yield curve inverts, which has historically been a reliable foreshadowing of recession and dramatic stock market decline.

Certificates of deposit (CDs) lock in a rate for their entire term. The drawback of CDs is the limit on size covered by the Federal Deposit Insurance Corporation (FDIC). In my mind it is mandatory to get the FDIC insurance to compensate for the lower rates paid by CDs.

Cryptocurrency such as bitcoin may be an out-of-the-box haven for excess cash. However, their rapid rise invites a boom-bust cycle, in my opinion.

Gold historically has acted as a hedge against rising interest rates by rising with inflation, so that is another possibility. SPDR Gold Shares (GLD) is an ETF that follows gold prices which may seem more convenient that holding physical gold. However, GLD does not hold the actual gold either which exposes an investor to counter-party and liquidity risk in the event of a sudden rise in gold prices.

Following a rotation strategy allows an active investor to use a bond index fund when appropriate to take advantage of bonds “safe” price rise during economic downturns and get out of the bond market during rising rates. See www.truthaboutetfrotation.com to find out more about rotation strategies.

To find out more about hunting with market-wide indicators, strong momentum, and positive divergences, please visit our website