November is turning out to be a more profitable month than I had anticipated. Our clients have their full equity allocations invested and working for them, asserts Marvin Appel, MD, PhD, of Signalert Asset Management.

State of the Market: Major indexes have shrugged off temporary doldrums to hit new record highs on November 21. Soft market breadth had been a concern, but this week the NYSE advance-decline line is close to confirming the price highs in the Dow Jones Industrial Average (DJI), S&P 500 Index (SPX) and Nasdaq Composite (IXIC).

Our models remain overall bullish. So much the better that November is turning out to be a more profitable month than I had anticipated. Our clients have their full equity allocations invested and working for them.

I recommend riding out any market volatility that may arise.

Foreign equity ETFs such as those tracking the MSCI EAFE Index (EFA) or the MSCI Emerging Market Index (EEM) have lagged the S&P 500 Index over the past two months. That relative weakness appears to be due to reverse.

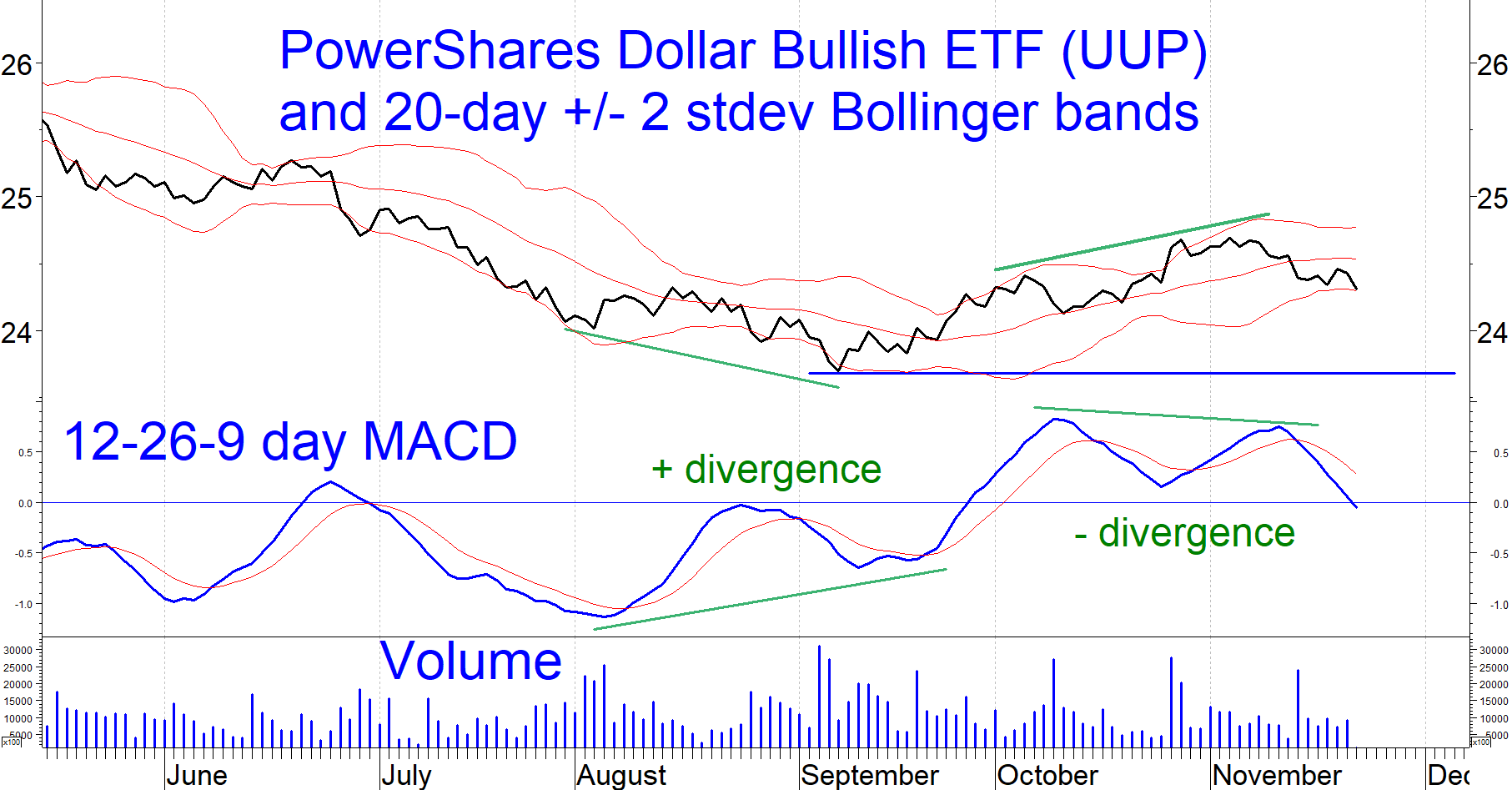

Figure: UUP, MACD and Bollinger bands. MACD points to a decline to retest the early September lows.

The chart shows how the U.S. dollar rallied starting in early September but has turned down this month.

A positive divergence between UUP and its MACD in September presaged the Sept.-Nov. rally. Now a negative

divergence has formed. Yet, PowerShares DB USD Bullish ETF (UUP) is already at its lower Bollinger band which is a near-term oversold condition. Putting this all together, I believe that UUP will fall further from its current level of 24.30 to retest its September low of 23.70. This will entail UUP riding down the lower Bollinger band, as it did in July.

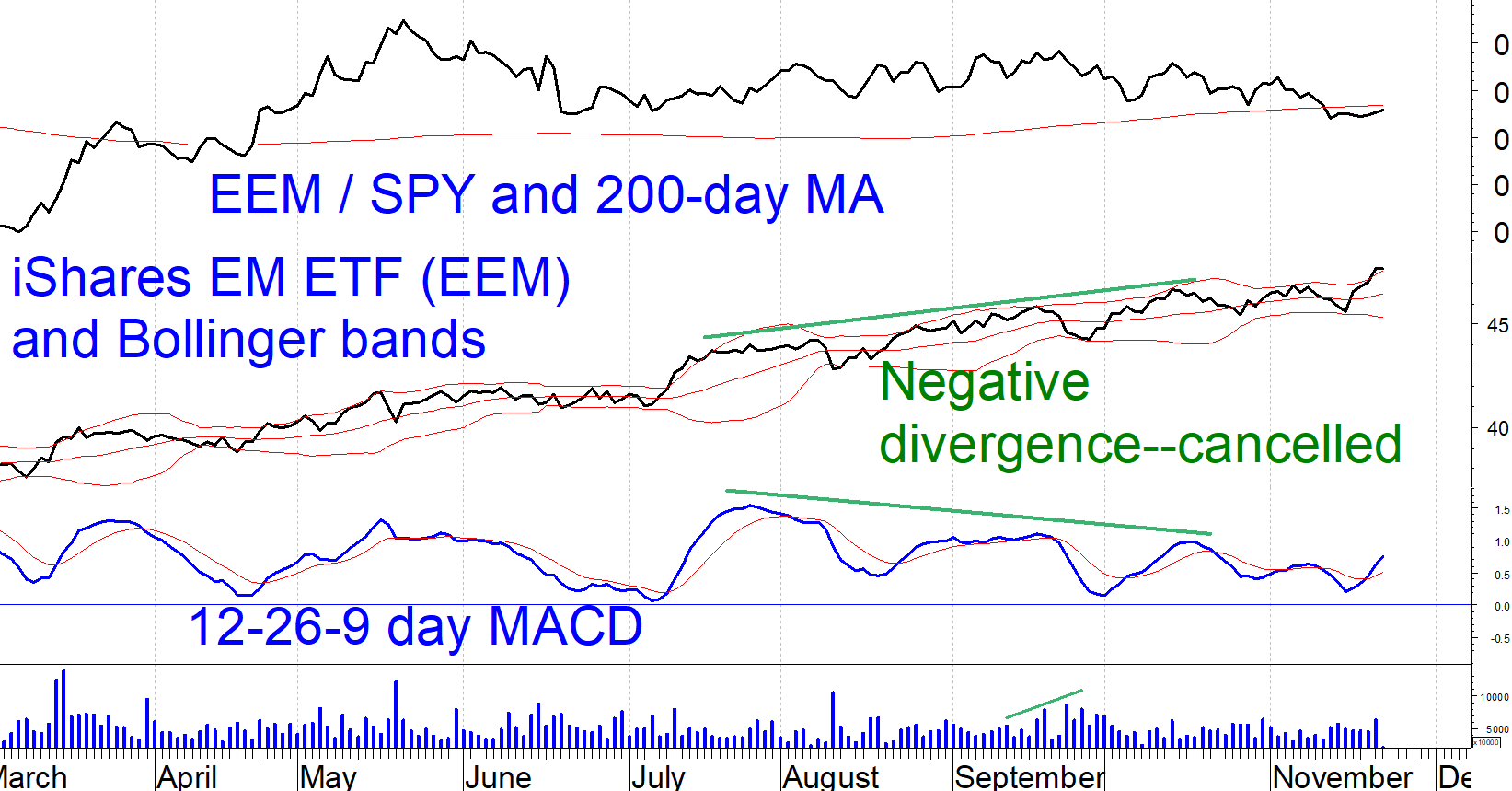

Update on technicals for foreign equity ETFs EEM and EFA

Emerging markets had formed a negative divergence with MACD in August-October (see EEM chart). In addition, the ratio EEM/SPY fell briefly below its 200-day moving average this month, which if in effect at the end of the month would signal that SPDR S&P 500 ETF Trust (SPY) is to be favored over EEM until EEM/SPY crosses back above.

However, the recent rally in EEM has brought it to a new high at its upper Bollinger band. MACD has now reached a level above its early November peak. Both of these developments cancel the bearish implications of the earlier negative divergence.

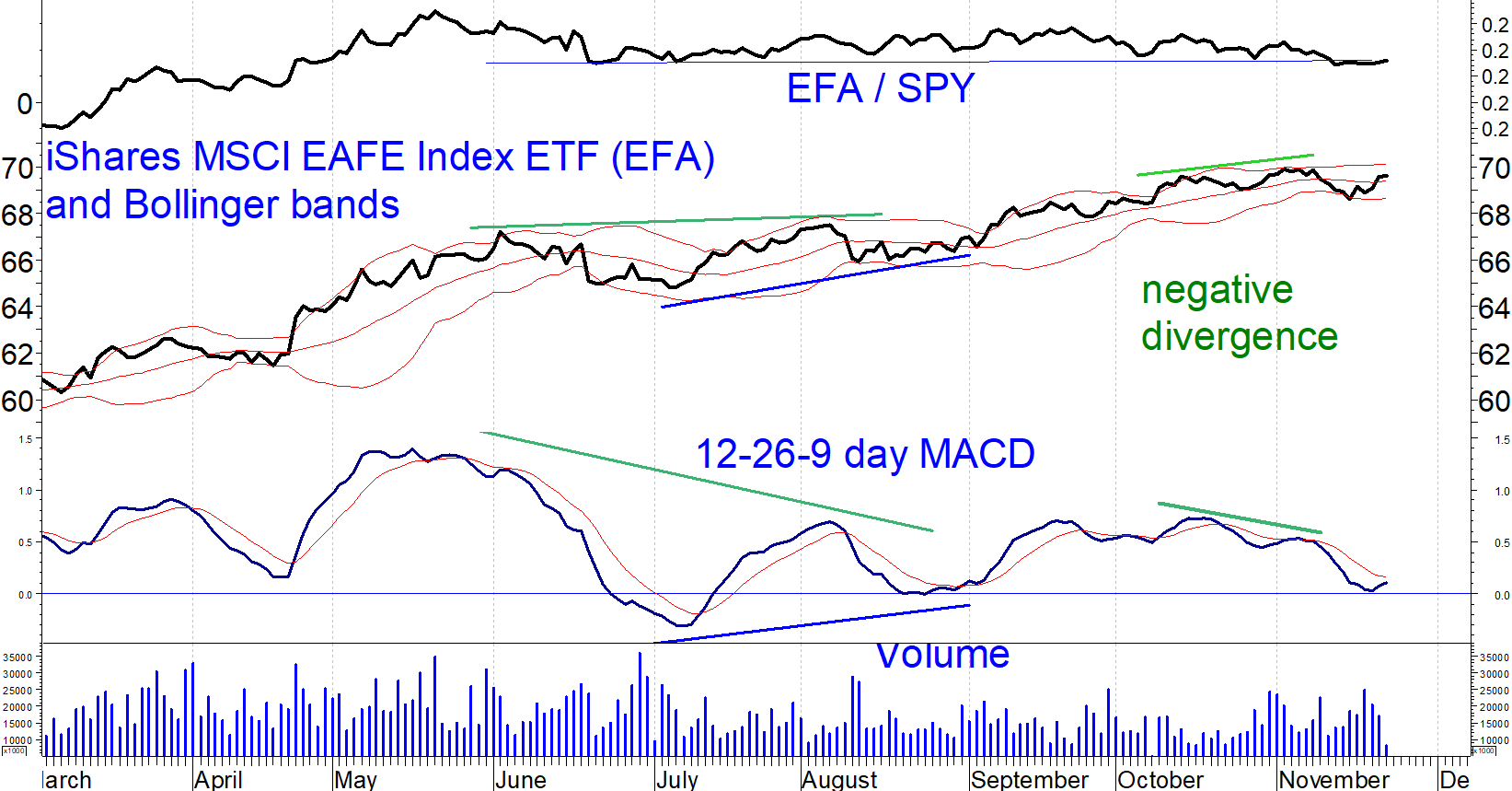

EFA has been weaker than either EEM or SPY in recent weeks. Its recent negative divergence with MACD remains in effect. On the other hand, the EFA / SPY ratio appears to be holding support. (See EFA chart.)

For the near term, I view EFA and SPY as likely to keep pace with each other. Over the next several years I expect EFA to outperform.

High yield bond update—the worst is over

I expected the iShares Corporate High Yield Bond ETF (HYG) to bounce off of support at 87.25. Instead, it fell to a closing low of 86.68 on November 15 and has since recovered to 87.72. It appears that high yield bonds are now out of danger.

Going forward, gains should be modest, limited to the level of interest income. I recommend holding onto your current high yield positions, but not to add to them.

Subscribe to Signalert Systems & Forecasts newsletter here...