Ziad Jasani shares strategies for short-term and long-term traders in Canadian and global markets this week in a companion video and text commentary. Join him and the Independent Investor Institute for a 3-hour deep dive on markets Dec. 2, 12 pm (EST). Register here.

Watch the related Market Strategy Session (3 hours) recorded Monday, Nov. 27:

Canadian Equity Markets

The S&P/TSX Composite Index (TSX) bounced on Nov. 15 with the rest of the world as China injected more capital into their economy and feverishly printed/sold debt (corporate mainly).

Alongside money-printing, Keystone was approved and OPEC/NOPEC Members churned the rumor mill as to the degree of production cut extensions and Russian participation, pushing Oil towards $60 and Energy Equities up off of support (XEG > 50-day average).

The key issue is the launch-pad the TSX bounced up off of to re-test all-time-highs (16,131) wasn’t “relatively cheap” enough to encourage fresh buyers to play, but forced institutions to play catch-up to ensure year-end-bonuses are juicy.

The TSX is 2 standard deviations away on the expensive side of 52-week routines, implying upside is limited and short-lived; ~60% of its market cap (Financials & Energy) are expensive to very-expensive on 52-week routines.

Oil and Energy Equities (XEG) are dislocated and expensive with an expected terminal value at ~$60 on Oil (followed by a swing-high) and the current dead-cat-bounce on Energy Equities likely terminates into week’s end – timed with the completion of OPEC’s meetings Nov. 29 & 30.

This week also comes with a Bank of Canada Financial System Review and the big bank’s presenting earnings. We anticipate delight from the banks and a pass on BOC’s review with risk in the housing market re-iterated.

Based on bank prices near or at all-time-highs we are not interested in chasing Canadian Financials, but rather selling/trimming into strength. Short-term technical tools still point the TSX up, but not for more than a week (this week); RSI is tilted up, MACD is attempting a bullish-cross.

A break/limp-out to new highs (> 16,131) is very likely this week with an upper limit at 16,250 at the same time odds are strong that this week ends with the TSX below 16,131.

Our focus this week will be to play out the bounce in Energy (XEG, ZEO), trim our longer-term Bank holdings on earnings, while hunting for entries/additions to Materials (XMA) and Gold (Producers) along with Gold (CGL-T, GLD, SLV), while maintaining our double bottom trade on Utilities (ZUT).

We are waiting for Telecoms, REITs and Staples to soften up and re-test short-term up-trends prior to acquisition.

Global Currency Markets

Merkel’s bluff “join the German coalition or face voters” worked and the Euro, Yen, Swissy, Pound & CAD$ gained ground at the expense of the USD (delivering handsome rewards on our trades: FXY, FXF, FXB, FXC).

Short-term the USD is likely pressured as Yellen testifies in a lame-duck situation with a Dec. 13 rate hike fully priced in, along with jitters leading up to the Senate’s vote on tax reform.

This is keeping us long the Yen (FXY), Swissy (FXF), Pound (FXB), CAD (FXC), Gold (GLD) & Silver (SLV). We transacted these trades ~2 weeks ago.

Expectations for a “disappointment” on Trump’s tax reform are what the charts continue to tell us. However, we still see the USD (UUP) stronger weeks to months out.

Our strategy this week will be to trail with stops FXY, FXF, FXB, FXC, while looking to open/add-to GLD, SLV (Gold/Silver) if Gold is able to sustain above its 50-day average ($1,287) and Silver able to hold above $17.

Global Commodity Markets

Into OPEC (Nov. 29 & 30) we maintain our trades on Oil (HOU-T) and Energy Equities (XLE, XEG-T). However, we recognize the usual pattern is sell-the-news; so our timing must be precise.

Oil and Energy Equities are dislocated and expensive on 52-week routines, making it high risk to play with Energy overall. WTI Crude Oil is on the path to test resistance at $61.35-$60.65; the next buy-point on XLE is above $68.03 (50-day average) and $12.12 on XEG-T.

Natural Gas is setting up for another bounce but requires either a bullish reversal above $2.82 to enter or a further drop down to $2.753 and a bullish reversal there; UNG, HNU-T will be in play at that time.

The commodity-complex (DBC) globally remains dislocated and expensive on 52-week routines = trading not investing.

Base Metals (DBB) may still see some shine on USD softness this week; Investors should be selling into strength, and Traders must be patient waiting for signals to short: Steel, Copper, Coal, etc…

Global Bond Markets (Defensives)

US Treasury yields remain stretched and point downwards (short-term), corroborating our short-term view for weakness on the USD to persist this week.

We maintain our long-side trades on TLT, XBB-T, AGG, LQD but tighten up stops. And, while the global equity market remains in a short-term bounce starting Nov. 16, we maintain long-side trades in Preferred Shares (PFF, CPD-T).

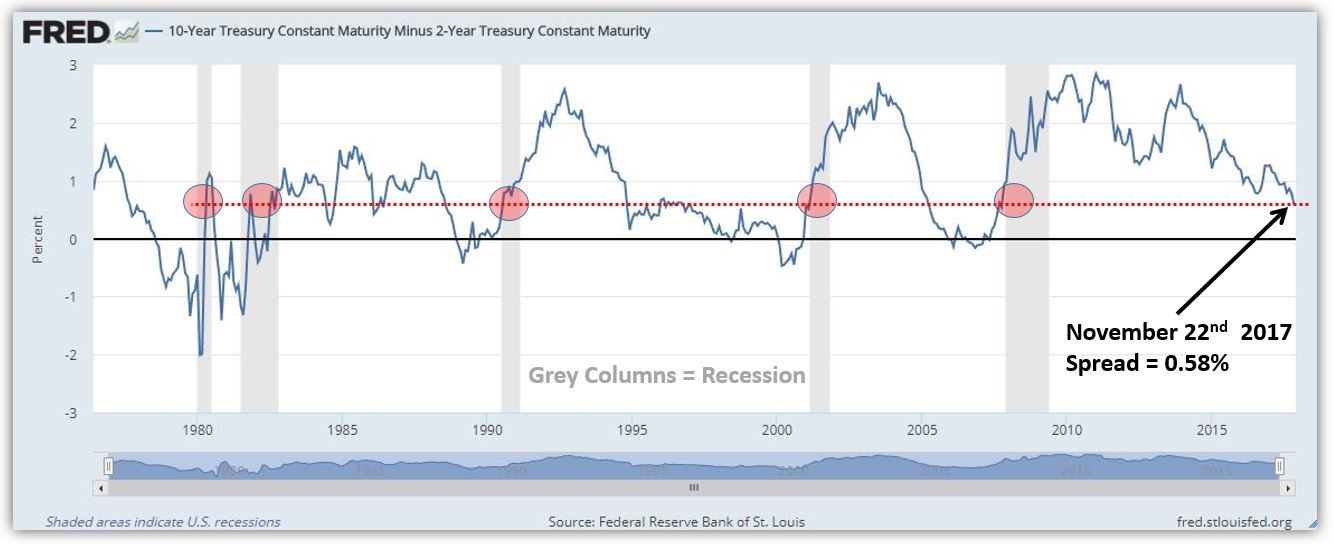

If we do get disappointment on tax reform this week, we would re-allocate away from Preferreds to TLT and heavily short U.S. Banks (KBE). We also note the spread between the 10-year and 2-year U.S. Treasury note has hit the marker where every-single recession since 1970 has occurred. However, we may actually see the curve invert first. This week a bounce in longer-term yields front end of week is likely while 10-year and less maturities see stagnation.

Join experts at the Independent Investor Institute for a 3-hour deep dive on markets Saturday, December 2, 12 pm (EST). The session will be held online. Register here. Or send Ziad an email with your request: ziad.jasani@educatedtrader.com