A Track Research dinner explored the role of rates going up and driving down stocks according to many who expect a correction in equities. Also, a healthy debate about inflation risks. The role of tax reform was mixed, writes Bob Savage, CEO of Track Research Wednesday.

The last dinner of the year at Track Research brought an accomplished group of investors, analysts and portfolio managers together to discuss what we learned in 2017 and what those lessons mean for 2018.

The major theme for the dinner was why markets don’t react to geopolitical risks like they used to in years past.

The evening focus was on North Korea given its Tuesday night missile launch – with the trajectory steepest on record – suggesting an ICBM that could reach the U.S. East Coast.

Why do geopolitical risks not matter?

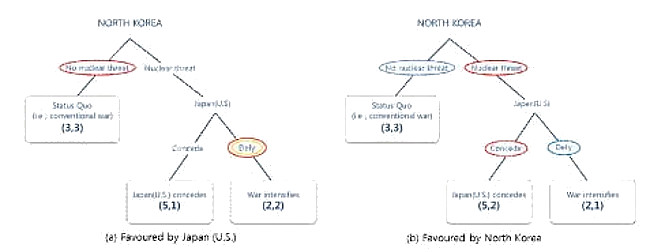

The North Korea focus was a foil for how all other events have just not mattered in 2017. The final outcome for North Korea is still seen as an unacceptable binary risk – with war on one hand and negotiations on the other. The ability for the U.S. to act in a multi-lateral manner was seen as increasingly difficult given the competing interests of Japan and China.

Some participants argued that the lack of reactions to events was due to a learned buy-the-dip behavior.

The push to algo-trading and to passive strategies aggravates this quality.

Others see that the fear about politics is less immediate and so more discounted over time.

North Korea issues, in particular, were seen as something that had no immediate solutions – as sanctions were the logical and necessary response from the U.S. and rest of world, which if they won’t work leave the untenable choices of military engagement or of China deciding to intervene to prevent such a risk.

The key player in the multi-lateral problem was seen as Japan – not the U.S. – with many wondering what happens in 2018 should the region see a more rapid rise in military investments. Some compared the North Korea conflict to that of Saudi and Iran with its present cold war. The end fears about nuclearization of a region remain untenable but real and the role of a global approach as the only viable solution directly conflicts with the recent shift in U.S. foreign policy and focus.

Why do tax reform and the U.S. debt add to de-globalization?

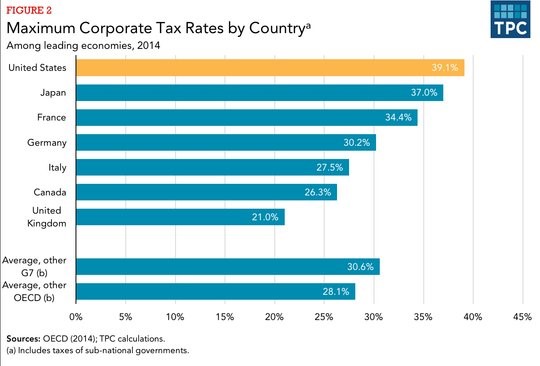

The second theme that came out of the discussion was about U.S. policy and how the present Trump administration focus on tax reform and bilateral trade deals are connected.

They make clear that the shift to a territorial tax system – similar to much of Europe – forces the step away from multi-lateral solutions and reinforces the de-globalization pressure on foreign policy.

The dinner participants saw the U.S. debt as a key part of the problem – as the $20 trillion size was seen as a tipping point for future trouble driving much of the policy mixes and approaches – with the push for growth and inflation one way out for the burden.

The problem with territorial tax is that it balances three competing goals –

exempting foreign business from domestic taxation (a bilateral deal);

protecting the domestic tax base (reversing any inversions);

keeping it simple – so that loopholes don’t make it a game for big companies at the expense of the SME.

The U.S. tax reform is seen as difficult to price into the market given that we still don’t know what is in the Senate deal and how that merges with the House and what eventually passes through to Trump is far uncertain.

Is inflation the key to turning low yields and low volatility around?

There was an argument that we are in the opposite of 1982 – when rates and inflation were at cyclical highs.

Many agreed that we need the historic lows for yields and inflation, given the significant debt outstanding the role of central bankers in effectively monetizing that money – particularly the BOJ but also the U.S., ECB and BOE.

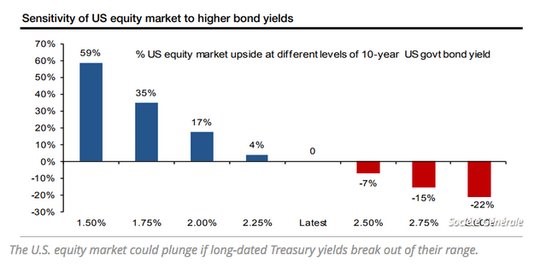

The low volatility, low yield world has been the driver for passive investing and a rush to higher-risk assets. The gains in growth over value in equities are notable and haven’t been seen since the dot-com bubble.

The factors behind the markets in 2017 are assumed to change with rate hikes, more geopolitical uncertainty (North Korea, Iran, Russia) and with the filling up of output gaps worldwide.

The role of rates going up driving down stocks is the focus of many who expect a correction in equities – starting with “risk-parity” programs. There was a healthy debate about inflation risks in 2018 with demographics and technology on one side and government policy on the other. The role of tax reform was mixed as some saw it driving a supply shock along with deregulation driving down prices while others feared the debt issues that a wrapped around it.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here