It’s remarkable that we have rates so low while the Senate is passing tax cuts to boost the economy almost nine years into the expansion, Don Kaufman, co-founder of TheoTrade.

The stock market ramped higher again on the prospect of tax cuts which we will get into later.

I was wrong in my projection that tech stocks would continue their selloff Thursday as the FANG stocks were either up or barely down and the Nasdaq was up 0.73%. The Dow was the biggest winner as it was up 1.39%. It hit its 63rd all-time high this year which is the third most ever.

The leaders of the index were Boeing (BA) and United Technologies (UTX) which were up 2.8%. Because the S&P 500 Index (SPX) became what it is now in 1957, the Dow Jones Industrial Average (DJI) is the best index to measure long-term records.

With the amazing run this year, that is necessary as the two years with more record highs were 1925 with 65 records and 1995 with 69 records.

That’s not to say the S&P 500 hasn’t set records. Since 1928, this is the longest streak of consecutive up months. The current streak of 13 months shows no sign of stopping. The previous records which lasted 12 months were in 1935-1936 and 1949-1950.

Senate passes tax bill

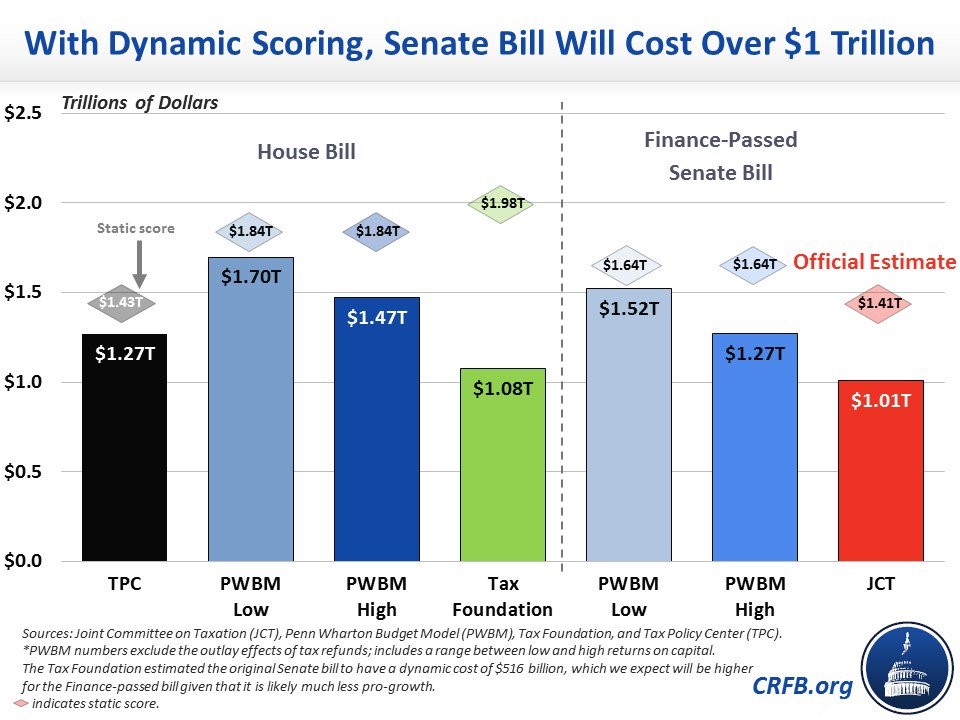

As we have discussed, one of the hurdles the bill needs to get over in the conference committee is garnering support by the deficit hawks. They aren’t happy with the tax plan adding $1.4 trillion to the debt over 10 years. The Joint Tax Committee came out with a report that the plan would add $1 trillion to the debt over 10 years even after you account for the growth which will come because of tax cuts.

The chart below reviews the estimates of how much the various plans would add to the debt with and without the dynamic scoring. The proposed solution to this was a deficit trigger which would raise taxes if the plan added a certain amount to the debt. However, this hit a snag on Thursday night as the parliamentarian said she would rule against having a deficit trigger in the bill, meaning it would need 60 votes to pass.

The solution to this new snag is to just add back the tax increases automatically regardless if the trigger is hit or not. In the end, this is just semantics because the deficits would probably have caused the trigger to go off since the estimates using dynamic scoring show it adding over $1 trillion to the debt. The headlines are saying $350 billion of the $1.7 trillion in tax cuts might be eliminated.

The final aspect to consider as this plan passed the Senate Friday is that the House will need to agree with the $350 billion of eliminated tax cuts. As you can see, the House and Senate plans are already very different.

The House plan adds anywhere from $1.43 trillion to $1.98 trillion to the debt. Those are unrealistic plans because the Senate’s limit is $1.5 trillion and the deficit hawks want it to come in lower than that. Because of this snag in the plan, the S&P 500 futures were down 6.25 points at 6:30 pm Thursday. According to PredictIt, the chance of an individual tax cut passing this year is 39% and the chance of a corporate tax cut is 65%.

Monetary stimulus has helped the economy

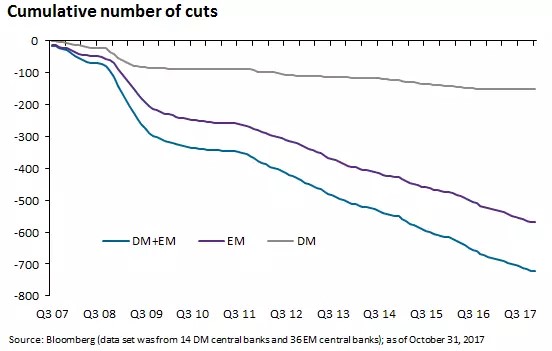

I often talk about the strength of the emerging markets; we need to contextualize how that strength came about. The chart below shows the cumulative rate cuts since this business cycle started.

Starting with the developed markets, it’s disconcerting to see that there haven’t been any hikes since the start of the recovery in 2009. It’s remarkable that we have rates so low while the Senate is passing tax cuts to boost the economy almost nine years into the expansion.

The expansion has been weak with this monetary stimulus. I question if it would exist at all without the stimulus.

The US is in better shape than most

Now let’s look at the rate cuts in the emerging markets which are shown with the purple line. These cuts are even more egregious.

As you can see, the recent economic spurt has been helped by huge rate cuts in the past 2-3 years. The scary aspect of the cumulative results is that JP Morgan estimates 1,000 hikes are needed to occur over the next decade to get back to even.

Given the length of this expansion, it seems unlikely that these cuts will be allowed to occur by the economy without triggering a meltdown.

Relatively speaking, the U.S. is in great shape as its QE unwind should end in 2-4 years and its rate hike cycle might end in 2019. There might be more hikes needed if inflation picks up in the next few years.

If inflation picks up, the Fed will be forced to make a choice between keeping rates stable and having high inflation or raising rates further and risking another recession. This is the decision that the Powell-led Fed will need to make sometime in 2019 or 2020.