If we have seen a bottom in 10-year benchmark yields, and are in the midst of a new secular bull-trend higher in interest rates, gold could really get clobbered--$700 anyone? writes Jack Crooks of Black Swan Capital. Watch his TradersExpo presentation and currency outlook.

Quotable

“It is better for you to be free of fear lying upon a pallet, than to have a golden couch and a rich table and be full of trouble.”

--Epicurus

“Major U.S. stock indexes have been historically quiet this year. Now, that inactivity has spread to the precious metals market. Gold stayed in a $34.50 trading range in November, the lowest gap between its high and low in any month since October 2005,” according to the Wall Street Journal Market Data Group Dec. 5.

We believe this low volatility period is about to change for the shiny metal.

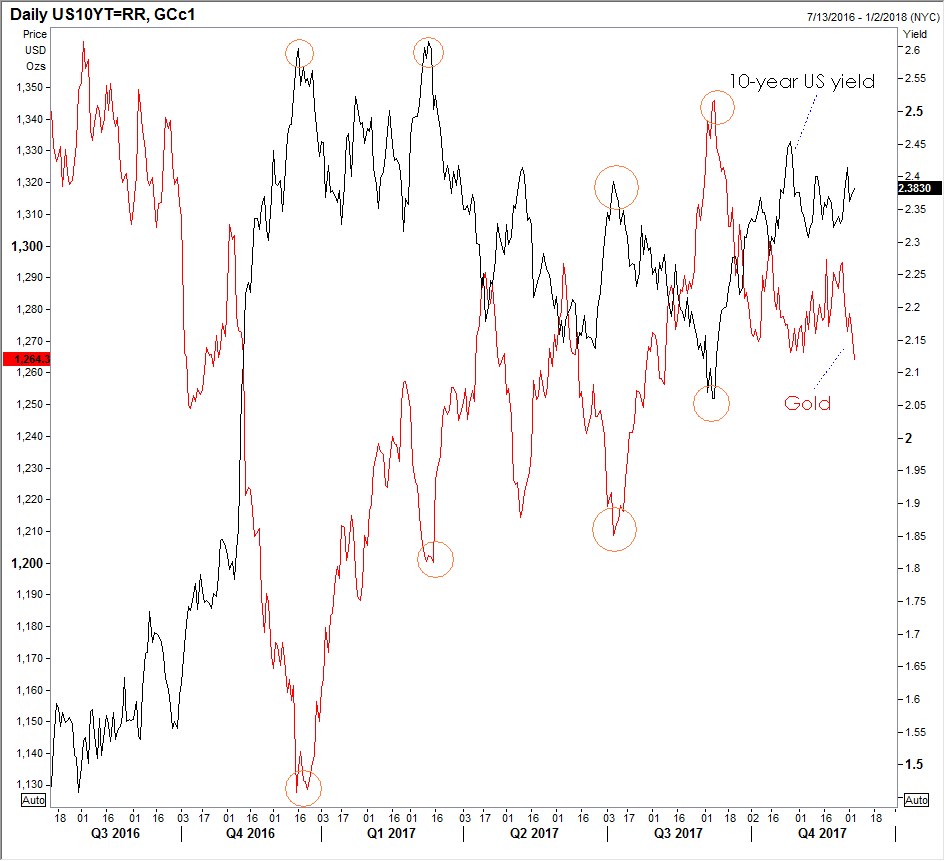

Gold pays no interest. Thus, gold prices tend to be negatively correlated to interest rates; i.e. higher interest rates and lower gold prices, vice versa.

So, if one accepts as probable the following we gleaned from this week’s Barron’s magazine…

"... ‘But a major risk for the market is the potential for a rise in U.S. inflation,’ says Mark Haefele, the giant Swiss bank’s (UBS) global chief investment officer. That concern, which could push the Federal Reserve to tighten more aggressively, is shared by Deutsche Bank’s strategists, along with the impact of the European Central Bank's tapering of its massive bond purchases. Deutsche last week joined the small but growing list of major banks that think the Fed could raise its interest-rate target four times in 2018, in addition to the quarter-point hike that seems to be a lock at the Dec. 12-13 meeting of the Federal Open Market Committee."

…then one should be very concerned about the price of gold. We are short.

In the chart below, you can see a clear negative correlation between gold and US benchmark 10-year yields:

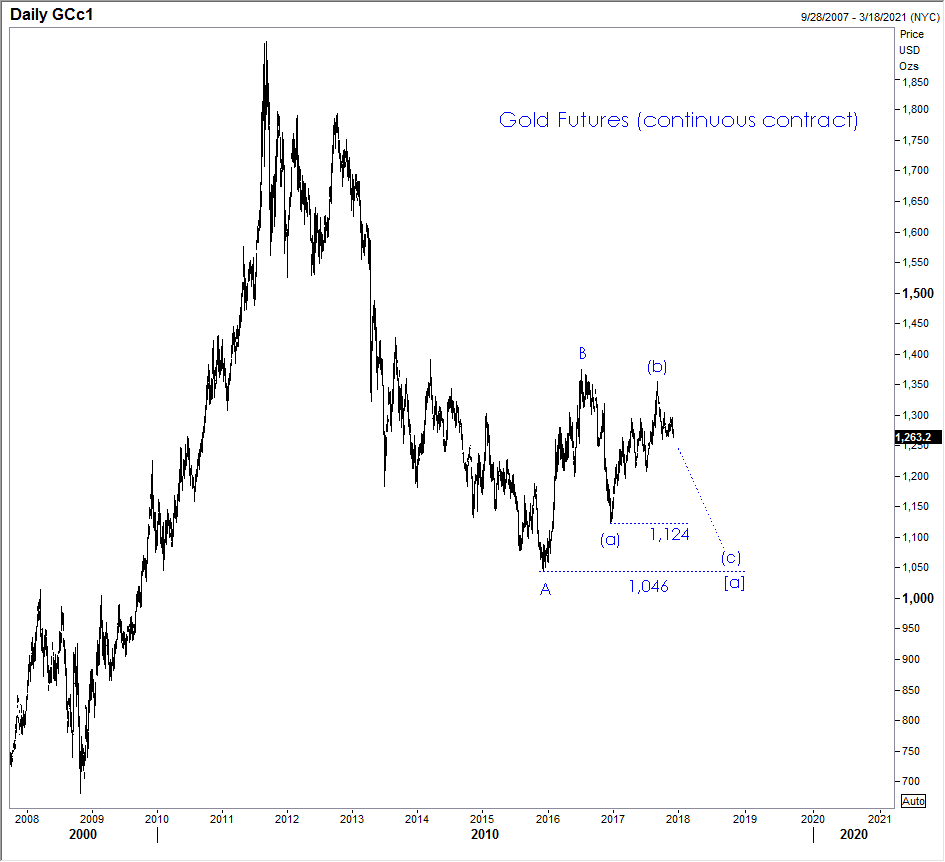

We expect gold to break down out of its currency range; the chart below shows our technical view.

The next swing support comes in at 1,124; then 1,046.

And if we have seen a bottom in 10-year benchmark yields, and are in the midst of a new secular bull-trend higher in interest rates, gold could really get clobbered--$700 anyone?

Watch Jack Crooks present Black Swan Foreign Currency Trading at TradersExpo Nov. 3, Las Vegas, here. Duration: 52:58.

Jack Crooks talks about the US dollar, currency pair forecasts, how the Japanese yen may weaken, opportunity in the British pound. The euro is an open question. Watch here. Duration: 3:28.

View Currency Currents, commentary, and analysis at Black Swan Capital here…