The pound has acted well against the dollar in the midst of Brexit. Friday was a reversal day. I am targeting the 1.2800 level; but on a major sentiment swing, coupled with dollar bullishness, a bigger break would not surprise, writes Jack Crooks of Black Swan Capital.

Quotable

“The real voyage of discovery consists not in seeking new landscapes, but in having new eyes.”

—Marcel Proust

Either Prime Minister Theresa May skipped class at Oxford when they were discussing the art of negotiation, or she never liked the idea of Brexit in the first place (we know the latter applies).

One only need witness the jubilation from the European Union after the “deal” was announced Friday morning to infer PM May caved in a very big way.

Of course, the so-called “business community” in the UK is said to be happy about the deal. This is the same community which was in lock-step against Brexit in the first place. The same business community (the world over) led primarily by well-connected and “well-educated” grey folks who lack historical perspective and a principled life philosophy.

But what these grey men lack in perspective and irony (Have you ever read a book written by a CEO? Proust is rolling in his grave musing on such tragedy), is made for by their ability to value executive stock options against next quarter’s forecasted business activity.

Would it be a stretch to say once again the sovereign will of the people has been thwarted yet again? I am going with yes, but time will tell.

And therein lies the problem for UK financial markets in general, and the currency in particular, this so-called “deal” may be hailed as providing a degree of clarity, but given the devil is in the details, this so-called deal seems to add more risk and uncertainty.

What is the next step?

Will UK reinstitute the EU regulatory scheme for toasters and tea kettles?

Will its fishing fleet, already devastated by sushi-eating white-wine sipping barista-buddies based in Brussels, be sunk again? (Apologies to fellow sushi lovers, but I thought it was a nice fit in that sentence.)

Will this deal with the EU preclude unilateral deals between the United States and China, or drastically delay them?

Is it smart to re-hitch yourself to a wagon whose wheels may falling off a la Spain splintering, Italy being Italy, and Germans possibly catching on to the damage caused by Ma-Merkel’s radical immigration policy?

I don’t know. I only ask the questions here. But as said, it seems risky.

Maybe the term Stockholm Syndrome helps explain PM May’s capitulation.

Or maybe I am missing something again in a very big way; it wouldn’t be the first time.

Given the pound’s price reaction to the deal on Friday, there is a good chance the British pound (GPB/USD) could get whacked.

We have been short the pound for the last several days based on the technical view below, our position being ensconced in the volatility so far. But I’m expecting a push lower in the pound (possibly much lower) if others see the deal as I do.

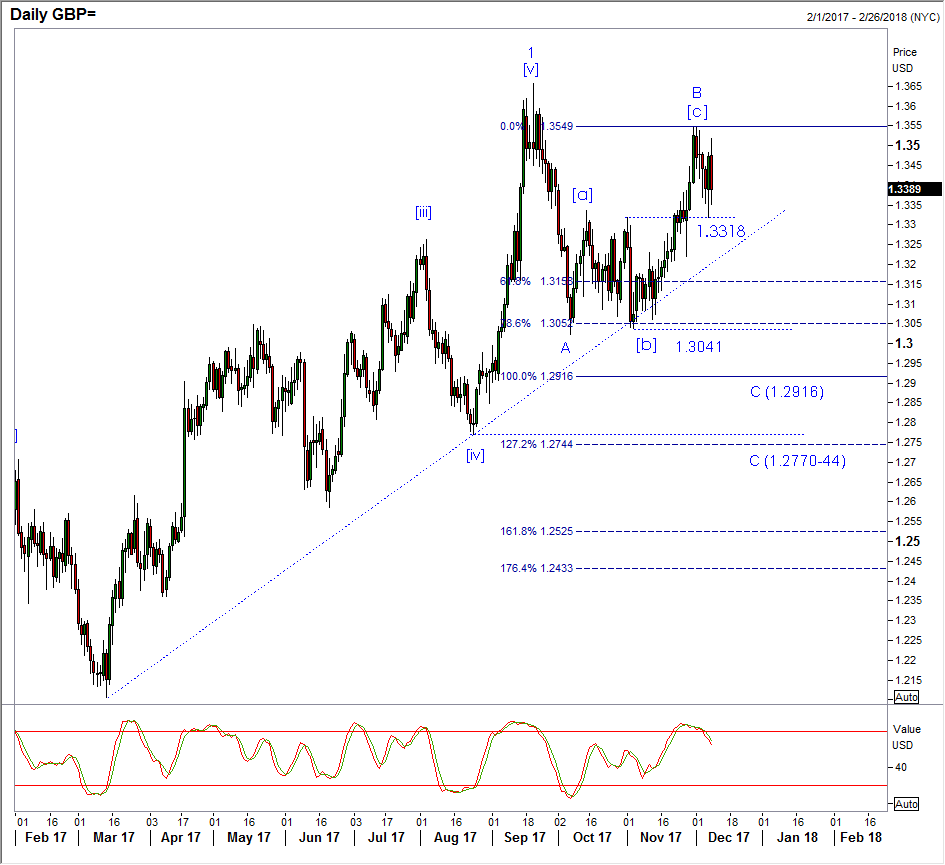

GBP/USD Daily: The pound has acted quite well against the dollar in the midst of these negotiations and you can see in the chart below. The daily trend going back to March (1.2152) is still intact.

But Friday was quite a reversal day with a “dark cloud” traced out (candlestick lingo). I am targeting the 1.2800-level; but on a major sentiment swing, coupled with some ongoing U.S. dollar bullishness, a bigger break would not surprise.

As indicated, I may be missing something here, so risk is to the most recent swing high at 1.3549.

Watch Jack Crooks present Black Swan Foreign Currency Trading at TradersExpo Nov. 3, Las Vegas, here. Duration: 52:58.

Jack Crooks talks about the US dollar, currency pair forecasts, how the Japanese yen may weaken, opportunity in the British pound. The euro is an open question. Watch here. Duration: 3:28.

View Currency Currents, commentary, and analysis at Black Swan Capital here…