Trade idea: DLTR has historically been a very rewarding target for option premium buyers. The stock sports a Schaeffer’s Volatility Scorecard (SVS) of 100, the highest possible reading, says Elizabeth Harrow, at Schaeffer's Investment Research.

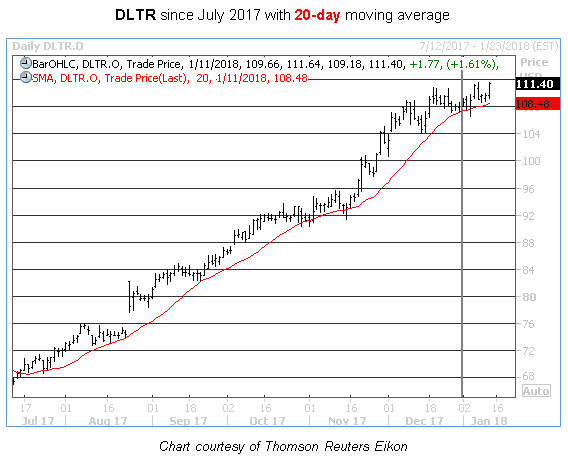

Retail stock Dollar Tree (DLTR) has bounced back in a big way from its summer 2017 lows around the $66 level. The shares have gained about 66% since then, with plenty of room to keep climbing before they bump into “double low” territory around $132.

DLTR is fresh off a new record high of $111.69, in fact -- and it seems as though there may be more upside yet to come before this rally is over.

Schaeffer’s Senior Quantitative Analyst Rocky White notes that front-month implied volatilities on DLTR options are hovering right around 21%, which ranks in the 4th annual percentile.

Since 2008, there has been just one other occasion where DLTR volatility has been this low while the stock simultaneously traded within 2% of its annual high -- and following that prior signal, the stock was up 4.3% one month later.

Guggenheim begins coverage on Dollar Tree.

Granted, it doesn’t get much smaller than a sample size of one.

Shown on the accompanying chart, DLTR has enjoyed the near-infallible support of its 20-day moving average since last July. Plus, a recent period of consolidation brought the equity’s 14-day Relative Strength Index (RSI) down into the 65 range, effectively working off an early December overbought condition.

Perhaps most compelling for contrarians is the steady flow of short-covering support DLTR has garnered. Short interest fell by roughly 8% in the most recent reporting period, but the current supply of shorted shares is still equivalent to about three times the stock’s average daily trading volume.

A continued capitulation by these underwater shorts could contribute to additional gains in the short term.

Trade idea: Meanwhile, it should be noted that DLTR has historically been a very rewarding target for option premium buyers. The stock sports a Schaeffer’s Volatility Scorecard (SVS) of 100, the highest possible reading -- which means the equity’s realized volatility has consistently outpaced the implied volatility priced into its options during the past 12 months.

With short-term vols near annual lows and trendline support firmly intact, it's a prime time to take advantage of the generous returns offered by DLTR options.