The last five times this signal has flashed, CF was trading higher 21 days later 80% of the time, with an average return of 3.4%. A bounce would continue the trend higher, as the stock has rallied about 41%. says Elizabeth Harrow, at Schaeffer's Investment Research.

A few weeks out from its fourth-quarter earnings report -- tentatively expected during the second full week of February -- agricultural chemicals specialist CF Industries (CF) is flashing a Buy signal, according to a recent chart analysis by Schaeffer's Senior Quantitative Analyst Rocky White.

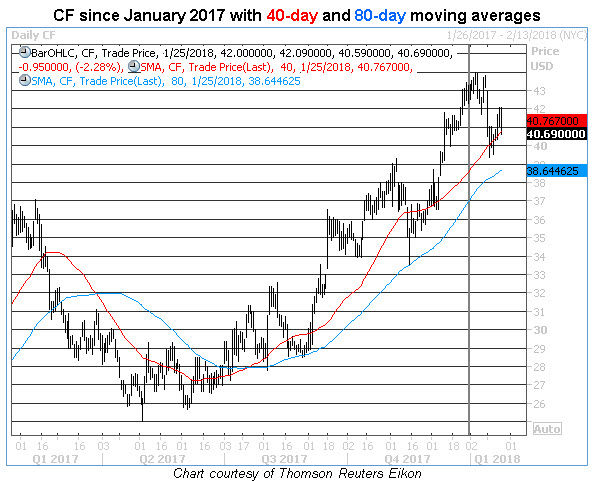

The shares are trading within one standard deviation of their rising 40-day moving average, and previous encounters with this indicator during CF uptrends have yielded consistently bullish results over the next month.

The last five times this signal has flashed, CF was trading higher 21 days later 80% of the time, with an average return of 3.4%. A bounce from here would simply continue the prevailing trend higher for CF, as the stock has rallied about 41% over the past six months. Along with that critical 40-day moving average, the equity’s 80-day trendline has also provided key support on pullbacks.

The positive price action hasn’t won CF too many fans on Wall Street, though. Short interest surged by more than 9% during the most recent reporting period, and now accounts for 7.1% of the stock's float. At CF’s average daily volume, it would take 6.8 days for all of these shorted shares to be covered.

Likewise, options players are gravitating toward bearish plays. Data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows 2.74 puts bought to open for every call during the past 10 days. This ratio arrives in the 93rd percentile of its annual range, as premium buyers have rarely shown a greater preference for bearish bets over bullish.

Analysts, too, remain on the sidelines.

Among the 12 brokerage firms tracking CF, only three have deemed the stock worthy of a Buy rating. CF insider trades.

From a contrarian perspective, this combination of positive price action with resoundingly pessimistic sentiment has bullish implications. As CF extends its uptrend, short-covering activity or upgrades could contribute to additional upside.

That said, there’s one major caveat to a bullish options play on CF right now. With that earnings report on the horizon, implied volatilities are looking a little rich. As of this writing, Trade-Alert pegs 30-day at-the-money implied volatility (IV) at 39.6%, in the 72nd annual percentile. This means short-term options on CF are pricing in higher-than-usual volatility expectations -- which effectively raises the cost of entry and breakeven point for call premium buyers.

Similarly, the 30-day IV skew checks in at 6%, in the 70th annual percentile. This indicates that puts are pricing in higher volatility than usual relative to calls -- but this is actually something bulls can exploit. By playing a put credit spread on CF while IV is inflated, speculative players can collect richer upfront premiums than they normally would, and the position should achieve maximum profitability if the uptrend continues through expiration.

As far as strike selection, bulls should note that $40 is not only home to the rising 40-day moving average, but it’s also a round-number level that independently served as support back in December. As such, this looks like a solid strike for the sold leg of a short put spread.

Outside of the earnings risk, our internal data shows that CF is slightly better suited to premium-selling than premium-buying strategies, anyway. The stock’s Schaeffer’s Volatility Scorecard (SVS) is a 46 out of 100 -- which means the shares have regularly underperformed the volatility expectations priced into their options over the past year.