Crude oil remains a leading play for the bulls. The U.S. economy fundamentals seem to be good enough to keep investors betting on higher oil prices, asserts Joe Duarte, MD of Joe Duarte In The Money Options. He’s traded, analyzed and written about markets since 1990.

It’s one thing to be correct, which is always rewarding when you trade and write about the markets, but it’s another when your expectations about the price target of a major commodity are met within a few short weeks of the publication of an analytical article.

So it is with some humility and surprise that I’ve been tracking the price of crude oil over the past couple of weeks. For those who may have missed it the price of crude oil is now between $65 and $70, something I thought was possible before the summer driving season in my January 4, 2018 article.

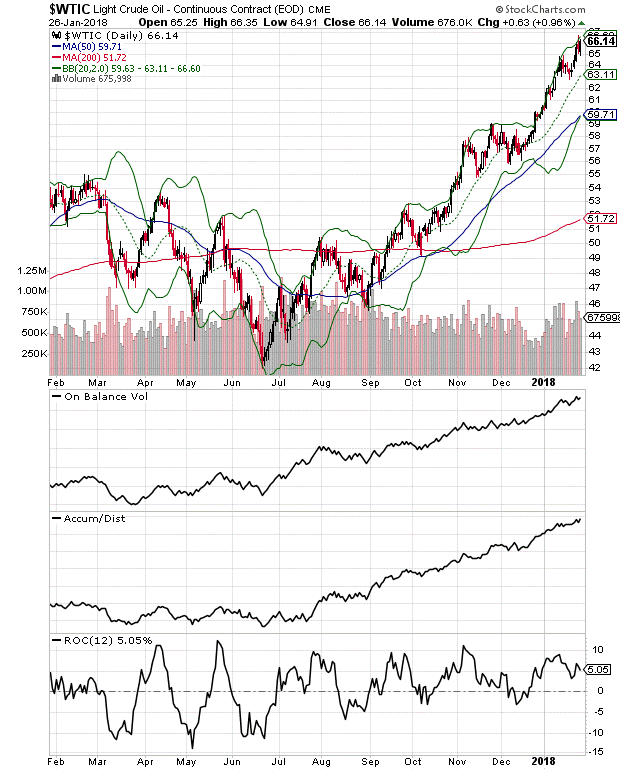

I made the prediction based on technical price trends as well as on the expectation that the U.S. economy might get a boost from the Trump tax cut. As I noted then regarding the price of West Texas Intermediate Crude (WTIC): “Especially positive is the steady uptrend in both the On Balance Volume (OBV) and Accumulation Distribution line (ADI) indicators. In fact, it is the very uptrend and very constructive trajectory of these two key technical factors which suggest we could see the price of crude trade above $70, perhaps within the next three to six months.”

Moreover since crude has now entered my target price range, it’s a good idea to revisit the sector and to deduce what the next direction of prices may be.

Perception and reality

Traditionally crude oil prices rise when there is a supply crunch, when the economy strengthens or both. Currently the U.S. economy is at its worst in fairly good shape, with low unemployment, regardless of job quality.

And if recent evidence is any clue about the future, companies are repatriating money from foreign lands, promising to build U.S. plants and create better jobs while handing out bonuses to current employees.

To a certain degree, this anecdotal/tangible evidence of positive outcomes from the tax cuts falls more into the perception side of the equation because this is a developing situation, thus it is somewhat uncertain as to when people will get their bonuses, and if and how they will actually spend them.

Furthermore, companies can promise to build plants which never materialize or that in this day and age may be staffed with robots. Still, the tax cuts seems to be having a positive effect on the financial markets, with stocks making new highs on a regular basis and the price of crude oil joining the hit parade.

On the reality side of the ledger there are two facts to consider.

One is that the most recent GDP print showed 2.6% year over year growth where 3% was the consensus forecast.

The other and perhaps the most important one is that crude oil production in the U.S. shale belt is ramping up, as the most recent Baker Hughes North America rig count of active oil and gas rigs in the U.S. rose to 947, up 235 from the prior year, according to Baker Hughes (BHGE). Since oil prices are mostly driven by supply, the only way that a full tilt production situation can sustain higher prices is when demand outstrips production, which at this point is an essential unknown.

Momentum remains in place

Regardless of some valid questions about the economy and oil supply investors are taking a leap of faith. Indeed, prices seem poised to keep gaining ground despite rising supply (rig count) and possibly slower than expected economic activity (GDP miss).

In fact, barring a major and severe price rout in the next few days, the bulls get the benefit of the doubt for the intermediate terms. In addition, as long as West Texas Intermediate Crude (WTIC) can stay above $62-$65, given the positive On Balance Volume (OBV) and Accumulation Distribution (ADI) indicators, we could get to the $68-$70 area in a few weeks after a potential breather.

The case for a short term pause is suggested by the ROC indicator, which measures momentum rolling over even as prices have been rising. However, as long as ROC remains above zero, the odds favor a consolidation versus a pullback.

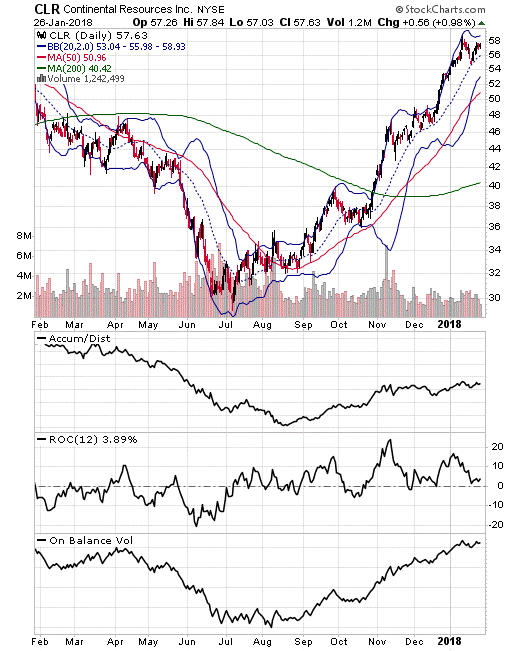

Investors who may have missed the rally in the frakking stock rally may wish to consider owning shares in Continental Resources (CLR), a leading oil driller and processor with significant shale holdings. This stock can be volatile and it has come a long way but what makes it attractive is its general correlation in the current market to the price of crude oil. I recommended to my subscribers in August 2017 and still own it myself.

Moreover, the stock has been consolidating and is showing signs of being in the early stages of an attempt to move out of its short term trading range. Note the slight upturning in the ROC while ADI and OBV remain steady. As long as the 20-day moving average continues to provide support, the odds of a credible attempt to break out toward the $60 area by CLR remain credible.

Superb technicals and good enough fundamentals

In this market, crude oil remains a leading play for the bulls. And although there are some valid questions regarding the future and the actual effects of the recent tax cut, as things stand now, the fundamentals of the U.S. economy seem to be good enough to keep investors betting on higher oil prices. So until something changes, this expectation of better economic days ahead seems to be good enough to keep the uptrend in oil viable for the next several weeks and perhaps longer.

One final note: the GDP miss may have been a reflection of business owners waiting to see if the tax cuts were actually passed. If that was the case then we should see stronger numbers either in the upcoming revisions or in the readings for the next quarter. In fact, this may be what the market is betting on.

I own shares in CLR as of this writing.

Joe Duarte is author of Trading Options for Dummies, now in its third edition. He writes about options and stocks at www.joeduarteinthemoneyoptions.com.