If FXE were to pull back in conjunction with a reduction in the massively bullish positioning in euro futures, then I might be interested in looking on the long side. Until then, I’d recommend being on the sidelines, writes Landon Whaley of Focus Market Trader Sunday.

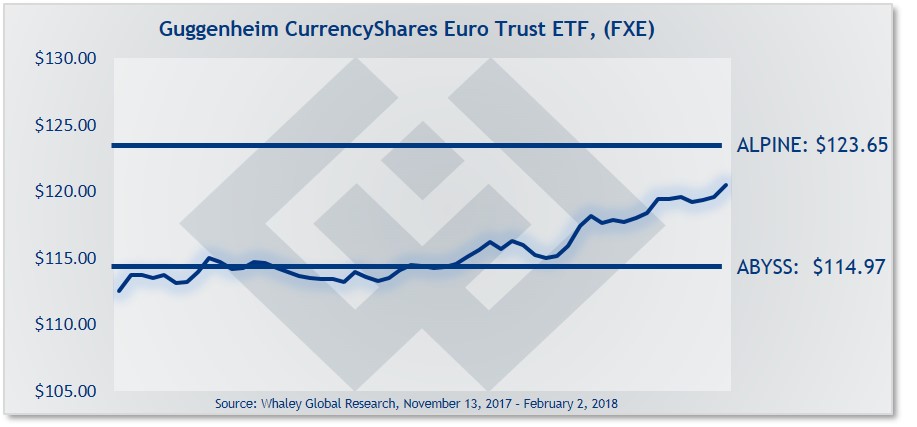

The Guggenheim CurrencyShares Euro Trust (FXE) gained 34 basis points in the week ending February 2 and has gained 3.8% to start 2018.

FXE’s Fundamental Gravity remains as murky as a man-made lake. On the one hand, economic conditions are euro bullish. However, on the other hand, the ECB has consistently reiterated they stand ready to reverse their tapering of QE should conditions dictate.

As a reminder, the bond buying program is scheduled to wrap in September with all monthly purchases ending by December 2018. However, the ECB reiterated last week “the program could be extended again if the inflation outlook is too weak.” This type of pillow talk from the ECB is bearish for the euro.

Quantitatively, Social, our proprietary trend indicator, is telling us it’s party time, indicating higher prices ahead. Barometric, our measure of buying pressure, is confirming this latest FXE rally indicating a high level of investor conviction. And rounding out our quantitative trifecta, Momo, our momentum indicator, remains very bullish and is sitting at twelve-month highs.

Behaviorally, investors have added $60MM to FXE during 2018 and remain massively long in euro futures.

The bottom line

FXE’s Fundamental Gravity is neutral, the Quantitative Gravity is uber-bullish, and the Behavioral Gravity is bearish, because of investors’ overly bullish behavior.

When everyone in the world is on the same side of a bullish trade, the risk of a pullback is extremely high. If FXE were to pull back in conjunction with a reduction in the massively bullish positioning in euro futures, then I might be interested in looking on the long side.

Until then, when the three Gravities stack up this way, we hold a neutral bias on a market. I’d recommend being on the sidelines, for the time being.