The market failed to see a LightPath Technologies filing as routine. LightPath retired about $6 million in debt, which restructured favorably their overall debt and eliminated payments on that note to the ISP sellers, writes Gene Inger in The Inger Letter Thursday.

A giant love-fest has morphed into a revival gathering on Wall Street; as the faithful flock together, pool their resources, and leverage-up yet again. It’s reckless; it’s predictable behavior by those convinced this will see no end on the upside and it sure runs-in anyone who shorted.

There were repeated breaks that recovered this week. Thursday was no different, except that the morning up-down-up move was more dramatic and even swifter than the others.

If Wednesday was a Cialis market as I’d labeled it in honor of Valentine's Day, then Thursday was another dose, as soon as things settled down in the morning, they sprung-up again without hesitation. Seriously, that move was 20 handles in the S&P down and 30 handles up; all within a couple of hours time, if that long.

Later it held and moved even higher, as our intraday comments were suggesting likely. Despite knowing that I view the market as pricey yet again, I do know that when it dropped from the first rally Thursday morning, my first comment was to cheer it on for a recovery. Not because I think we have value restored (we don’t); but might as well have this revival take it as far as they can.

LightPath: I did want to mention some were curious about LightPath (LPTH) filing a routine form to register the shares of the ISP Optics (the Latvia acquisition) that transformed the company. As you know just recently LightPath retired in my recollection about $6 million in debt, which restructured favorably their overall debt and eliminated payments on that note to the ISP sellers.

The announcement of a “selling shareholders” offering of just under 100,000 shares shook the shares slightly; presumably some seller(s) did not recognize this (as I did confirm with the company) as a routine filing.

Their Investor Relations gentleman said indeed it was for the retired ISP Optics founders, who were bought out and given stock in-lieu of the interest payment they had been receiving.

I do not know if that is a total number of shares they were assigned as part of the transaction; though it really doesn’t matter as they’re not free to transact the share (if they want to) until they’re registered; and if they didn’t plan to monetize the shares at some point, they'd probably prefer just to have continued receiving interest on the sale of their former company.

I basically suspect it’s probably also why the issuing of shares to those retiring ISP guys was referred to as “minimal dilution” by CEO James Gaynor. Until the company identifies (if they do) the selling shareholders, one can’t be sure, but that was confirmed to be the source and not a long-term consideration; other than those guys get cashed-out if they want and the company doesn’t have the debt service they had before.

The market failed to see this as routine and reacted. It’s actually a plus that the ISP founders took stock instead of the payments on the loan. And that’s likely going to invite buyers who see this as a procedural filing registration. It’s not new and it’s not a new offering.

In-sum: Many stocks are now fully recovered or getting there. That’s not how a bear market would unfold, because you don’t bring ‘em back fully in such conditions. However, there are historical anomolies where that's happened and then fiasco.

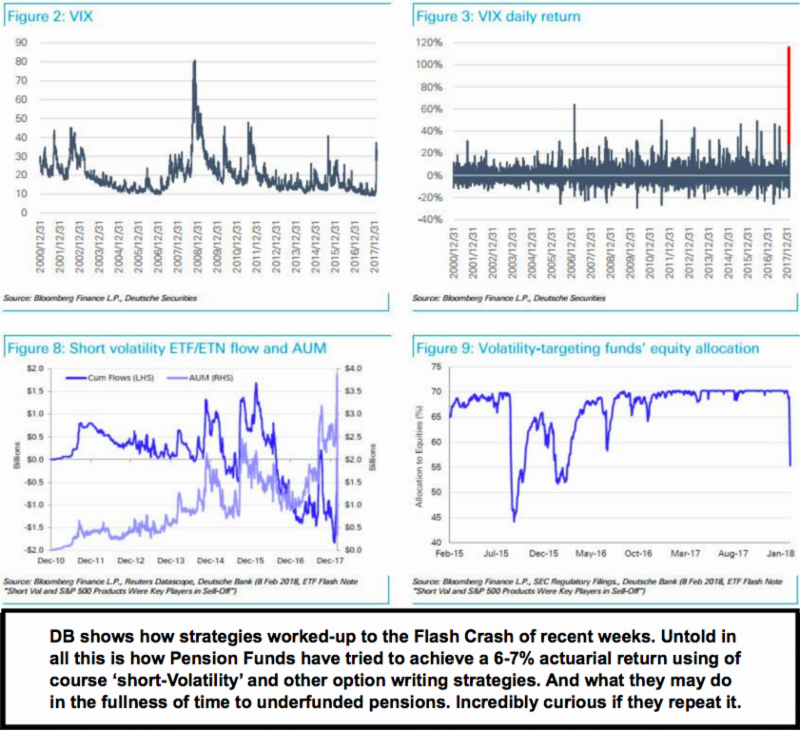

Bottom line: whether managers not selling the rally eventually turns-out to be renewed greed or not is pending. Because now they do have real opportunities to lighten-up and be made whole. That's because those that weren't hurt by the excessive 'yield-chasing' writing efforts like short-volatility strategies, are out of the picture. The question is will they, the intact management firms, do so. Probably not until forced by market events down the line a bit.