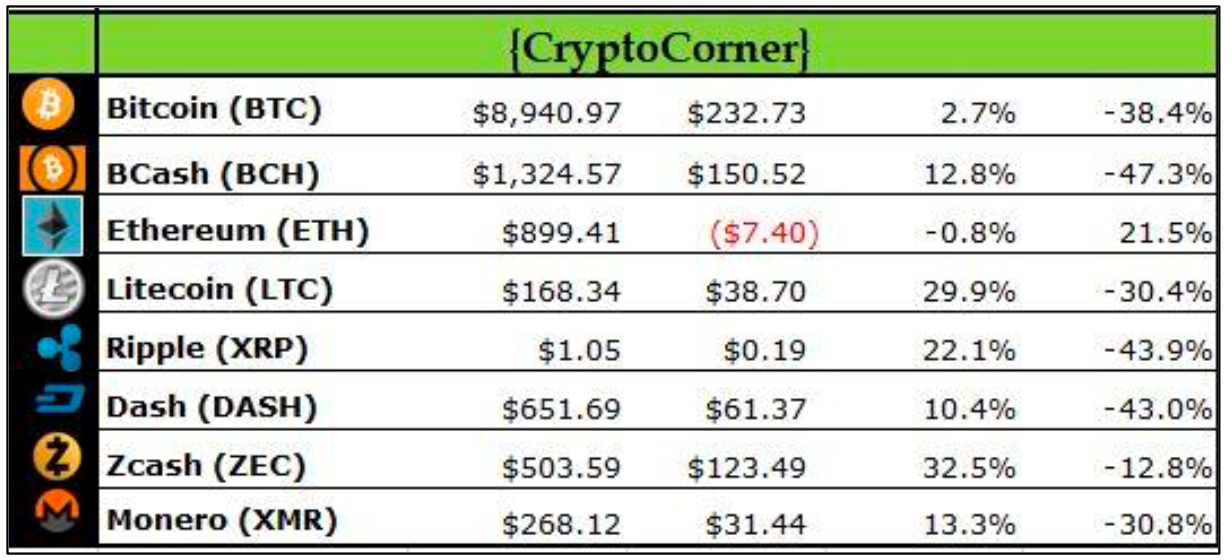

The overall crypto space had a decent week as seven out of the eight cryptocurrencies we follow posted positive weekly gains. The only loser: ethereum (ETH). Zcash (ZEC) and litecoin (LTC) posted 32% and 30% weekly gains, writes Nell Sloane of Capital Trading Group.

Bitcoin (BTC) even mustered a $232.73 up 2.7% its first weekly gain in months based upon our proprietary charting. We know that the $5900 level was huge and this 50% rally off the lows is significant in our opinion. Anyway, before we get to more commentary here is the weekly settle chart based on Friday, Feb. 9 closing prices.

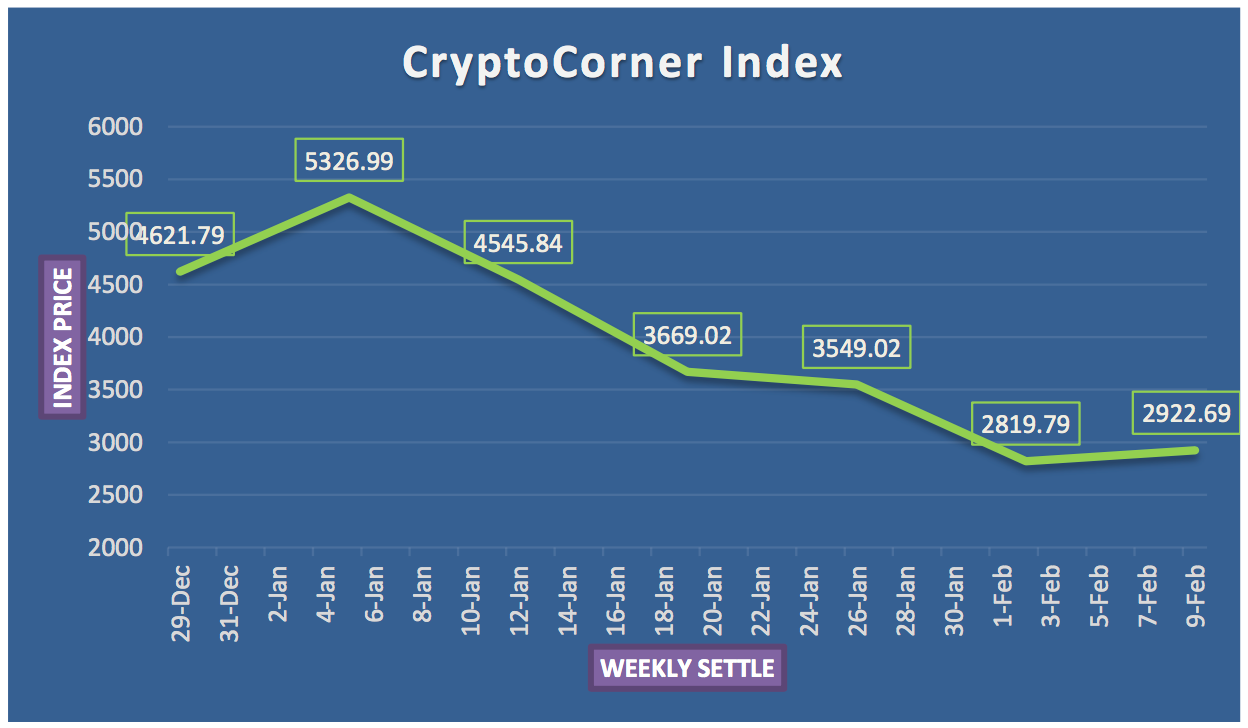

We have decided to create a weighted index of these eight cryptos and will keep track of the weekly settlement chart shown here:

Our weekly data will be plotted using a market cap weighted average and thus you can consider the y axis as a dollar amount to buy our index or CCI.

The goal is to strip out any one single crypto having too much of an effect in aggregate in order to smooth volatility over time. We want to give our readers a clearer picture of the broader market. We may add additional crypto to the list, but considering the difficulty in accessing or trading certain coins we generally will commit to only the larger more well-known coins at this time.

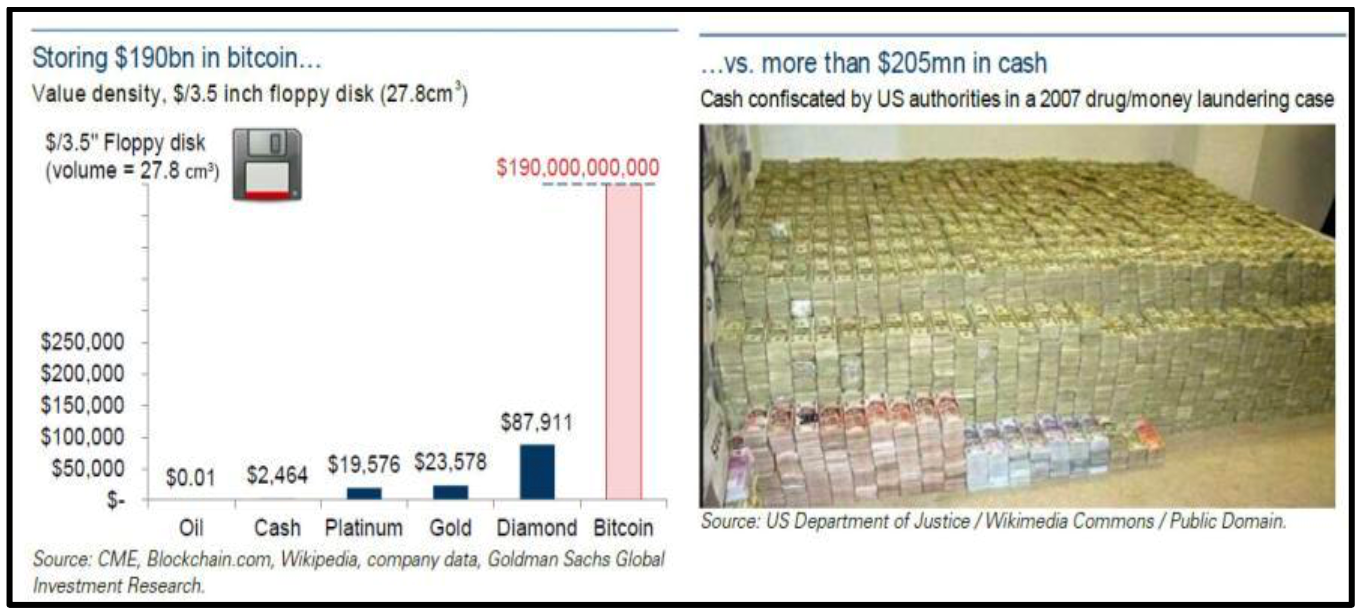

OK, so what have we seen this week? Goldman pointed out a great facet of cryptocurrencies and they used the following picture to put things into perspective (no doubt making comparison to cartel drug use as well):

The attribute or facet they were speaking of was how much value cryptocurrencies can concentrate in virtually no physical space. They went on to say, “Unlike other storage commodities like oil, gold, platinum, diamonds, and even cash, there is no need to hold much physical material to own bitcoin; even a technology as obsolete as the 3 1⁄2 inch floppy disk can hold almost 30,000 private keys. There is no theoretical upper limit to the value of bitcoins in a wallet, but if we assume each wallet secured by this disk contains as much as the largest wallet today (180,000 BTC), this single disk could hold all bitcoins in existence and remain less than 0.5% full. Assuming a bitcoin market cap of roughly $190 billion (as of late January), this disk would be the equivalent to either: 95% of the 4,583 tons of gold in Fort Knox, or 1,344 very large crude carrier supertankers of oil.”

Forbes magazine published its first ever "Richest People in Crypto" List. Some of the more notable names were obviously the Winklevoss twins Cameron and Tyler whose original claim to fame was Zuck stealing their idea and creating Facebook, now the current owners of Gemini a cryptocurrency trading exchange.

Also, on the list Mike Novogratz of Galaxy Investment Partners, he is currently working on creating a blockchain cryptocurrency merchant bank. Another notable, Vitalik Buterin the creator of ethereum and Ripple’s Chris Larsen. If you want to read about the others on the list the article can be found here.

Also, out last week was an awesome and informative piece aptly entitled, “How Blockchain Could Disrupt Banking.” We highly suggest you read it in full. It has a ton of information and it gives an excellent detailed breakdown of blockchain and those currently working on the next generation of trusted blockchain systems for monetary transfer utility.

It does a fantastic job of breaking the monetary payment transfer system in its current form, the costs associated with that system and how blockchain can substantially lower fees and costs. The article can be found on CBInsights website or here.

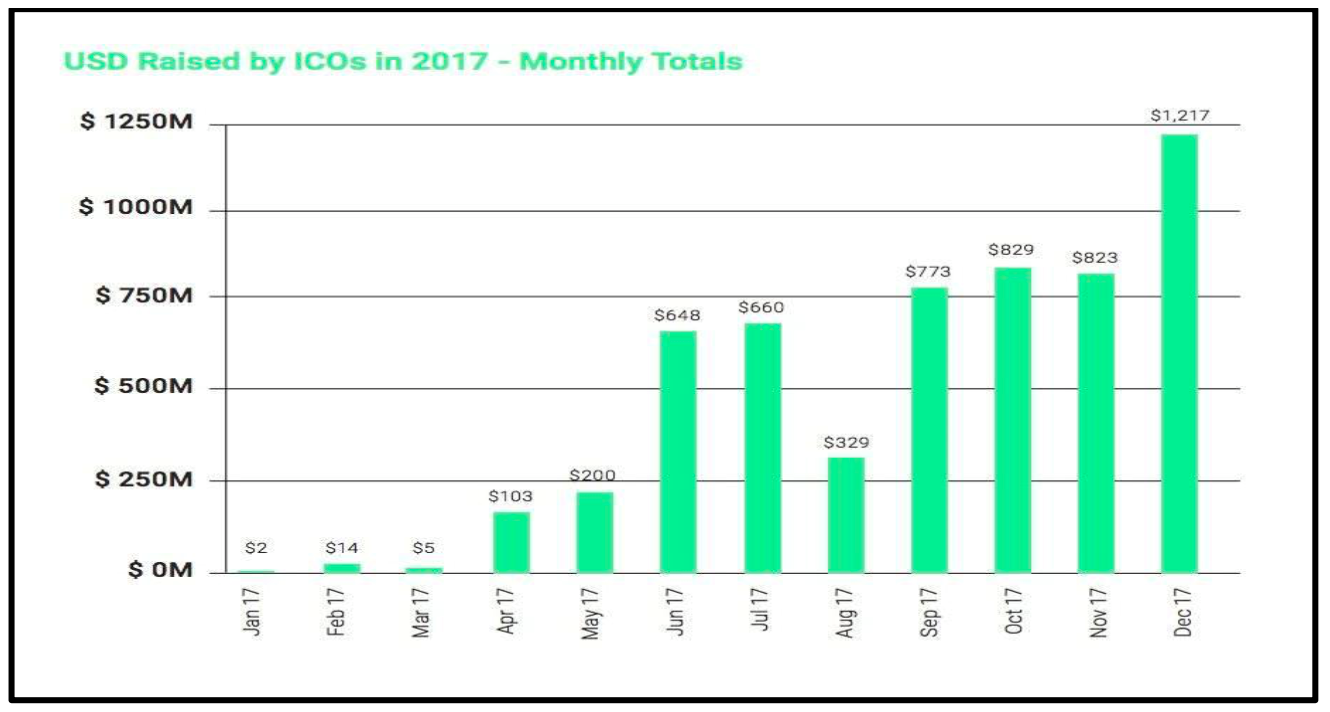

One chart we would like to point out from the article is this one here displaying the fundraising most blockchain companies use and those are referred to as ICOs or initial coin offerings. In 2017 $5.6B was raised through ICOs and the trend is apparent in the chart:

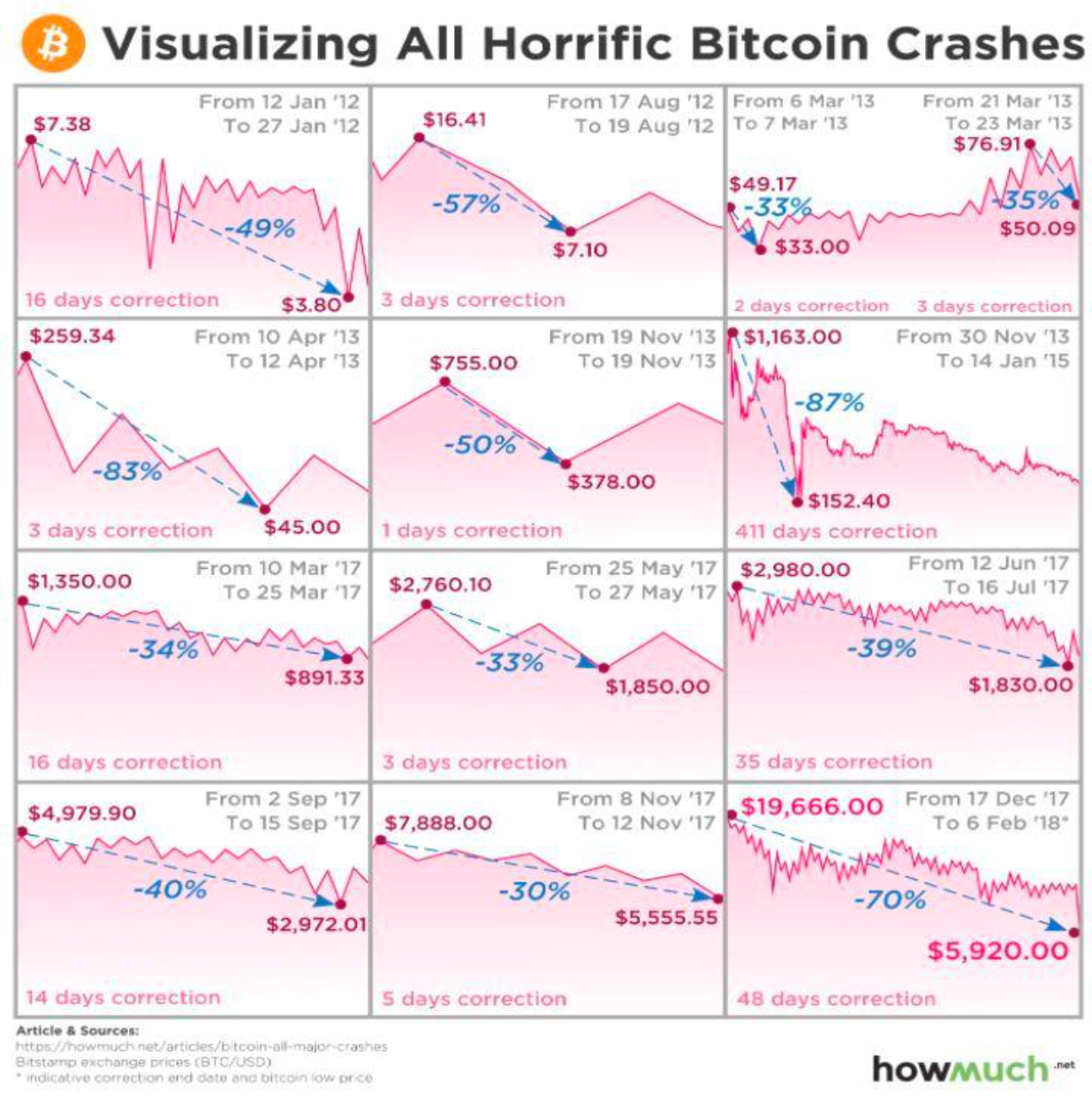

We found an awesome chart from howmuch.net that does a great job in visualizing the market corrections in bitcoin. For those that love consistency, well, take comfort in knowing that every time itcoin has fallen it has regained and made a new high. Will this time be different? We don’t think so and this chart gives us more than enough pudding for proof:

As far as the bitcoin wallets, the top two are in a dead heat with 167203 and 161339 respectively, with the top wallet shedding 5k BTC on the week and the second place adding 1279 BTC.

Net new BTC addresses picked up toward its average of 2.3m new addresses last week. Fundamentals remain strong and we can only expect wider adoption means greater absorption and an even stronger blockchain and crypto eco system in general. We look forward to bringing you continued coverage. Cheers!