The rally back in oil in 2018 affecting CPI is perhaps one of the key risks for both the FOMC and ECB for faster action. U.S. leverage in the consumer particularly in auto, student loans and housing could spell trouble for 2019, writes Bob Savage, CEO of Track Research.

The Italian election – Polls are pointing to a hung parliament into the blackout period ahead of the March 4 vote. Adding to the concern, the Forza Italian and other right-wing parties have cracks in their coalition according to reports. Silvio Berlusconi and key ally Matteo Salvini, leader of the anti-migrant and euroskeptic League, both failed to show up at an event in Rome Sunday at which they had been invited to sign a pledge to remain faithful to their alliance after the ballot.

India Financial Sector hit Feb. 19 when banks disclosed exposure to one of the nation’s biggest frauds. The press suggests the exposure may jump to RS 20,000 crore – twice the initial estimates.

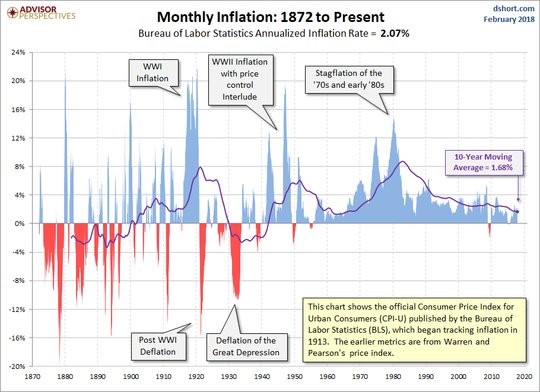

Question for this week: Is the U.S. CPI sufficient for 4 rate hikes in 2018? The Friday U.S. CPI was 2.07% y/y – above the 10-year moving average of 1.68% - but below the longer term 3.75% average post WWII. The FOMC minutes Wednesday are central in figuring out if this matters. The 2% level was a target that proved illusory for two FOMC chairmen. The new Powell Fed will face the more difficult task of reining in this inflation while not killing the economic growth in the process.

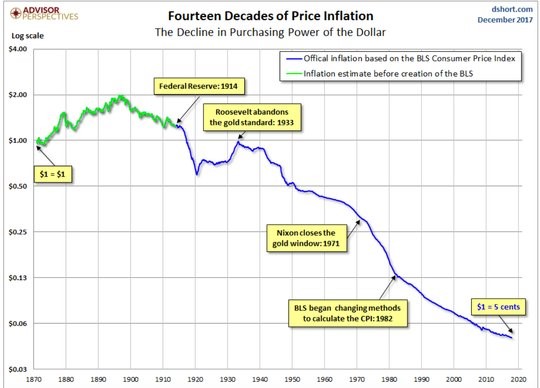

The role of inflation in the weak U.S. dollar (USD/EUR) shouldn’t be forgotten either. The 140 years of price inflation on the purchasing power of the dollar is important.

The USD trend from 2017 reflects the market doubt that the FOMC will fight the inflation harder or faster than the rest of the world – particularly the ECB.

The larger picture in the CPI is in the role of energy with the rally back in oil in 2018 perhaps one of the key risks for both the FOMC and ECB for faster action.

The U.S. leverage in the consumer particularly in auto, student loans and housing could spell trouble for the 2019 outlook. This is the balancing act for the Fed and puts the numerous speeches this week into perspective.

Market Recap: Inflation focus dominated last week – CPI was slightly higher than expected but hardly roaring. Other data was mixed in the U.S.

Retail sales fell 0.3% in January, with core retail sales (excluding autos and gasoline) falling 0.2%, the largest drop in nearly a year. December sales were also revised downward.

Weekly initial jobless claims rose slightly but remained near historic lows.

Industrial production also fell slightly in January, weighed down by a decline in mining output. UK retail sales, a key driver in the UK economy, grew by 0.1% in January, a steep drop from December’s 1.4% increase.

Meanwhile, Eurostat said that EU-19 industrial production rose by a better-than-expected 0.4% in December. GDP reports were in line but Italian 4Q GDP came in slightly lighter than estimates, which hit the Italian stocks, particularly within the financial sector.

In Japan, Abe reappointed Kuroda – calming JGBs – while 4Q GDP was light at 0.1% but key was domestic demand led growth.

The South African rand (ZAR/USD) was also in focus last week with Zuma finally resigning Friday – this was expected – but led to a 2Y high in ZAR.

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here