State of the market—Interest rate jump derails the stock market rally. The S&P 500 Index should retest its Feb. 8 lows but apart from that the worst should be over for now. Our intermediate-term U.S. equity model remains on a buy signal, says Marvin Appel, MD, PhD.

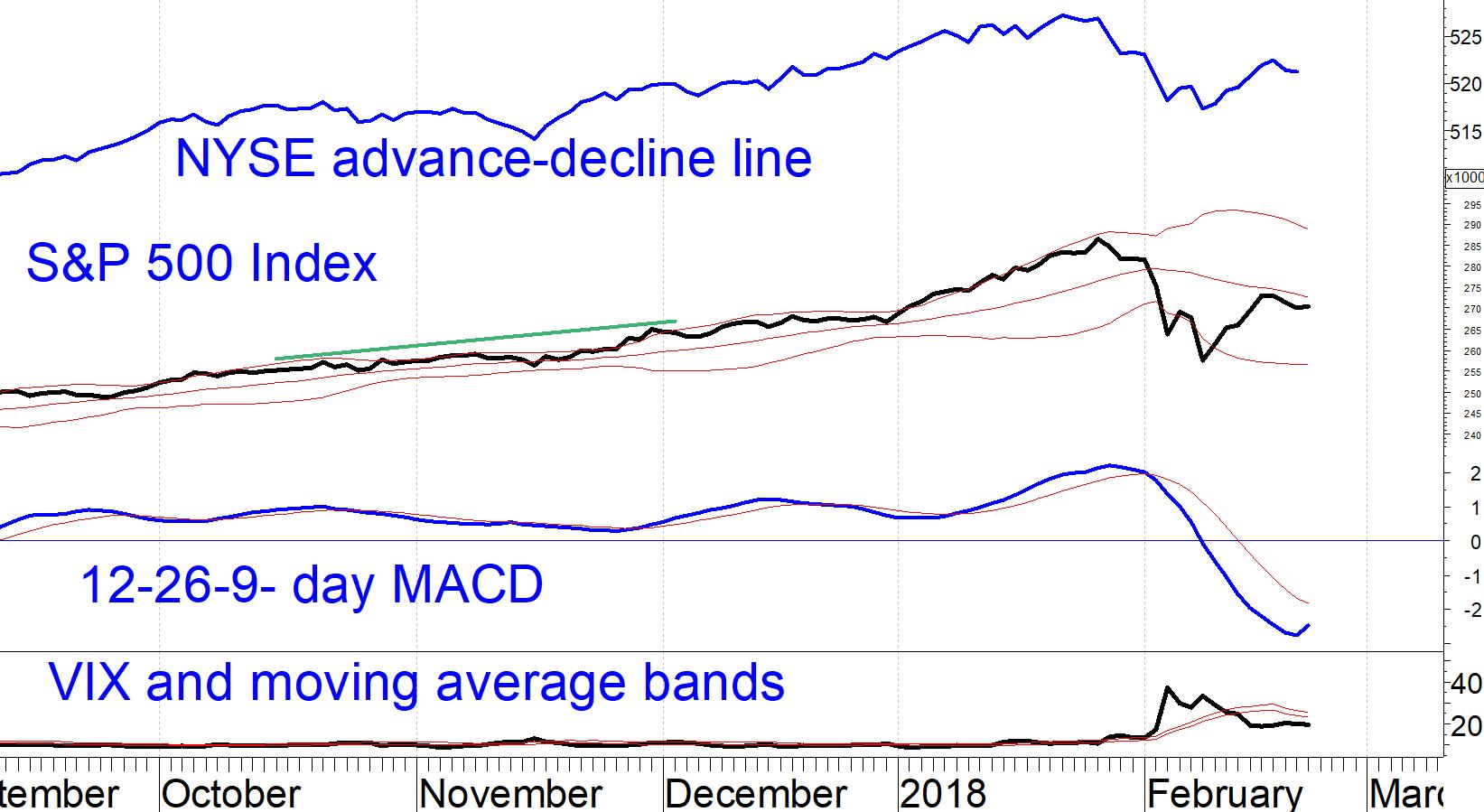

The S&P 500 suffered a correction from January 26-February 8 with no technical warning signs. The rapid decline, featuring two days with losses in the 4% range, brought MACD to its most oversold condition in two years and CBOE Volatility Index (VIX) to its highest level since mid-2015.

The ostensible trigger was a rise in 10-year Treasury yields to 2.9%, the highest level since early 2014, along with news of a 2.9% rise in wages.

All of this points to increasing inflation pressures and signs that the Federal Reserve will tighten accordingly.

Since the February 8 low the S&P 500 Index (SPX) has bounced 5% before stalling last week at the middle Bollinger band and also at the 50-day moving average (not shown).

Our models remain bullish, suggesting that further downside risk is limited. However, after such a sharp decline, the S&P 500 Index is entitled to retest its lows even if the worst is behind us as I expect. The lasting implication of February’s stormy market is that the era of easy gains with low volatility is over.

One tactical note: Historically, when VIX has been above 19%, as it was as recently as Feb. 21, it has been more profitable to write covered S&P 500 Index options than to hold the S&P 500 Index outright. So after years of drought, covered call writing appears attractive again.

Subscribe to investment newsletter Systems and Forecasts here…