U.S. Treasuries are the safest investment in the world, right? Right?, asks Mike Larson, senior analyst at Weiss Ratings.

That’s what most investors believe. But these proverbial “widow and orphan” investments are a lot riskier than investors realize – especially when interest rates are rising steadily and consistently.

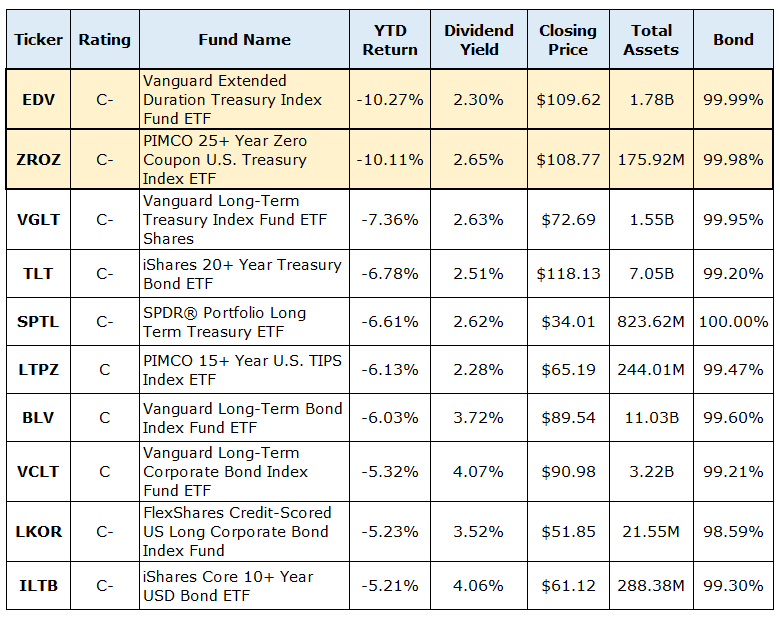

Skeptical? Well, just look at this table that shows the worst-performing, unleveraged, fixed-income ETFs in our Weiss Ratings coverage universe. I’ve included data on total returns, dividend yield, total assets, and more:

Data Date: Feb. 26, 2018

You can see that the Vanguard Extended Duration Treasury Index Fund ETF Shares (EDV, Rated "C-") and the PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF (ZROZ, Rated "C-") are both showing losses of more than 10%.

And I’m not talking about losses racked up over a span of years, either. That’s how much they’ve racked up in just the first two months of 2018!

Now take a look at their dividend yields -- 2.3% and 2.6%, respectively. Those pale in comparison to the price declines. In fact, anyone who owned these two U.S. Treasury ETFs has already lost enough in price to wipe out their annual yield as much as 4.5 times over. Ouch!

What's happening? How can Treasury funds tank so much?

Well, if you go down this list, you’ll see some version of the words and numbers "Long-Term," "15+" and "20+" on multiple occasions.

And that's the real problem.

Longer-term Treasuries … along with the ETFs and mutual funds that invest in them … have much higher “durations” than other bonds and bond funds.

Duration is simply a measure of interest-rate risk. If a fund has a duration of 24.4 years like EDV did recently, that means it’ll lose roughly 24.4% of its value for every percentage point move higher in the overall level of interest rates.

The yield on the 30-year Treasury bond recently topped 3.2%, after dropping as low as 2.7% in December. That’s been a problem for EDV, ZROZ and other high-duration funds. And if rates climb further in the remainder of 2018, the losses are going to keep growing and growing.

That’s why I’ve been warning about the risk of supposedly “safe” U.S. Treasuries for more than a year. If you need income and yield, you’re much better off investing in the kinds of dividend-paying stocks and higher-yielding, lower-duration ETFs I emphasize in my High Yield Investing newsletter.

Meanwhile, a good rule of thumb in this rising-rate environment is to avoid bond ETFs and mutual funds with durations of three years or more. All bond fund managers and ETF sponsors publish that information on their websites, usually where they describe what their portfolios hold.

Keep in mind they may use slightly different measures called “effective duration” or “average duration.” But suffice it to say that the higher the numbers, the more money you’ll lose holding those funds with each tick higher in interest rates.

Until next time,

Mike Larson

Mike Larson is presenting at MoneyShow Las Vegas May 16: Top Stocks to Buy During a Mid-Term Election Year. And: Investors Are Doing Everything Wrong (Bu There’s Still Time for You to Get Things Right!)

Check out Mike’s short video interview at MoneyShow Orlando: How to Find Dividend Stocks here.

Duration: 2:26

Recorded: Feb. 9, 2018.

Follow Mike Larson and subscribe to Weiss Ratings products here.