Investors need faith that growth is coming along. Like equities, credit market behavior is anticipating economic expansion resulting from new policies, instead of a recession or slowdown that typically follows late-stage up cycles, says Gene Inger of The Inger Letter.

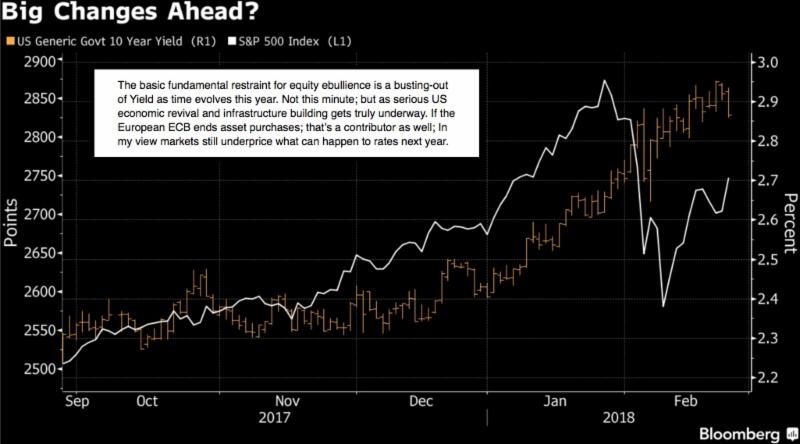

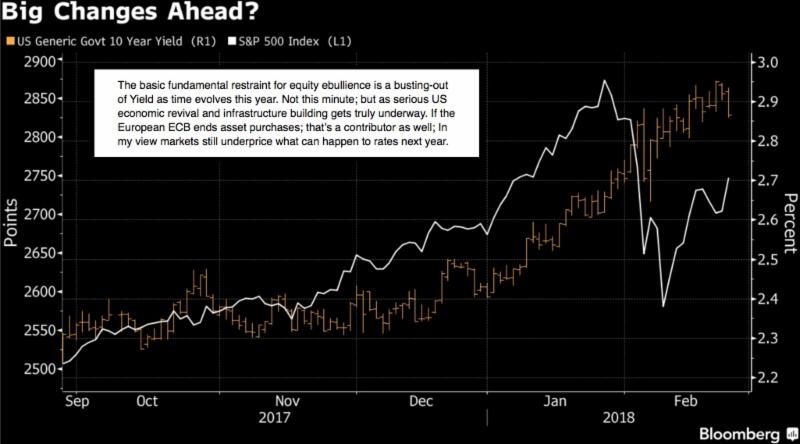

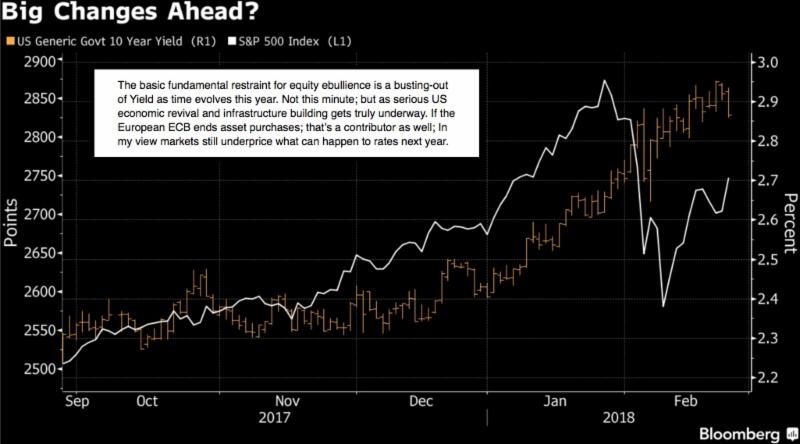

The emergence of credit riskhas generally overshadowed all other concerns with respect to how equity markets will respond over time. The suspected and glaringly-obvious battle lines are drawn around a well-defined technical congestion zone in the mid-2700s of S&P 500 (SPX), which of course invited being broken-out of at the tail-end of last week.

Thus, an overall backdrop of bond market jitters prevails as a key fundamental backdrop.

Just because rates eased a hair Monday doesn’t mean the pendulum has swung back to the side of recession (oddly equity bull) proponents. Rather, as I am going to note in my talk at the TradersExpo Tuesday, we have a rather long period of economic growth and development in store for the USA.

As to this equity advance, we can view the technical presumption if they moved it up as they did. This includes alternating responses by FANG stocks; and the very significant Oil moves that pump fuel into rallies indirectly (and without a bit of concern about inflationary impacts of higher energy prices).

And of course our own concern about whether managers have committed new funds or leverage to this market more to protect their option-writing and other strategies (hedging or income related) simply to deflect being hit.

Perhaps because many money managers have gone through their lives (entire careers even) without seeing an often-called-for shift in long-term interest rate trends, you have repeated calls for higher rates that appear but have no staying power.

That’s why I contrast where things have just recently been moving. And how either cynical analysts are unconvinced that a nearly-generational trend lower actually has odds to be ending; or whether actual growth rates can support forecasts of a rate inflection having occurred (or being near, depending on their constantly shifting perception of where that point is mostly for the 10-year Treasuries).

To me, part of the issue has been similar to how many disputed our idea well over a year ago: that if Trump won, the market would soar to higher levels than almost anyone anticipated.

Well, it did that as a discounting of the prospective growth coming (that's why perpetuating it at all surely required not only regulatory reform, but the lower tax and repatriation as has been achieved).

The charts showing fairly mundane conditions for now would not and do not reflect much growth. It’s still pending.

In a similar way, Treasuries have been firming generally without much evidence of actual economic growth that seriously moves the needle in terms of GDP gains. That has also been why the Fed forewarned and at the same time made assumptions about that forthcoming growth.

It’s been a tussle between so-called near-full employment and nominal wage or household income gains so far (but structured so as to be forthcoming). A look at charts (which the algo crowd focuses on) which do not reveal much reinforcement for the growth optimism.

That requires an investor (or money manager) to actually think or have a bit of faith that this is coming along. Like equities, credit market behavior is gradually anticipating a very prolonged economic expansion resulting from the new policies, rather than the often-seen recession or slowdown that typically follows late-stage upward cycles.