My economic argument for later this year: no catastrophe but perhaps a serious correction. And we know that interest rates won’t by intention be officially raised too high, because of the huge challenge of debt service, says Gene Inger of The Inger Letter.

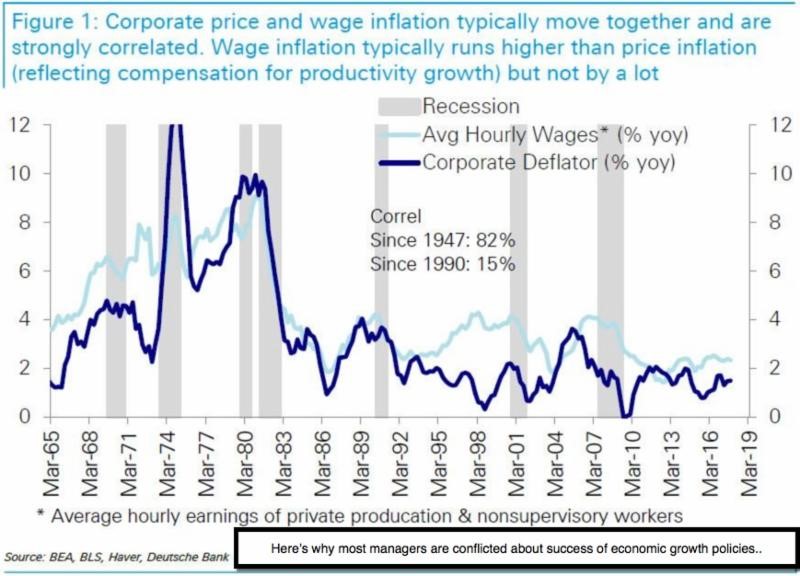

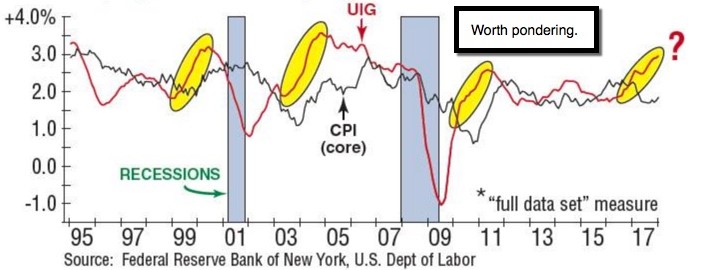

Economic assessmentsby the new Fed Chairman were as expected along the lines of somewhat higher prices, stronger economic outlook and multiple rate hikes.

The market was a bit roiled as if expecting less than a positive tone, which I wouldn’t call hawkish, but realistic. Makes no sense that equities overreacted given this was expected but clearly denotes how sensitive this market is, and on top of the congestion zone that needs to not be penetrated heading south or look out below.

I understand that a cursory glance at more or less total economic activity pictures doesn't reflect the anticipated gains the equity market has already displayed regarding future profitability. To a degree, the stock market was up because it could move up with flows of cash within and to the United States, not merely due to buybacks.

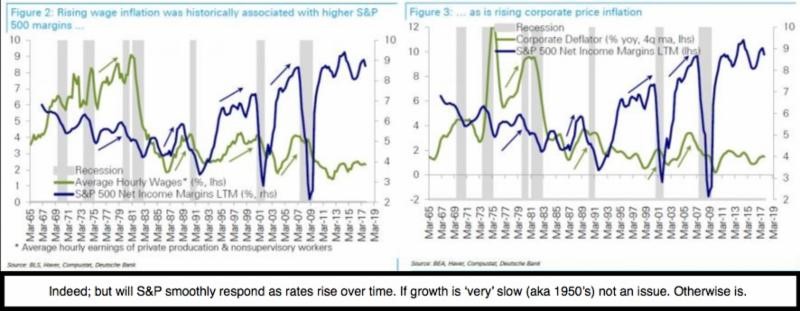

We do have an S&P 500 (SPX) level that requires not only growth but somehow the maintenance of price stability. (The Fed’s mandate shouldn’t push a desire for inflation but does.) Of course, that’s what we argued if Trump won: that the stock market would soar regardless of economic meat being tangible in the near-term. It was improving but so gradually.

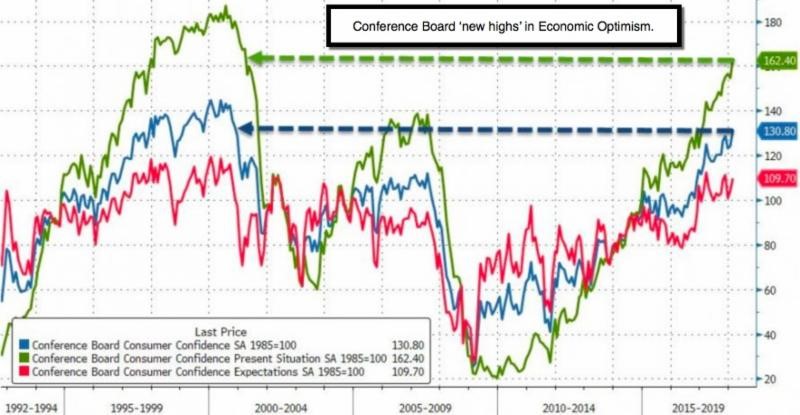

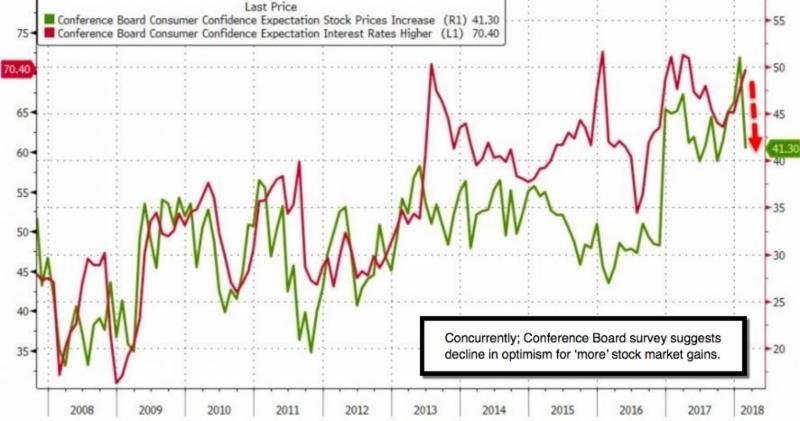

As I await my flight back to Florida Tuesday night, we smile a bit as Consumer Confidence has surged to new highs, while the same survey shows stock market hope as somewhat plunging. So, what do I make of that? People are smarter than pundits give them credit for.

It’s perfectly normal to allow for a stock market that anticipated (discounted) the political, fiscal and monetary change in the past year--plus, to actually rest or correct to various extents, even as the fruition of those policies kick-in and levitate the economy better.

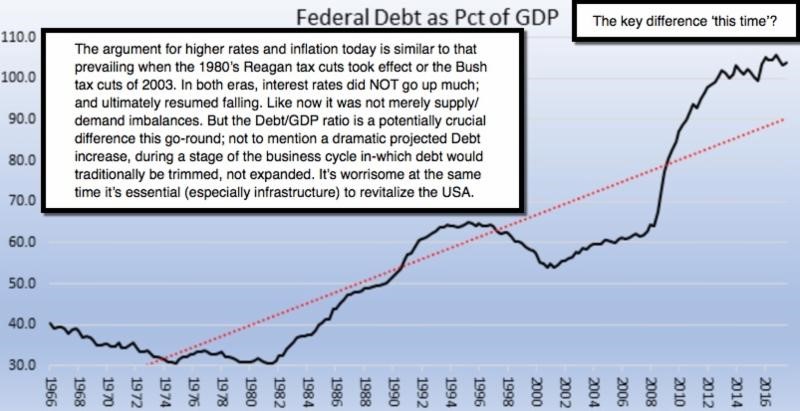

In-sum: that’s my economic argument for later this year: no catastrophe but perhaps a serious correction. And we know that interest rates won’t by intention be officially raised too high, because of the huge challenge of debt service. Of course, the rub is as I’ve assessed: they aren't fully in control of that. It’s precisely why rates have perked-up even as a Fed delay in moving official Funds rates higher stalled (likely due in March).

I concur with analysis suggesting the Fed wants to rein in the pace of rate growth (due to not being blamed for a recession or another fiasco in markets). The markets have a way of pushing them behind the curve as we’ve assessed, even as they took no recent overt action other than letting paper roll-off the balance sheet.

Bottom line: The ongoing debate about rates, policies and desire by a Fed that knows the fiscal debt expansion level are unusual to say the least in a later stage of a business cycle. They tend to be myopic as I have contended. When you factor in the importance of ECB and BOJ as well as BOE moves, you have a better idea of the rate relativity and the amazing fund flows into the US, as well as rates being nudged upward.

The stock market move persisted within context of an A-B-C rally but will be long-in-the-tooth, combined with rising complacency again, soon. At the moment, it must consolidate and rebound or soon becomes now.

I enjoyed visiting family, traders and investors in New York this week. I appreciate the guest appearance at TradersExpo, and I thank Sophia, Debbie and Charlie for inviting my sharing of serious strategy views and risks.