Because there is no discernible price trend at the moment, raising cash in long-term holdings, taking profits where you have them, and day trading with small amounts via ETFs and options is going to be more useful over the next few weeks, asserts Joe Duarte, MD of Joe Duarte In The Money Options.

Last week’s Dramamine prescription came in handy as the market served up quite a roller coaster ride. Don’t get me wrong, I’m all for major rallies in the stock market, especially after a three-day drubbing courtesy of the current Fed Chairman Jerome Powell and his ongoing - hellbent for leather - talk of raising interest rates.

In fact, things are so insane at the moment, given the Fed, the volatility, and the talk of trade wars from the White House, I’m getting the feeling that a vacation from the market may be in order.

The problem is the contrarian in me knows damned well that when vacation fever arrives because the market is crazy, the last thing I should do is to take my eyes off the trading screen, at least not until things have sorted themselves out.

So, instead of a trip to the beach, my trading plan is more likely to include raising more cash – I’ve been raising a lot already - keeping only small positions in stocks and ETFs that are working, and looking for opportunities to trade the market – up or down - over the short term.

Last week US Steel delivered heavy metal profits

I recommended the sale of U.S. Steel on March 1 after a combined profit of $1590 for the stock and the April 20 call option. Overall, the combination delivered a 45% profit based on an initial investment of $3515 if you bought 100 shares of the stock when I recommended it and added the option on February 26.

- SOLD - U.S. Steel April 20, 2018 $45 Call Option (X_20180420C45). Bought 2/26/18: $2.75. Sold 3/1/18: $4.55. Return for this trade: $180 per option contract (+ 65.45%)

- SOLD- U.S. Steel (NYSE: X). Bought 12/8/17: $32.40. Sold 3/1/18 $46.50. Return for this trade: $1410 per 100 share lot (+43.51%)

The trend is still up in the air

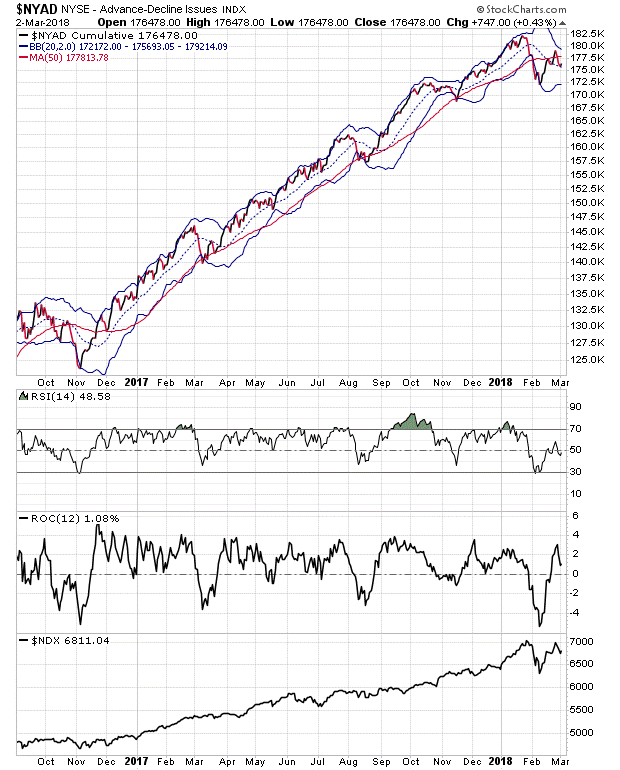

When in doubt about the next trend in the stock market, I look at the NYSE Advance Decline line (NYAD).

And while this has served me well over the last 30 years, the uncanny ability of the NYAD to predict the overall trend in stocks over the past eighteen months has been extraordinary. So, until NYAD proves to have lost its luster, it’s more than ever, my first chart of the day.

A close look at NYAD based on the close of business on March 2 suggests that the odds are no better than even that we will get back to the top of the trading range, or new highs, in the next two to four weeks. Of course, I may be wrong as robots aren’t human and who knows if they are no longer following their programs but have evolved to make their own trading decisions.

And while it’s easy to conjure up visions of Skynet trading stocks and taking prisoners, consider the following.

Over the last twelve months, until recently, NYAD has broken below its 50-day moving average decisively only one other time, in October-November 2016, right around the presidential election. As the chart shows, since then, NYAD has successfully found support at the 50-day moving average three times; in March, August, and December 2017, with new highs following the successful test of the support level each time.

But, and I hate to say it, this time is different as the Federal Reserve isn’t backing down on its goal of raising interest rates.

Meanwhile, there was no talk or threats of trade wars during 2017 either. In other words, the influence of external events is much different now, a fact which suggests the odds are greater than even that the market will have to sell off more vigorously before the Fed gets cold feet and backs off their current talking points.

But nothing is etched in stone these days – at least not yet.

So the less likely possibility is a resumption of the March 2 rally where NYAD takes a similar path to what it did in July-August 2017, where the breach of the 50-day moving average was very temporary and thus swiftly resolved with a new rally quickly emerging. Time will tell.

Liquidity and external events hold the key

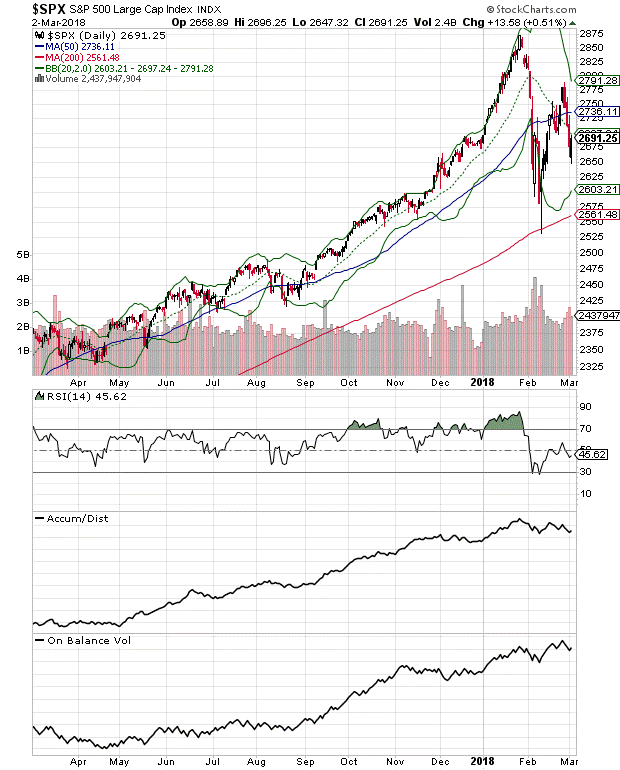

The S&P 500 (SPX) managed a rally on March 2, after a three day bust, but failed to close above three key resistance levels: 2700, the 20 or the 50-day moving averages. So until those technical resistance levels are successfully breached and prices show they can stay above them, we are still in a short to intermediate term downtrend and the overall price trend remains in question.

So what are the odds of a ramp in prices above key resistance levels at the moment?

I’d say based on the anemic look of the Accumulation Distribution (ADI) and On Balance Volume indicator (OBV) for SPX, the answer is “not so good,” at least not without more volatility and pain at first to shake out the bulls and create a real bear climax.

Indeed, the market not only has a Federal Reserve problem, a talk of trade war problem, but also a lingering liquidity problem. And it’s that liquidity situation that will come back, over and over again, to squash rallies unless it is corrected.

The bottom line is that we still don’t know if the current downtrend is going to resolve in a W bottom, or whether we are on the verge of entering a bear market.

The latter is more likely if SPX falls below 2500 or so and keeps going. But the way things are going and given the jitteriness in investor behavior fueled by the Federal Reserve, the robots trading the headlines, and the talk of trade wars coming from the White House, the only certainty is that there will be more volatility.

Don’t let them beat you down – duck now and survive

There is a way to win in this market; by managing your risk and staying patient. Ultimately, history shows that during turbulent times, cautious investors keep more of their money than those who gamble foolishly - if they follow sound trading principles.

As a consequence, the number one goal is to survive the volatility and the confusion with as much money in your pocket as possible in order to fight another day and eventually buy good stocks at much lower prices.

Let everybody else try to buy the exact bottom now or try to beat the market by being the first ones in – pigs get slaughtered and fools wade in. Believe it or not, there is nothing you or I can do about the volatility because what’s happening in the market is well beyond our capacity to influence.

Still, that doesn’t mean we have to stand around like the proverbial deer in the headlights.

Just remember this simple set of principles. Because there is no discernible price trend at the moment, raising cash in long term holdings, taking profits where you have them, and day trading with small amounts via ETFs and options is going to be more useful over the next few weeks than to do what was working for the last eighteen months.

It’s also a good time to start compiling that buying list which will come in handy when the Federal Reserve gets over its current temper tantrum.

Joe Duarte is author of Trading Options for Dummies, now in its third edition. He writes about options and stocks at www.joeduarteinthemoneyoptions.com.