Trade idea: U.S. Manufacturing PMI is fantastic. Manufacturers in emerging markets still have a lot of room to grow, which is why I think it makes sense to go overweight them at the expense of the American market, says Don Kaufman, co-founder of TheoTrade.

Once the tariff situation works itself out, I think stocks will resume their uptrend. It’s tough not to be optimistic with such positive economic reports coming out.

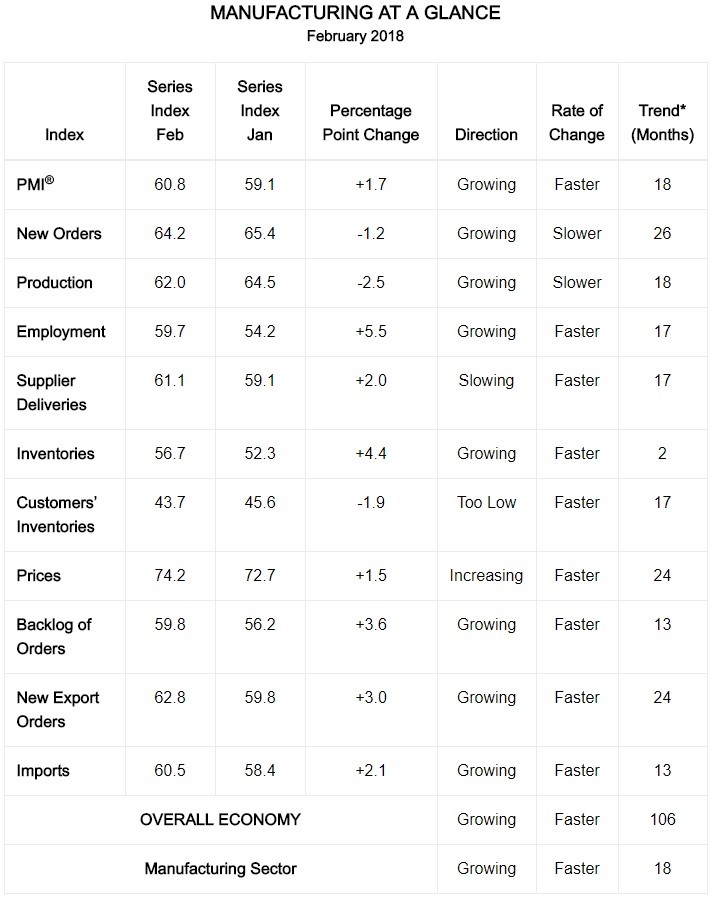

One example of these reports is the February Manufacturing PMI report report. The PMI was 60.8 which is the highest since May 2004 and 2.8 points above the 12-month average. This report is 1.7 points higher than the January report which caused the Atlanta Fed model to show 5.4% growth.

The table below reviews the latest results. Most of the trends are continuing. The PMI being more optimistic than most indicators is one trend that continued, although, I think manufacturing is doing better than the services economy.

The all-important new orders index fell 1.2 points, but it’s still strong. The price index in January was the highest since May 2011. It moved 1.5 points higher in February. The employment index went up 5.5 points to 59.7.

The price index being higher than employment could signal the inflation is being caused by commodity prices.

GDP models expect 3.3% growth in Q1

This report signals increased inflation, but it has also signaled great GDP growth, which hasn’t been reached. For example, the ISM from February signals GDP growth of 5.4%.

However, the Atlanta Fed GDP Now is only signaling 3.5% growth. That’s actually up 0.9% from the previous estimate.

One of the main reasons it increased is the latest PMI report. This is interesting because if the PMI is too optimistic like it has been in 2017, the Atlanta Fed result will be too high. The blue chip average estimate has fallen in the past few weeks to 2.7% growth.

Despite the positive effect of the PMI report, the NY Fed Nowcast has GDP growth down from 3.11% to 3.05%. It appears the Atlanta Fed weights the ISM reports too heavily. This has only been a problem recently because GDP growth has been so far from what the PMI usually signals.

The St. Louis Fed has GDP growth at 3.45%. It’s still too early to come up with a final projection, but there’s enough data to check where the quarter will end up at. It seems to be tracking similar to 2017. However, the market sells off on the possibility of four hikes because it doesn’t think the economy can withstand such a hawkish policy.

Positive responses from PMI Report

A food, beverage, and tobacco products firm said, “Employment is one of our biggest challenges. No labor available.” The question is whether this sentiment leads to wage growth. We’ve seen a few indicators show that firms are having a tough time finding workers, but they aren’t raising their wages and salaries.

Anyone can say they can’t find workers, but it doesn’t mean anything if wages don’t increase. If a company really needed new workers, it could easily find them by offering higher pay. Workers from other firms would leave to come to get the higher pay.

A fabricated metal products company said, “Steel market is doing rather well. Everybody is out of what I need.” This is suddenly an important statement because the steel and aluminum markets are at the epicenter of extreme controversy with the proposed tariffs.

If the steel market is doing well, it doesn’t make sense to risk the entire economy to help it. This is the equivalent of canceling a critical business meeting because your printer is out of paper, only to find out there’s more paper in another drawer. You ruin the health of your company because of a problem which doesn’t exist.

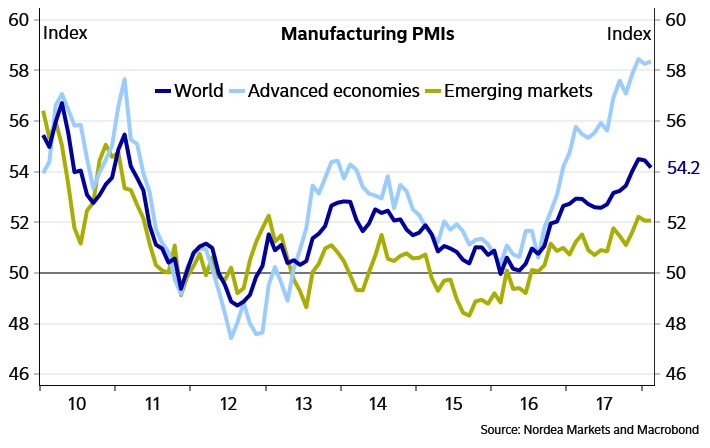

Global manufacturing is strong

As you can see from the chart below, the manufacturing economy is strong throughout the world. The advanced economies are doing the best because they are near the end of their business cycle. Judging by the volatility in this industry, I don’t expect this strength to last throughout the year. However, deceleration doesn’t mean a recession.

As you can see, there have been two periods of weakness which didn’t lead to a recession in this business cycle. It would probably take until 2019 for it to go negative, but we’ll cross that bridge when it comes.

The emerging markets still have a lot of room to grow which is why I think it makes sense to go overweight them at the expense of the American market.

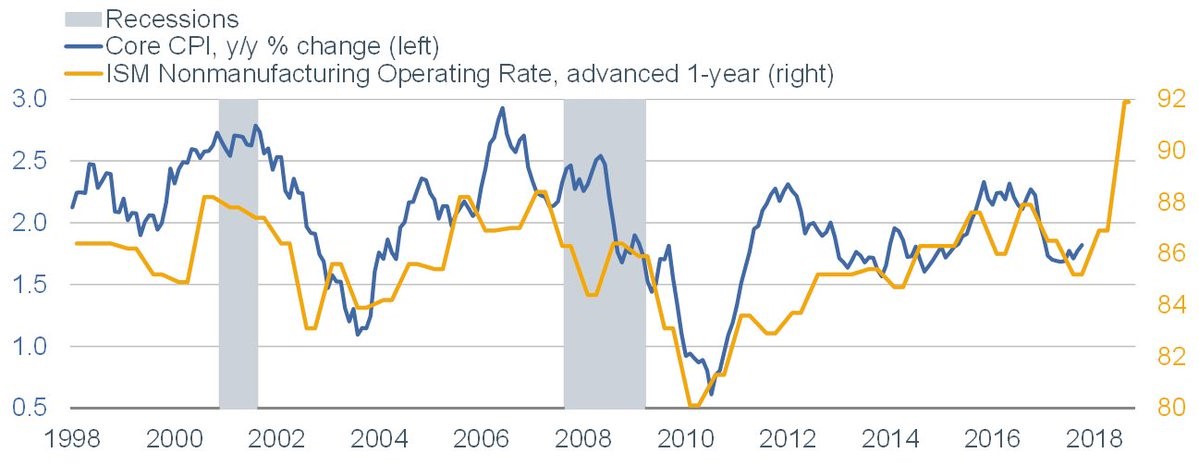

ISM Non-Manufacturing Report signals inflation

The ISM Non-Manufacturing Report was released Monday. The previous report had a PMI of 59.9. The next PMI was expected to be 58.8. I expected that estimate to be beat. It did. February Non-Manufacturing NMI was 59.5%. The chart below uses the non-manufacturing ISM PMI to forecast the year-over-year change in core CPI.

In the past, it has mostly been a good forecaster with a notable exception in 2012. Interestingly, the manufacturing PMI was negative in 2012, meaning it also didn’t expect high core CPI. That was the core CPI peak of this cycle.

The estimates have that peak being breached by the end of this year.

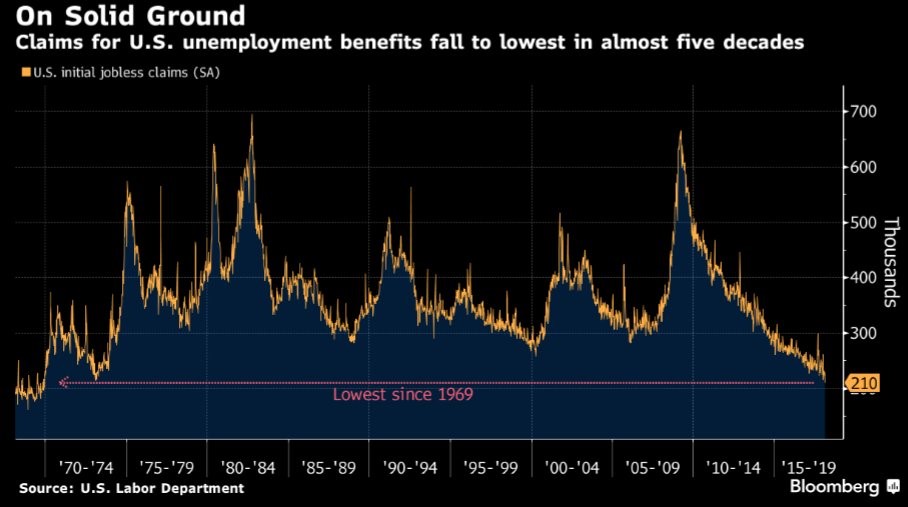

Jobless claims extremely low

The jobless claims report continues to be shockingly low. It has been at a record low when you adjust it for the population for many quarters.

As you can see from the chart below, the latest report was 210,00, which is the lowest since 1969. This continues to be a somewhat phony indicator. The labor market is strong, but there’s still room to improve based on the 25-54 age employment ratio.

I will get worried if this report spikes, but even if it falls below 200,000, I won’t think the labor market is at full employment. The jobless claims could fall below 200,000 next week. That shouldn’t change how you view the labor market.

There were hundreds of thousands of people who gave up looking for work after the 2008 financial crisis. The reason the economy isn’t at full employment is that those workers still haven’t all re-entered the labor market. I expect them to do so in the next 12 months.

I still expect wage growth acceleration, but not as much as I previously did. If the Fed keeps raising rates in 2019, the economy never may see wage growth so high that it causes rampant inflation.