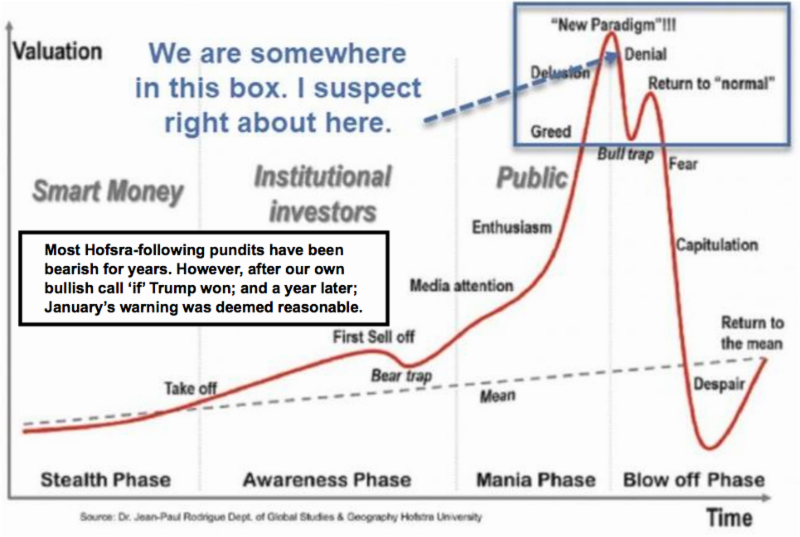

The market is showing the attention span of a 2-year-old, with wild flailing moves every which way as far as what observers see, but technically developing the pattern that could prove to be a more significant distribution over time, says Gene Inger of The Inger Letter.

Tariff threats as a negotiating tactic for a better NAFTA deal was my suspicion of what the president is trying to achieve. Know that finalized aspects are somewhat improved with regard to food and dairy, which is a significant component of the trade relationship with Canada.

Now that seems to be a done deal, and hard to say if it would have been derailed by the seemingly heavy-handed Trump approach to nudge things along.

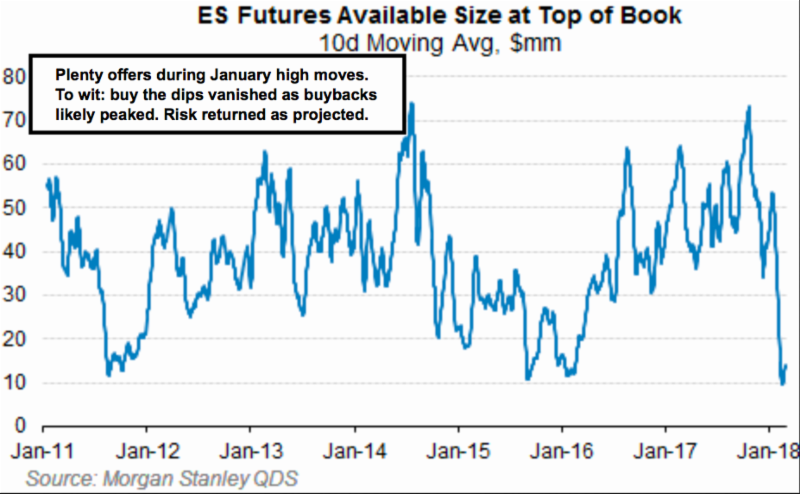

Once again we have a snapback but beware of it's sustainability.

However, Canada is not a low-cost producer like a slew of others. (Mexico included, but of course many Asian countries.) At the same time expecting countries to cave-in during negotiations right in the middle of formal trade talks kind of compels stiffening-up, even if (as is the case) most of these partners need us more than the reverse.

Yes, it’s very much triggering political disputes such as Speaker Ryan's threat to turn Congress against Trump’s tariff proposals. For sure the idea to turn the trade relationships to a fairer status via-a-vis the U.S. is certainly right at the core of why Trump ran for the presidency.

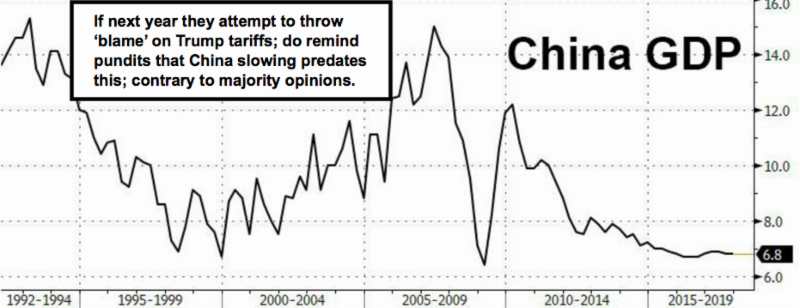

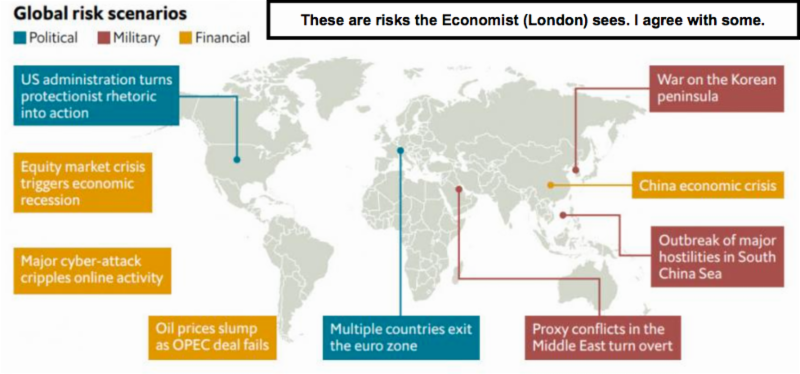

(Ironically The Economist omitted monetary and currency concerns in the chart above.)

And now we are so far down the rabbit hole with globalism that merely trying to flatten out currency-related variances meets stiff resistance. Of course, I realize that old industry alone won’t solve our revitalization, so I don’t disagree with the breakdowns of how jobs might be lost perhaps in the short-run.

However, I think most underestimate the clout the USA still has. It’s not that Trump expresses much correctly, but on this issue, he has it right just that the timing suggests his trade negotiators haven’t been successful, so he’s pushing things along (which might not help).

In-sum: Monday the U.S. NAFTA negotiator said things were not coming to an agreement, and that Mexico was more cooperative than Canada as I recall.

And that this might not end successfully or fail, but simply persist for several more weeks.

I bet the the market will love the interim and persistent volatility associated with alternating stories along those lines.

Of course, maybe there will be a breakthrough.

I am aware that others say bears are wrong and we have another year of upside. However, we’re not bears. And we are calling for corrective action within the context of a very long-term cycle that could have years to run if trade comes together and if we don’t get monetary moves that trigger an equity bear while we see a bond bull... something that is trotted-around out there.

Bottom line: What’s remarkable for markets has been these alternating swings with such ambiguity in policies: S&P 500 (SPX). Or certainly how they seriously could impact many projections regarding so-called synchronized global recovery.